2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Related Segments

Oncology 2013

Eyes Wide Open

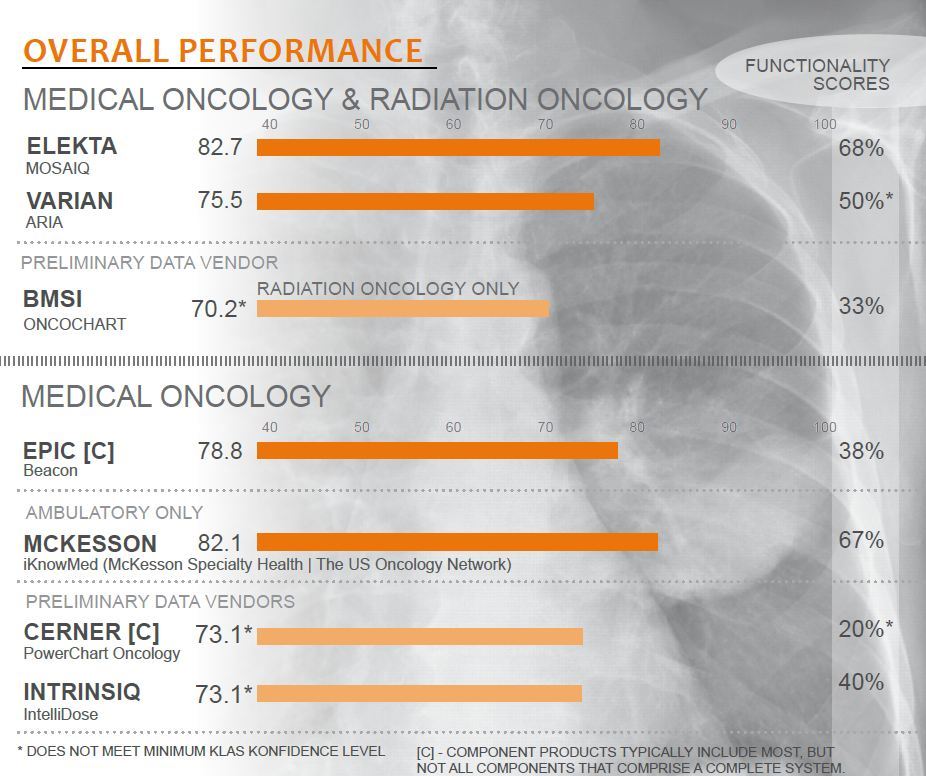

As oncology providers tackle an increasingly complex world of government regulations and requirements, their vendors’ ability to inter face with a variety of systems and develop better functionality is more important than ever. In this study, providers rated specific areas of medical and radiation oncology functionality, the vendors’ ability to interface, and patient portal offerings. One hundred and seventy-six provider interviews paint a picture that Cerner and Epic are making a big play in medical oncology, but product immaturity is leaving providers with a lack of functionality. Radiation oncology is still a best-of-breed market with Elekta and Varian as the main competitors.

ONCOLOGY 2013

Eyes Wide Open

Report Author: Monique Rasband

As oncology providers tackle an increasingly complex world of government regulations and requirements, their vendors’ ability to inter face with a variety of systems and develop better functionality is more important than ever. In this study, providers rated specific areas of medical and radiation oncology functionality, the vendors’ ability to interface, and patient portal offerings. One hundred and seventy-six provider interviews paint a picture that Cerner and Epic are making a big play in medical oncology, but product immaturity is leaving providers with a lack of functionality. Radiation oncology is still a best-of-breed market with Elekta and Varian as the main competitors.

