2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Related Segments

Computer-Assisted Coding 2013

What's the Impact?

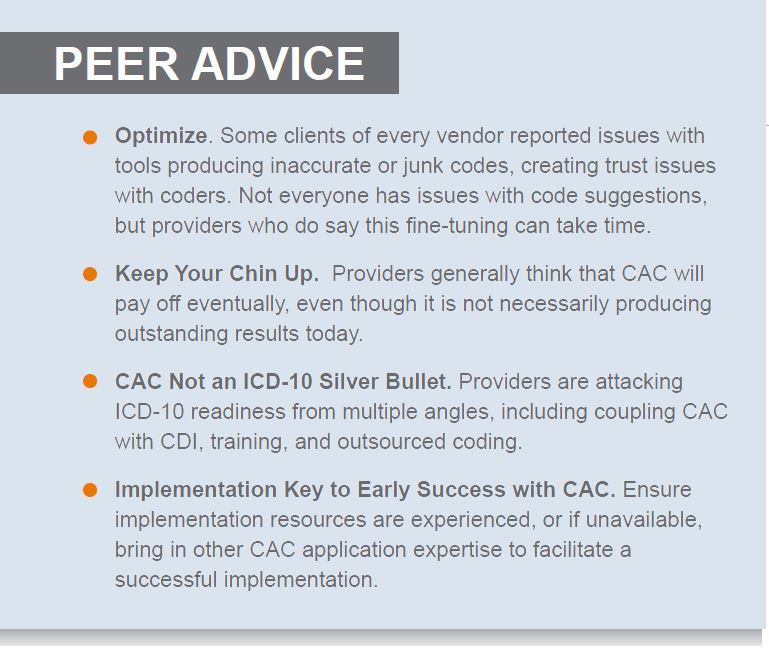

It’s crunch time. The ICD-10 deadline is fast approaching, and providers know that it will bring disruptions to their coding environment. Many are making a preemptive strike via CAC to train staff and hopefully increase coder productivity. However, not all products are created equal. This report discusses early market leaders with inpatient CAC, how these CAC solutions differ in their impact on coding productivity and other key metrics, how CAC solutions are mitigating coding challenges, and how vendors are instilling confidence with clients in their readiness for ICD-10.

COMPUTER-ASSISTED CODING 2013

What's the Impact?

Report Author: Mike Smith

It’s crunch time. The ICD-10 deadline is fast approaching, and providers know that it will bring disruptions to their coding environment. Many are making a preemptive strike via CAC to train staff and hopefully increase coder productivity. However, not all products are created equal. This report discusses early market leaders with inpatient CAC, how these CAC solutions differ in their impact on coding productivity and other key metrics, how CAC solutions are mitigating coding challenges, and how vendors are instilling confidence with clients in their readiness for ICD-10.

WORTH KNOWING

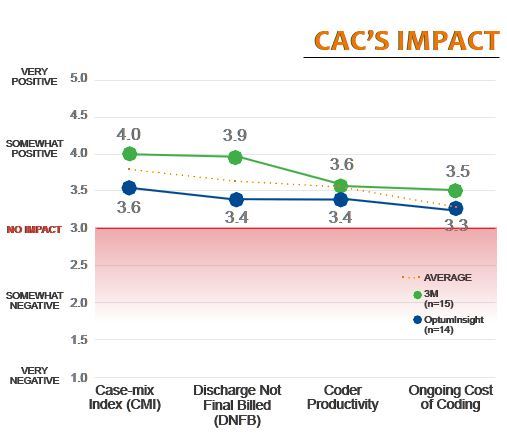

CODER PRODUCTIVITY, CMI, AND DNFB IMPROVING FOR MANY, BUT IMPACT DEPENDS ON VENDOR.

3M has the strongest positive impact across all three areas, with a noticeably stronger impact on CMI and DNFB. Coder productivity is the least impacted metric. While a few providers have experienced significant productivity gains and many feel CAC is having a somewhat positive impact, nearly 45% of 3M and OptumInsight clients have yet to see a positive impact at this early stage.

