2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

MEDITECH 6.0

A Lot of Ground to Cover

MEDITECH promises 6.0 to be the fully integrated, cost-effective, user-friendly answer for today’s healthcare. With providers facing increasing pressure from meaningful use (MU), value-based purchasing, and accountable care, it has never been more important for vendors to deliver on their promises. After three years on the market, how well is MEDITECH 6.0 delivering the advanced clinical usability providers were promised? How does 6.0 compare to MAGIC and C/S, as well as other EMRs on the market? Is MEDITECH 6.0 becoming the EMR of choice to solve today’s healthcare needs?

Worth Knowing

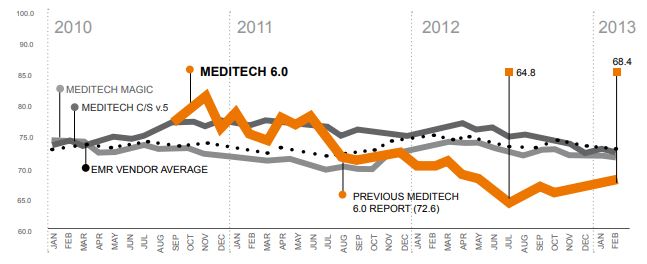

MEDITECH 6.0 Trails Performance of Most EMRs, Including MAGIC and C/S—MEDITECH has never tried to compete based on bells and whistles. Their strength has been affordability and reliability. Unfortunately, a number of providers who moved to 6.0 said they have lost integration, speed, and reliability, as well as some reporting capability. As a result, MEDITECH 6.0’s performance scores are among the lowest in the market. Transitioning from MAGIC to 6.0 can be especially challenging and complex. Despite the challenges, 95% of organizations on MEDITECH 6.0 plan to stay.

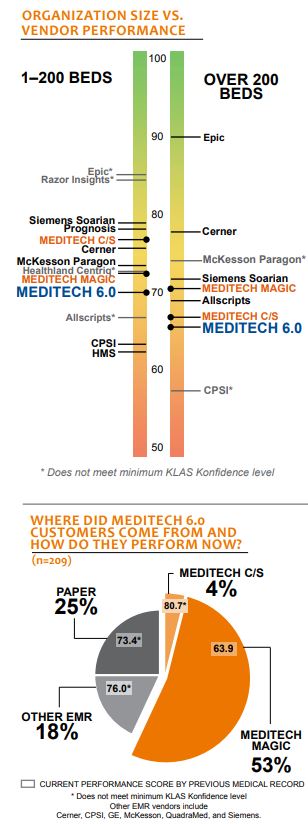

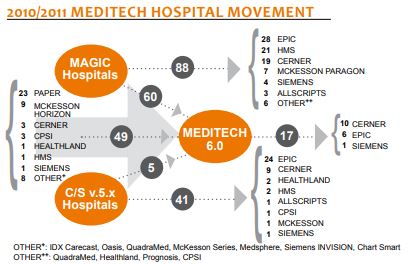

Healthcare Reform Pushing Providers Away from MEDITECH—Mandates for EMR adoption combined with MEDITECH’s brand recognition and low price point caused 49 non-MEDITECH hospitals to adopt 6.0 from 2010 to 2011 (most under 200 beds). At the same time, more advanced MU requirements and healthcare organization consolidation have taken their toll as 146 MEDITECH hospitals (51 over 200 beds) have moved to other EMR solutions.

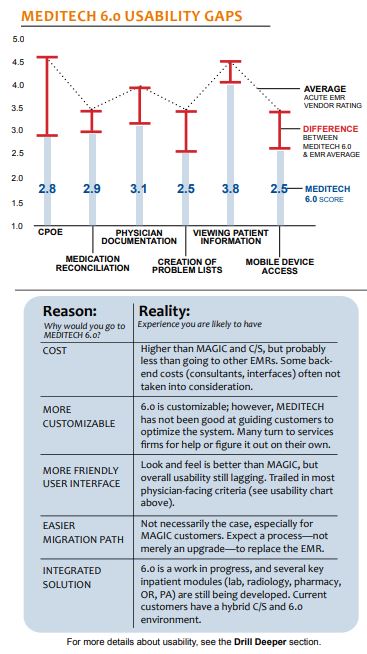

Usability Better Than MAGIC, but Still Lagging—While the look and feel of 6.0 is an improvement, providers indicated they are facing usability challenges of an immature product. Usability for MU Stage 2 requirements like CPOE and physician documentation lags behind most other EMRs’. ED physicians specifically report workflow limitations and numerous clicks as impediments.

Recent Improvements a Step in the Right Direction—While many deployments have been successful, many have struggled. Customer satisfaction varies widely. Recent implementations have gone better and performance scores are up four points over the past year. However, MEDITECH still has a lot of work left to deliver on customer expectations—currently 38% of customers surveyed give a performance score equivalent to a C or lower.

Integration Still Under Development

Integration has been a bedrock for MEDITECH customers, but 6.0 is not currently an integrated product. The pharmacy, OR, lab, radiology, and patient accounting platforms have not been updated to the 6.0 platform. This is something MEDITECH promises to fix in versions 6.1 and 6.2.

Meaningful Use (MU) and MEDITECH 6.0

Many clients on all MEDITECH platforms have successfully attested for Stage 1, including 63 MEDITECH 6.0 hospitals, which is approximately 30% of contracted clients. However, MU Stage 1 pushed many MEDITECH MAGIC clients to switch to 6.0 earlier rather than waiting for the system to mature. As a result, implementation and attestation frustrations often converge in low performance scores. Some blame MU for 6.0’s immaturity, concluding MEDITECH would have had more resources to improve the product if not devoting so much time to government-certification checklists.

MEDITECH 6.0 More Appealing to Smaller Hospitals

Although MEDITECH has some larger customers, they are typically considered a small to midsize hospital solution. However, as providers adjust to healthcare reform, MEDITECH’s customer base is decreasing in overall numbers and shifting toward the small hospital space (fewer than 200 beds). In 2010– 2011, MEDITECH gained 6 hospitals over 200 beds but lost 51. As a result, MEDITECH’s overall large hospital market share fell from first to third.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.