2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Post-Acute Care Perception 2013

High Hopes and Big Plans

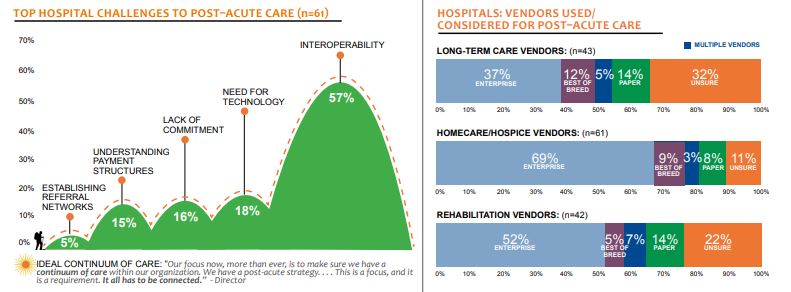

Despite its reputation for complex regulations and slim profit margins, post–acute care is a renewed area of interest for health systems that see it as a critical part of their accountable care strategies. KLAS interviewed 77 hospitals and 51 standalone post–acute care facilities to better understand their plans, challenges, and technology decisions. Among the gaps in enterprise and best-of-breed solutions, what paths are providers taking?

Worth Knowing

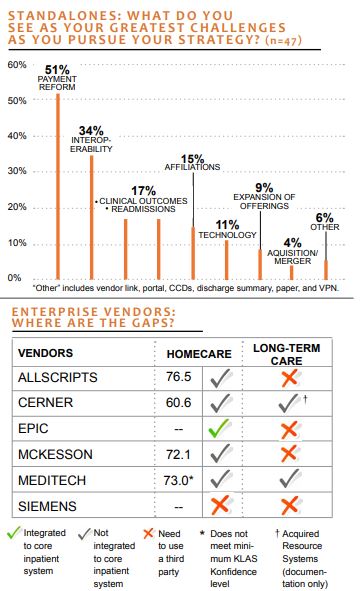

Continuum of Care Not Connected for Enterprise Vendors: Most enterprise vendors have a homecare solution, but almost all of them perform below average and providers report interoperability is still limited with inpatient EMRs. Long-term care (LTC) and rehabilitation are the biggest technology gaps for enterprise vendors. MEDITECH was the only enterprise vendor to offer clients an LTC-specific solution.

Best-of-Breed Vendors Outperform Enterprise Vendors but Lack Hospital Acceptance: Homecare solutions from best-of-breed vendors Thornberry, Delta, and Homecare Homebase outperform enterprise solutions. In addition, HealthMEDX, MDI Achieve, and PointClickCare* perform well in the standalone LTC market. However, where enterprise vendors lack formal LTC and rehabilitation solutions, hospitals often adapt their inpatient or ambulatory EMR. Although enterprise vendors cannot yet claim an integration advantage, they are the choice for most ACO-oriented hospitals who cannot afford to invest in and interface with an additional vendor.

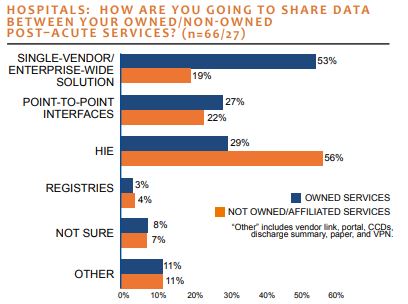

More than Half of Providers Still Challenged by Interoperability: Fifty-seven percent of hospitals reported bidirectional data sharing with post–acute care as their greatest challenge, meaning higher cost (incurred from interfaces) to gain needed value in a cash-starved environment. Hospitals are looking for a single-vendor/enterprise-wide system for owned services but will depend on health information exchanges (HIEs) to share data with affiliated post–acute care facilities. Both approaches face uphill challenges, as most enterprise vendors lack integrated post–acute care solutions and HIE vendors are often inconsistent in integrating disparate EMR platforms.

