2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Clinical Decision Support 2013

Sizing Up Point-of-Care Reference Tools

CDS reference tools play an important role in aiding caregivers by providing current information on diseases, drugs, and care plans. With a number of products on the market, which ones are being used most and why? How impactful are these tools, and how would care differ if they were gone?

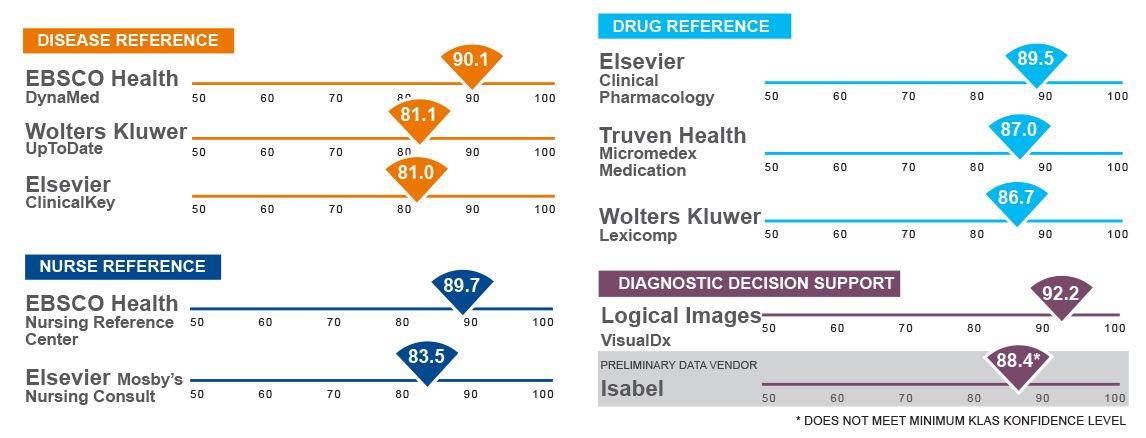

OVERALL PERFORMANCE

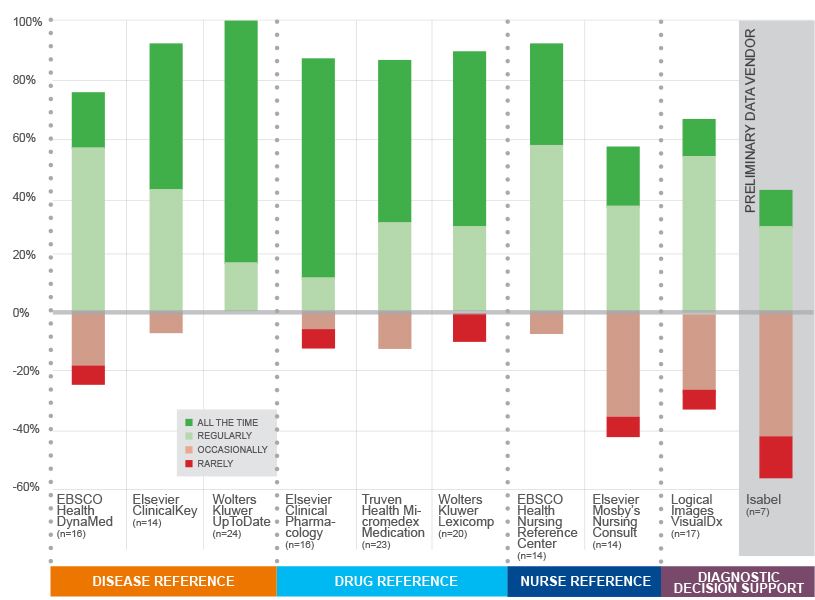

HOW OFTEN DOES THIS PRODUCT GET USED?

WORTH KNOWING

MOST PORTFOLIOS SILOED; WOLTERS KLUWER SEES SOME LEVERAGE

Even as providers seek strategic direction in place of à la carte products, portfolio fragmentation keeps the market mostly siloed. Wolters Kluwer customers mentioned workflow benefits thanks to links between UpToDate, Lexicomp, and ProVation Order Sets, as well as an association with VisualDx. Conversely, EBSCO Health’s, Elsevier’s, and Truven Health’s portfolios are not considered to be aligned, and providers have not yet mentioned benefits from the recent EBSCO Health and Isabel partnership.

THE UPTODATE PARADOX

Providers report UpToDate is indispensable and has the most positive impact on patient care. Despite having lower overall satisfaction scores fueled by complaints of high prices and contracting issues, UpToDate has the widest usage and is preferred by physicians at the point of care. However, DynaMed continues to provide the best customer experience and the most evidence-based content.

