2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

IV Robots & Workflow Management 2014

Is It Time to Adopt?

Providers continue to see manual compounding of IV solutions as the area of the medication preparation process most vulnerable to errors. Despite the risk for compounding errors, the early adoption of IV robots and use of workflow solutions has not kept pace with the threat because of cost concerns and competing priorities. Provider interest is still high, and many wonder when, if not now, is the right time to adopt.

WORTH KNOWING:

RIVA CONTINUES TO PROVIDE THE BEST CUSTOMER EXPERIENCE AND FUNCTIONALITY

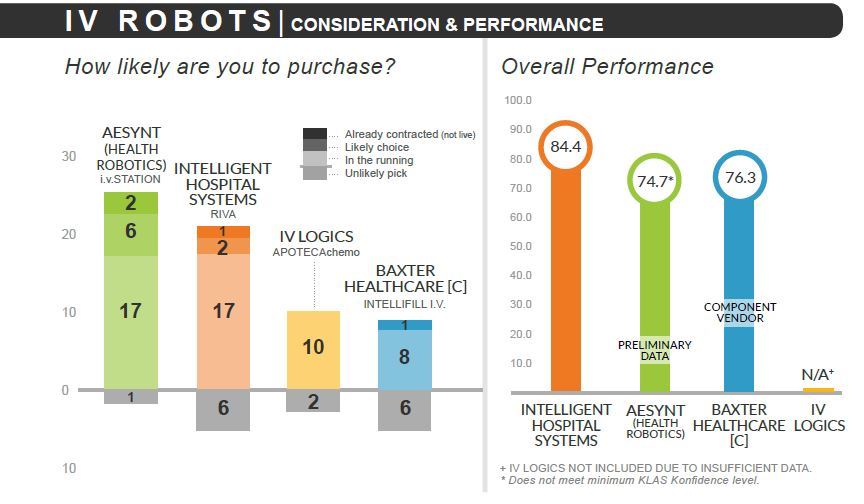

The Intelligent Hospital Systems RIVA received higher ratings than the Aesynt i.v.STATION in every vendor and product specific metric. Customers reported IH Systems to be a proactive vendor who consistently develops and supports a quality product. Half of RIVA customers indicated that IH Systems is the best vendor they work with.

I.V.STATION SURPASSES RIVA AS ROBOT PROVIDERS MORE LIKELY TO BUY

Aesynt’s i.v.STATION had the largest number of providers come live and the most state that they had contracted (but were not live). It was also listed the most often as the likely choice among potential customers. A lower cost and smaller footprint are the primary drivers for the i.v.STATION’s progress. In contrast, the RIVA shifted from being the most likely choice (in 2012) to having more providers list it as the unlikely choice. As providers deal with increasing financial pressures, they report being less able or willing to make the investment required by the RIVA.

RIVA’S MONEY’S WORTH VS .I.V.STATION’S FASTER ROI?

Providers listed cost as a major obstacle to purchasing an IV robot, but almost all providers running robots today reported achieving the ROI they expected. The i.v.STATION is much less expensive than the RIVA, and the majority of customers reported getting their ROI in one to two years. RIVA customers typically reported a longer time to ROI (50% reported four or more years) but indicated that the vendor experience and robot performance are well worth the extra money, rating the RIVA much higher on money’s worth.

WILL ANYONE COMPETE WITH DOSEEDGE?

Providers are considering a wider range of IV workflow management solutions, but no one has proven they are ready to compete with Baxter DoseEdge System. DoseEdge System dominates in performance, mindshare, and market share. Among the other products mentioned by respondents, Aesynt i.v.SOFT was the next most considered, but only a few providers are currently live with it. Other solutions mentioned by providers are Grifols PHOCUS Rx, MedKeeper PharmacyKeeper, BD Cato, and CareFusion Pyxis Prep (not commercially available).

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.