Strained Resources in a Sea of Conflicting Priorities: Though most viewed post– acute care as a critical part of their care continuum, many hospitals were too tied up in other initiatives to commit the financial and other resources needed to carry out post– acute care strategies beyond homecare. Of providers, 16% said lack of commitment was one of their greatest challenges.

Payment Reform Is Primary Concern for Standalone Post–Acute Care Facilities

Post–acute facilities face many challenges, causing uncertainty for the future. The biggest-reported challenge was payment reform (mentioned by 51% of respondents). Many are concerned with reimbursement cuts and rising costs and are pursuing shifts in current business models.

Despite uncertainty, the industry-wide focus on the care continuum, avoidable readmissions, and ED diversions has created renewed energy among post–acute care facilities. The next steps for many going forward were (1) preparing to affiliate with hospitals (46%) and (2) preparing for electronic data exchange (34%).

Long-Term Care Vendors: Bottom Lines

HealthMEDX (82.3): Web-based application depending on client preference. Typically sold in large facilities. Strong service. Customers have high interoperability expectations with new upgrade. Implementation and training have been inconsistent.

MDI Achieve (77.9): Client base split across multiple products but most using goforward MatrixCare platform. MatrixCare reported to be web based and user friendly. Recent executive involvement with clients has been challenged by changes in upper management. Reports of inconsistent support quality.

NTT Data* (62.9): Customers report slight performance improvements over the past year. Continues to have some inconsistency delivering quality support and meeting clinical functionality needs.

PointClickCare* (79.0): Web-based product specific to LTC. Seen as basic, affordable, easy-to-use solution with sufficient support. Lacks deep reporting and some pharmacy interfaces. Struggles with interoperability. Product enhancement requests from clients are often delayed.

Homecare Vendors: Bottom Lines

Thornberry (91.5): Highest-scoring homecare solution, reported to give excellent and dedicated support. Solid product seen as robust and easy to use. Capabilities for further customization is a need.

Delta (86.8): Consistent high performer. Offering new, web-based product called Crescendo. Strong and reliable support. Communication can be an issue.

Homecare Homebase (85.6) Best in KLAS vendor between 2010 and 2012, now challenged by Thornberry. Primarily sold to midsize and large clients. Delivers robust, hosted-only product. Increasing client concern over support due to vendor growth. Better quality testing of upgrades is a top client recommendation.

CareAnyware (68.0): Offers remote hosted–only option. Customers have high expectations of future product road map. Delivers well in areas of implementation and training. Challenges are noted with reporting capabilities.

HealthWyse* (81.5): Consistent scores around ease of use and support. Primarily deployed as remote hosted. Clients want better deep customization ability.

Procura* (81.2): Reliable system reported to have needed functionality that appeals to field clinicians. Support has become less consistent over the past year.

Enterprise Vendors Post–Acute Offerings: Bottom Lines

Allscripts: Homecare scores below best-of-breed homecare vendors but is highest-rated enterprise solution. Clients struggle with go-live support and training and report interfaces are pricey and difficult.

Cerner: Recent reports of improved support overshadowed by unmet v.5 expectations, lack of integration with Cerner’s Millennium EMR, and cost. Over 37% plan to leave. Acquired LTC documentation only vendor Resource Systems in 2011.

Epic: KLAS validated several live sites but not enough to report performance. Early feedback reported spotty performance with expectations of improvement.

McKesson: Horizon Homecare seen as stable, reliable system. Typically slow to develop, but clients optimistic about v.13. Limited integration with McKesson Horizon and Paragon EMR.

MEDITECH: Offers MEDITECH Long-Term Care, but KLAS hasn’t validated any clients yet. MEDITECH Home Care clients still struggle with inpatient EMR integration, though clients who dedicate time and resources after implementations report success.

Siemens: Do not currently offer LTC or homecare software.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.