NURSING REFERENCE FEELING THE SQUEEZE

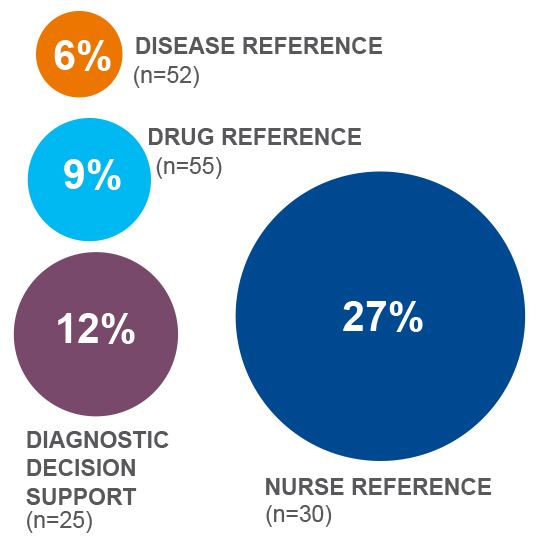

Nursing reference tools are the CDS products most likely to be discontinued: 27% of providers said they might stop using or leave their product, more than double or triple the rates seen with other CDS reference products. Dissatisfaction is not the cause. Instead, customers are looking to cut costs by consolidating to fewer reference products. Over 33% of Elsevier’s Mosby’s Nursing Consult customers said they were considering cutting ties compared to about 20% of EBSCO Health’s Nursing Reference Center customers.

DIAGNOSTIC REFERENCE TOOLS: NICE TO HAVE, BUT NOT A MUST-HAVE

Despite high praise for both Logical Images and Isabel, providers use those products less frequently than other CDS reference tools, and 39% of respondents said not having the product would have little or no impact. Both vendors are working to increase usage: Logical Images has a phenomenal mobile solution, and many have integrated the product with UpToDate. Isabel is trying to overcome its siloed reputation by deploying Active Intelligence, which runs in the background and extracts keywords to help clinicians formulate diagnoses.

