2025 BEST IN KLAS

2025 BEST IN KLAS

Preferences

Related Series

Agfa HealthCare 2013

Partnering With Agfa in 2013

As needs evolve for imaging departments, providers are looking for long-term vendor partners that can articulate and execute a strategic vision as a sole source across several solutions. Many vendors have mastered the ability to articulate a vision, but can they truly help their clients achieve the anticipated success? Agfa customers are asking this question. In this study, we will be looking at the full spectrum of deliverables offered by Agfa. Has Agfa achieved a strategic vision with their customers? Do their current customers see them as an excellent partner? And where is Agfa headed?

Key Findings

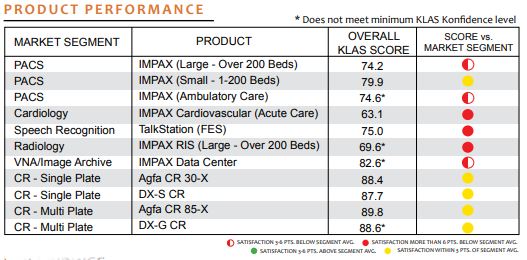

Second-Tier Performance as an Imaging Partner: While Agfa describes synergy of imaging, with clinical knowledge and information technology as key to delivering their solutions, their focus on client success is not living up to client expectations. Overall functionality of their PACS has improved with new versions, but performance is still mediocre. CVIS development and delivery have been major disappointments to clients. Speech recognition is a more positive client experience in the Agfa portfolio, but that is not enough to buffer an overall poor experience.

Leading Out with VNA Technology: Few vendors have tackled the emerging area of image archive as successfully as Agfa has. In the 2012 KLAS enterprise imaging report, KLAS validated a few Agfa sites storing data in native formats. Despite Agfa’s efforts to be a leader in this space, their service and support are holding them back based on early indicators.

Agfa’s Digital X-Ray a Win for Customers: Agfa’s delivery of digital x-ray is competitive with the top players in the market. The MUSICA2 platform, common to their CR as well, is a customer favorite. In the U.S., Agfa’s DXD-500 general radiography room has been launched recently and the success is still to be seen; their mobile x-ray platform is seeing some adoption. The transition for current Agfa CR customers to Agfa DR is slow.

Global Plans: Internationally, Agfa, a competitor in PACS, wants to deliver a worldwide EMR/HIS solution, an example being the recent acquisition of WPD and the intended interface with ORBIS in Brazil. Allscripts and other EMR vendors in the U.S. have attempted similar strategies with limited success to date. Agfa may break that barrier. While doors are opening for EMR/EPR solutions and patient administrative systems in the UK, Agfa’s ORBIS is not found in the UK. Cerner and iSOFT are key competitors there.

Is it too much to expect a vendor to be a real partner?

KLAS bases a solid partnership on delivering three elements:

- Synergistic or integrated solutions

- Technology for today and tomorrow

- Client success orientation (attitude and aptitude to get the client to the finish line)

Clients do not report an intense focus from Agfa on customer success, making it an area ripe for improvement. Agfa speaks to a successful partnering model and appears to be incorporating elements of the model, yet historically, Agfa has not delivered anywhere close to an ideal level.

Where does Agfa fall among the competition?

For those imaging departments looking to jump in deep with a strategic imaging partner, several vendors fit the bill. Agfa is at the table because they have most of the pieces needed for cardiology and/or enterprise imaging (VNA, PACS, CVIS, speech recognition, RIS). Agfa also offers digital x-ray. Fuji, GE, McKesson, Merge, and Philips are competition for Agfa with some similar portfolios and solutions that could be deployed for enterprise imaging.

For current Agfa customers who are looking to expand their imaging efforts, a good case could be made to go with Agfa’s IMPAX Data Center and other offerings. However, for a new customer starting from scratch, Agfa is not likely the numberone choice. Agfa’s performance in cardiology is a red flag, and many radiology PACS customers also report that Agfa is not a great partner.

Compared to their peers, Agfa lags with technology and upgrades and is dinged for charging customers a lot for upgrades. Clients are less likely to include Agfa in long-term plans and are less likely to recommend Agfa to peers. These are clear indicators of a lack of success with Agfa and suggest that Agfa has a big opportunity to improve in order to be a true partner.

Market Segment Bottom Lines

PACS: Agfa’s performance trend stagnant in large hospitals; lagging behind top PACS performers DR Systems and McKesson by significant margin (10 points). System is stable and scalable. Support and relationship suffer from extra charges for upgrades. Most Agfa PACS customers are over 200 beds.

CVIS: Agfa not a good partner for cardiology; little hope of system improvement. Only 58% of clients plan to stay with Agfa. Not living up to expectations. Far below top cardiology performers and below segment average in functionality. Customer adoption of cardiology modules (i.e., cath and echo reporting) is on par with competitors’ adoption.

Enterprise Imaging Archive: Leading out with enterprise strategy; seen as a strategic partner for enterprise imaging, especially for current Agfa PACS customers. Agfa indicates they have VNA customers outside of current Agfa PACS clients, but all IMPAX Data Center customers validated by KLAS are using IMPAX PACS. Offering a zero-footprint viewer as well, the XERO technology viewer.

RIS: Agfa is ambulatory and small hospital player. Service and support remain steady, while satisfaction with functionality has significantly deteriorated over the last year. Overall performance lands in bottom tier.

Speech Recognition: TalkStation very focused toward imaging customers. Integrated; built for and only sold to Agfa PACS customers. Working on NLP. Speech is Agfa’s highest-performing area. Several providers mention big improvement with new v.4—better recognition with upgraded Dragon engine.

Digital X-Ray: Huge Agfa CR install base. Reliable, rock-solid equipment. Maintaining quality while equipment keeps getting smaller. Customers love MUSICA2 imageprocessing software, citing great image quality; new DR also using the same image processing and workstation. Planning to leverage CR install base to place DR units. U.S. DR install base is limited as it is new.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2025 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.