WORTH KNOWING

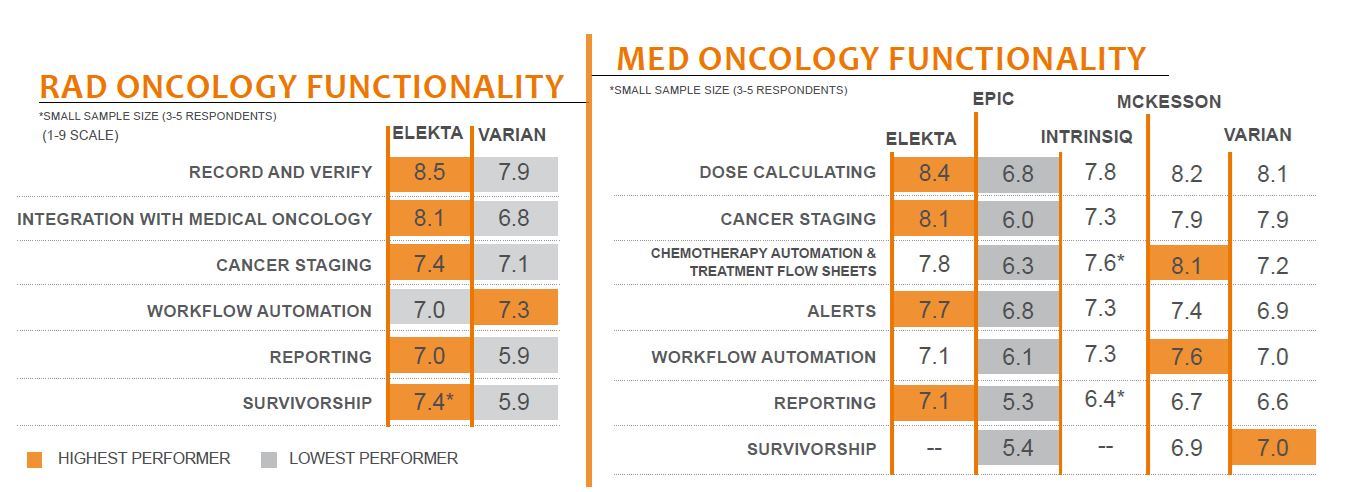

ELEKTA CONTINUES TO DOMINATE IN FUNCTIONALITY—Elekta outperforms Varian in radiation oncology functionality, especially in reporting and integration with medical oncology. Though Varian is the radiation oncology market share leader, Varian performs better than Elekta in only one area—workflow automation. In medical oncology, Elekta is the top performer in four out of seven measured areas, while Varian lands in the middle of the road in most measured areas. Elekta earns kudos for having integrated medical and radiation oncology on a single platform, while Varian customers are frustrated that Varian has not fulfilled promises to fully integrate.

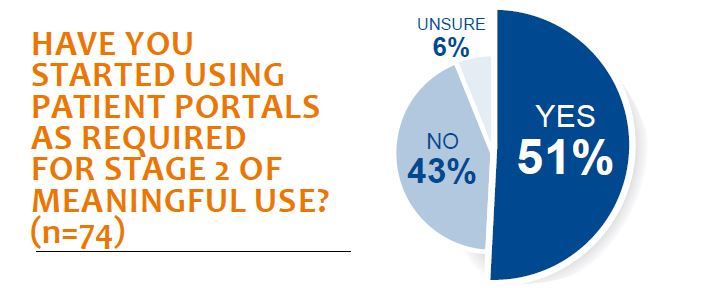

VARIAN AND ELEKTA LAG BEHIND EPIC AND MCKESSON IN PATIENT PORTAL ADOPTION—Sixty-seven percent of providers in this study reported that they had attested for meaningful use. Fifty-one percent of those had started using patient portals, which is a 21% increase over last year. Varian and Elekta had very few customers who have adopted patient portals thus far. KLAS validated five providers using Elekta/Intuit for patient portals and only one provider using Varian. Epic had the highest number of customers using a patient portal (43%), followed by McKesson (34%). However, Epic portal users find that the portal does not offer the oncology-specific functionality they need. McKesson’s My Care Plus portal users were happier with the oncology-specific functionality.

EPIC AND CERNER LACK CLINICAL FUNCTIONALITY—Epic scores well with the IT department, which bolsters their overall score, but looking deeper into specific areas of clinical end-user functionality reveals some major deficiencies. Epic earns the lowest score in every measured area and especially struggles with reporting and cancer staging. While Cerner and Epic are similar in performance scores, the tone of the comments is different. Cerner, as a relatively new system, is still functionally immature with several sites not fully live on ordering. However, Cerner customers are optimistic about the future. On the other hand, Epic customers expect more from Beacon and have been waiting for Epic to focus on oncology like Epic has done with other clinical areas.