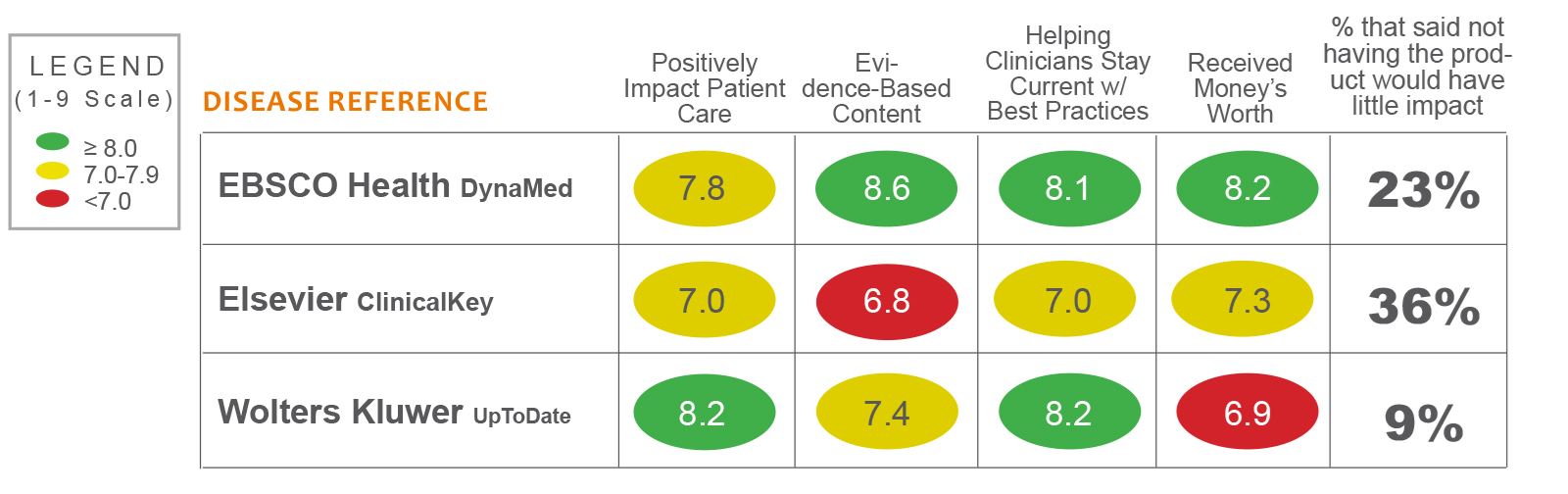

KEY DIFFERENCES - DISEASE REFERENCE

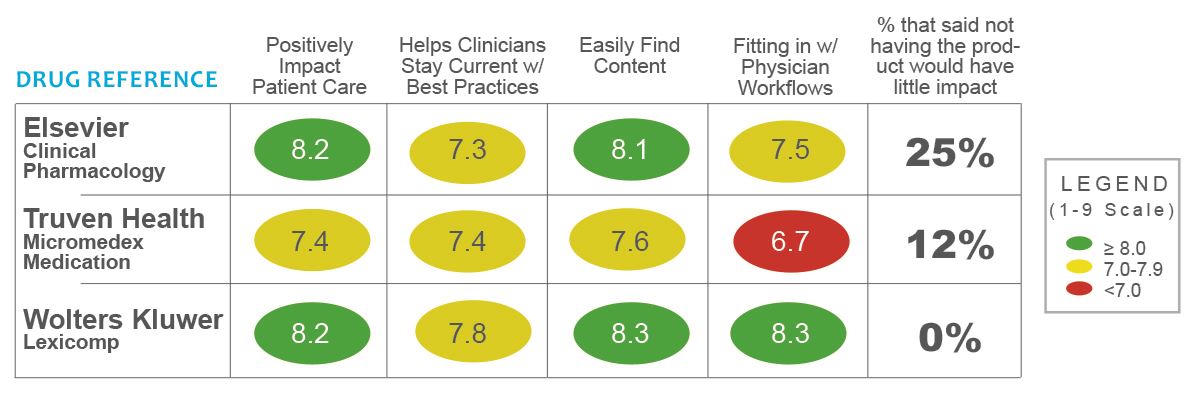

KEY DIFFERENCES - DRUG REFERENCE

BOTTOM LINE ON VENDORS

DISEASE REFERENCE TOOLS

EBSCO HEALTH DYNAMED

Topperforming disease reference tool. Easily digestible, bulleted format helps users quickly find information. Highly rated for evidence-based content and keeping users updated on best practices. Good mobile tools. Despite glowing reviews, DynaMed usage substantially lower than competitors’.

ELSEVIER CLINICALKEY

Goforward option replacing MD Consult/ First Consult; some say ClinicalKey still feels unfinished. Lowest-rated disease reference product in specialty categories. Used as a research reference. Providers appreciate voluminous content, but search tool lacks filtering ability. Poor integration with physician workflows.

WOLTERS KLUWER UPTODATE

Clinician favorite. Widespread usage. Not generally regarded as evidence based but rather as expert opinion; however, still keeps clinicians abreast of best practices. Easy-to-use search and frequent integration with EMR and ProVation order sets save time. Price concerns continue to be mentioned.

Other Products: For more information on BMJ and Truven Health’s disease reference tools, see the Drill Deeper section.

NURSE REFERENCE TOOLS

EBSCO HEALTH NURSING REFERENCE CENTER

Highest-rated nursing reference product. Frequently updated, evidence-based information conveyed to nurses in succinct care sheets. High usage and integration with EMR facilitates positive impact on patient care. Nearly one in five considering discontinuing use in order to cut costs.

ELSEVIER MOSBY'S NURSING CONSULT

Average performer. Product updated regularly to incorporate evidence-based content. Lower usage. Noted learning curve and cumbersome searches, but providers say usage improves with familiarity. Poor mobile options. Over 35% considering leaving the product.

DIAGNOSTIC DECISION SUPPORT PRODUCTS

ISABEL (PRELIMINARY DATA VENDOR)

High performer. Convenient to use and effectively helps providers perform diagnoses through evidence-based algorithms. New Active Intelligence functionality captures keywords to aid in patient diagnosis. Not well integrated into physician workflows, leading to lower overall usage and limited positive impact on patient outcomes.

LOGICAL IMAGE'S VISUALDX

Very high-performing product with easily searchable, comprehensive database of images. Rates highly for impacting patient care—images and disease information can easily be shared with patients. High usage, but most using it for dermatology consults. Phenomenal mobile application.

DRUG REFERENCE TOOLS

ELSEVIER GOLD STANDARD CLINICAL PHARMACOLOGY

Top-rated drug reference solution with highest usage. Average for tying into workflows and saving clinicians time, but easy to search and navigate. Quick search results positively impact patient care. Occasional gaps in drug information and noted to be slower for updating content.

TRUVEN HEALTH ANALYTICS MICROMEDEX MEDICATION MANAGEMENT

High performer. Very comprehensive medication reference tool. In-depth information but not presented in concise format for quick reference. High usage in pharmacy but rates lower for impacting patient care.

WOLTERS KLUWER LEXICOMP ONLINE

High performer. Strong integration with workflows and UpToDate, saving clinicians time. Concise information is easily searched. Patient-education sheets a positive for patient care. Trusted reference for pediatric content. Solid, easy-to-navigate mobile app. Many want more content.

WHAT % OF CUSTOMERS ARE CONSIDERING DISCONTINUING THEIR USE?

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.