IMPLEMENTATIONS A MAJOR FRUSTRATION FOR MANY 3M AND OPTUMINSIGHT CLIENTS due to inexperienced or stretched implementation resources, resulting in delayed timelines, cumbersome workflows, poor system design, and a lack of expected and quick productivity gains. While implementation quality and timeliness was the most challenging area for both vendors, OptumInsight clients were noticeably less satisfied, scoring OptumInsight nearly a point lower than 3M (on a nine-point scale).

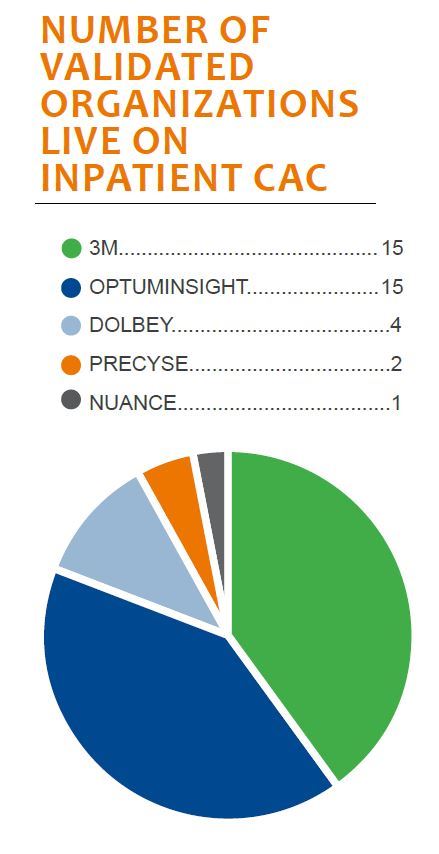

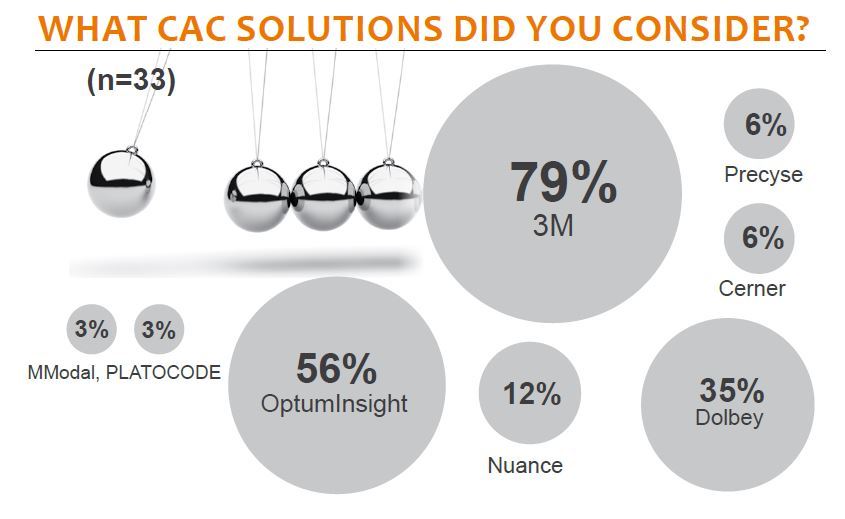

FEW LIVE; MARKET GROWING RAPIDLY; 3M AND OPTUMINSIGHT EARLY LEADERS.

KLAS has validated 37 unique organizations that are live on inpatient CAC—80% of which are either on 3M or OptumInsight. Most who select 3M are existing encoder and CDI clients, while most who select OptumInsight do so because of OptumInsight’s NLP engine after going through a competitive bid process. Early leaders face competition with Dolbey, Nuance, or Precyse, and that competition is heating up as there are many more organizations (hundreds) that are either considering a system, have contracted with a vendor, or are in the process of implementing a CAC.

MOST LIVE WITH INPATIENT CAC BELIEVE IT WILL HAVE A POSITIVE IMPACT ON THEIR ICD-10 READINESS.

While many have yet to fully realize the benefits of CAC, that has not dimmed the optimism for tomorrow: Most providers (57%) anticipate they will be more satisfied with CAC a year from now, and most believe their CAC will have a positive impact on their ICD-10 readiness. This enthusiasm is supported by real data: 3M clients live over a year scored 3M over 7 points higher than did those live less than a year (86.4 versus 78.8, out of 100). OptumInsight clients live for less than a year scored OptumInsight 54.8, but the score jumps by nearly 25 points as clients live for over a year rated OptumInsight 79.6.

