2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Radiology Dose Monitoring Solutions 2014

Provider Strategies in an Evolving Market

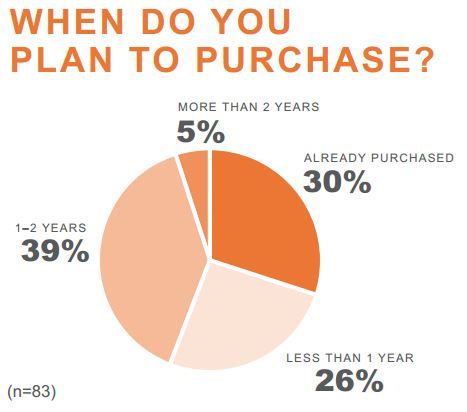

Driven toward compliance with government regulations and JCAHO certification, providers are making plans to purchase dose monitoring solutions. A number of vendors have stepped up to the plate, though only two have true mindshare. Which dose monitoring vendors are being looking at and why? Which vendors offer dose monitoring, and are they commanding mindshare? KLAS spoke with over 100 providers randomly, 83 of whom are seriously looking for a dose monitoring solution.

WORTH KNOWING

BAYER DOMINATING WITH FUNCTIONALITY AND PRICE TAG:

Of the providers who have already purchased a dose monitoring solution, 52% have chosen Bayer or a partnering vendor (e.g. Siemens). Providers consider the Bayer solution to be robust: “Our chief of CT, who had the final say, liked the analytics tools and the views we could produce from the data for analysis.” 20% of providers are looking at Bayer as the best cost-effective option: “GE’s DoseWatch solution was expensive and did not seem as mature as Radimetrics’ solution.”

PROVIDERS LOOKING AT GE BUT HAVE GENUINE RESERVATIONS:

Of the twenty-five providers who have already purchased a dose monitoring solution, four have selected GE. However, for those that have yet to purchase, GE is considered second only to Bayer. Providers who have bought or are looking at GE are doing so because of name recognition or because they have other GE software or imaging equipment: “We purchased from GE because we have a very good relationship with them and felt that over time they would provide a very good dose monitoring solution for us.” Twelve providers are concerned that GE’s DoseWatch software is expensive, while others are unimpressed with its functionality and integration.

PACSHEALTH TRAILS FAR BEHIND IN MINDSHARE:

In a distant third place, PACSHealth is being looked at because it is inexpensive and because of the positive relationship providers have with the vendor. Two providers have already contracted with PACSHealth and find the vendor to be easy to work with. There are mixed feelings among providers about PACSHealth’s size as a company. Several report that DoseMonitor is not as robust as Bayer’s eXposure software.

PACS/RIS VENDORS ARE POORLY COMMUNICATING THEIR DOSE MONITORING OFFERINGS:

Just two of nine Agfa customers are looking at Agfa, and two of five Sectra customers are considering DoseTrack. In contrast, GE has done a much better job of communicating their dose management offerings. Thirteen of the seventeen GE PACS customers say they are considering DoseWatch. Although Epic doesn’t offer a formal dose monitoring solution, three providers plan on utilizing tools within Radiant to monitor dose.

WHO IS GETTING ATTENTION OUTSIDE OF BAYER, GE, AND PACSHEALTH?

ACR

Two providers are already using ACR for dose monitoring, and a couple are considering ACR. Providers feel that DIR is not as functional as other solutions on the market, and one provider is using it while looking for a more robust solution.

AGFA HEALTHCARE

Agfa advertises that their solution is vendor neutral and can work as a standalone product, but only one provider who does not have Agfa IMPAX is looking at IMPAX REM. Two of the three providers looking at Agfa say they are looking at it because they have other Agfa software.

IMALOGIX

Three providers mention this best–of-breed dose monitoring vendor, but each says it is his or her organization’s top choice. Each has his or her own reasons; recommendations by others, vendor neutrality, and great fluoro dose tracking are just a few of the reasons given.

MCKESSON

Three out of the ten providers looking at McKesson give the reason that they are already McKesson imaging clients. Two providers mention that they haven’t decided whether to buy through McKesson or to go directly to the OEMs (Bayer and PACSHealth).

NOVARAD

Both of the providers using NovaPACS list Novarad’s rebranded PACSHealth solution, NovaDose, as their top choice. Nova- Dose is also getting looks outside of the Novarad customer base, with two other providers considering the solution. Most of the providers say they are in the early stages of looking at dose monitoring and are merely aware that NovaDose exists.

PHILIPS

Five of the fourteen Philips PACS providers are looking at Philips. Just like McKesson customers, a couple providers are debating about whether to contract directly with Bayer rather than dealing with Philips. Providers are looking at Philips because they own Philips equipment or imaging software.

SCANNERSIDE

Three providers mention Scannerside, with two saying it is their top choice. Low cost is the number-one reason these providers give for looking at Scannerside.

SECTRA

Four providers are considering Sectra. Two are Sectra customers. DoseTrack is being considered because providers are already using Sectra’s imaging software or may be purchasing Sectra’s PACS soon.

SIEMENS

Of the two Siemens PACS customers interviewed, one plans to go with Siemens because of the Bayer partnership. Four providers who are not Siemens PACS customers are looking at Siemens, but none give a definitive reason.

OTHER MENTIONS

Bracco and RADIANCE are both mentioned once. Bracco currently partners with PACSHealth, but no mention is made as to why Bracco is being looked at. RADIANCE has already been looked at because it is freeware, but it has been ruled out because of IT-support concerns.

MISSING IN ACTION

DR Systems Unity v|Series PACS v.9 comes with dose monitoring functionality, but none of the DR Systems customers KLAS spoke to are planning on using it. Two providers have already contracted with another dose monitoring vendor. Providers mention they are unaware that DR Systems offers dose monitoring. INFINITT, another PACS vendor offering dose monitoring, is not being looked at by anyone.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.