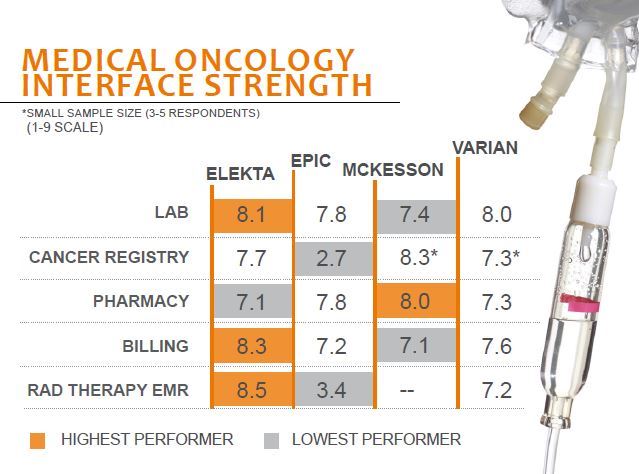

ELEKTA AND VARIAN KEEP UP WITH OR SURPASS ENTERPRISE VENDOR INTERFACING ABILITY—Best-of-breed vendors Elekta and Varian are showing that they can interface with lab, billing, and cancer registry just as well as, or better than, enterprise vendors Epic and iKnowMed (now owned by McKesson). Epic has not adequately interfaced with radiation oncology EMRs. However, Epic and McKesson do a better job interfacing to the pharmacy.

BOTTOM LINE ON VENDORS

Ranked–Fully Rated

Elekta—Elekta leads radiation oncology functionality, especially for reporting and survivorship. Clients looking forward to v.2.5. Early data from those on the newer versions show the versions delivering on Elekta’s promises. Seventy-five percent of providers said MOSAIQ has the needed functionality, the highest in the study. Strong interfacing abilities. Contracting experience is slipping. Elekta’s service and support are spread thin and take some time to resolve issues. Few customers using patient portals.

Varian—Contracting involves a lot of back and forth, implementations are poor, and training is not hitting the mark. Only 53% of providers said they have needed functionality. Competitive in medical oncology, even though radiation oncology is Varian’s focus. Poor relationship acumen; executives not available to customers. Providers optimistic about future upgrades and a number of them see improvements to the integration. Ninety-two percent plan to stay with ARIA, but only 78% would buy again. Only a handful using patient portals.

Epic—Providers hopeful that Epic will deliver the tools they need for medical oncology, but only 38% said Beacon has the functionality they need currently. Relatively good phone support. Not easy to use. Integration between Epic Beacon and Epic systems works well but it is challenging to integrate to non-Epic products. One hundred percent said they will stay with Beacon for the long term.

McKesson—Found only in ambulatory sites, but web-based system is very scalable. Loyal client base—100% said it is part of their long-term plans. Contracting is smooth, and implementations are fantastic. McKesson is continuing with iKnowMed’s strengths, leading in chemo automation and flow sheets. Sixty-eight percent feel the product has the needed functionality—second highest in the study. Support is decent. Second only to Epic in patient portal adoption. One hundred percent said it is part of their long-term plans.

PRELIMINARY DATA VENDORS

BMSI—Poor implementations and training. Only 43% said they have functionality they need. Solid phone support, with great responsiveness. Boutique company with personalized service. No record and verify. Development is stagnating.

INTRINSIQ—Consolidation trend had led to several facilities dropping IntelliDose. Only 55% of providers said product is part of long-terms plans, but just about as many said they would buy again. Only 36% feel like it has needed functionality. Easy-to-use system.

CERNER—One hundred percent said it is part of their long-term plans. Not easy to use, and only 33% said they have needed functionality. However, customers are optimistic for new functionality and appreciate clinician involvement in development, as well as Cerner’s hands-on approach. NOTE: Cerner excluded due to insufficient number of responses.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.