BOTTOM LINE ON VENDORS

Ranked Vendors

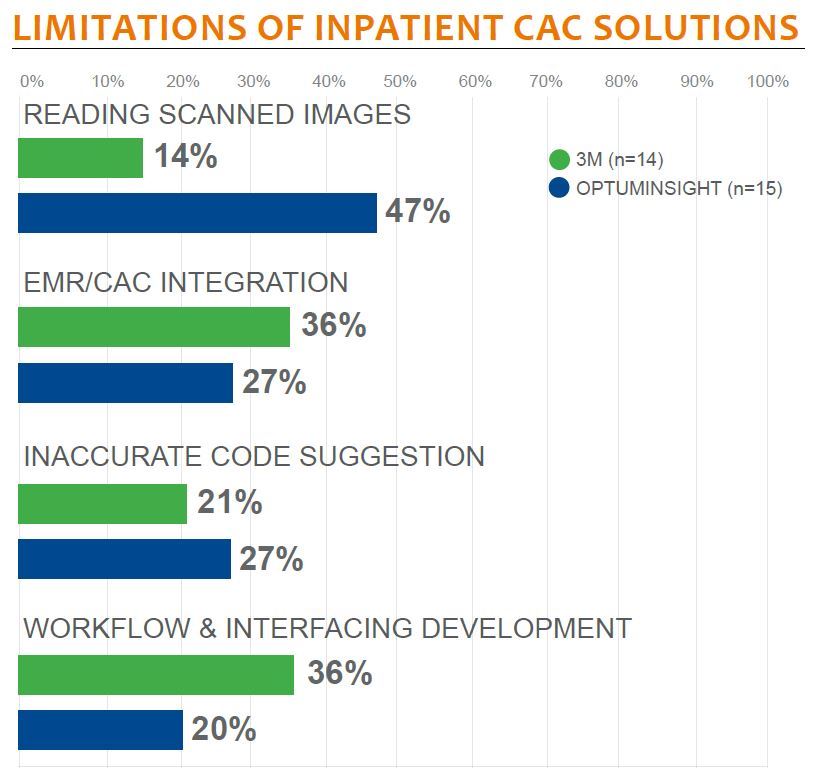

3M: Solid overall performance score and receives the highest marks for positive impact on coder productivity, CMI, DNFB, and overall cost of coding. Some frustrated with poor implementation resources, lack of quick and effective issue resolution, and missed timelines. Is the most considered inpatient CAC vendor and has about 40% of the validated live inpatient CAC clients. Most clients also purchase 3M’s CDI solution. Issues with integration with Epic cited by several clients.

OptumInsight: Has the most validated hospitals live on their inpatient CAC solution and 40% of all validated live clients. Mediocre performance score, with clients live for less than a year scoring them dramatically (25 points) lower than those live for over a year score them. While receiving lower marks than 3M, OptumInsight is having a somewhat positive impact on coder productivity, CMI, DNFB, and overall cost of coding for several clients. Second most considered inpatient CAC vendor at 56% of the time. Most select OptumInsight because of its NLP engine. Poorquality implementations and missed timelines have had a major impact on overall performance scores. In October, 2013, Dignity Health and Optum formed a company called Optum360, which their CAC product is now associated with.

Other Vendors Validated in this Study

Dolbey: Third-largest CAC vendor in terms of considerations (35% considered Dolbey) and the number of unique inpatient CAC installations (four unique clients validated). Also provides speech recognition solutions to providers. KLAS will start publishing performance data once there are more than six unique clients.

Nuance: Most recognized for speech recognition technology but is making noticeable investments in the coding space. Late last year acquired QuadraMed’s encoder and CAC assets as well as J.A. Thomas, a major CDI vendor. While it is still early, KLAS has validated one client live on inpatient CAC. Twelve percent of those live on inpatient CAC considered Nuance.

Precyse: Precyse has long been offering outsourced coding and transcription services as well an eLearning solution to help organizations provide online training to their constituents. Precyse also has CAC and CDI solutions. KLAS validated two clients live on inpatient CAC and is aware of several others that have contracted with Precyse for CAC.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.