2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Related Segments

Clinical Market Share 2014

Competition Mounts as Markets Collide

In our first report combining EMR trends in both large (over 200 beds) and small (200 beds or less) hospitals, KLAS charts the speed and direction of the acute care market in 2013.

WORTH KNOWING

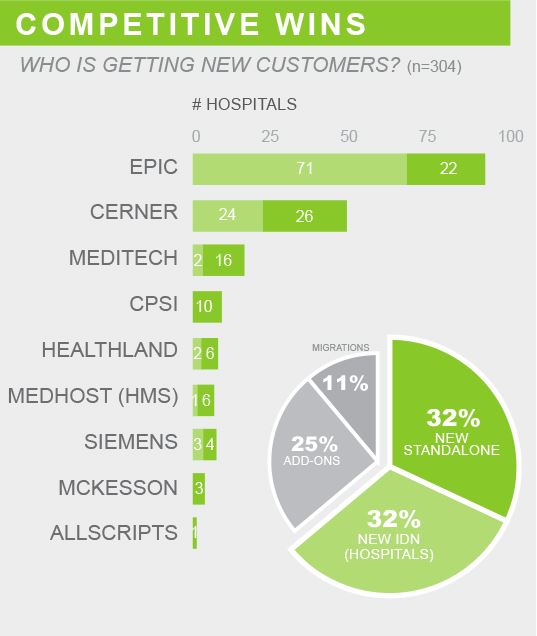

ONLY THREE VENDORS NET SIGNIFICANT POSITIVE GROWTH:

Cerner and Epic continued to expand their market share and took a combined 60% of new wins in 2013. MEDITECH was the only other vendor to see significant growth in market share. All other vendors lost more hospitals than they gained. Among active vendors, McKesson had the largest net loss—a decrease of 34 hospitals (the vast majority being legacy Horizon customers).

BIG CHANGES IN TOTAL WINS; SMALLER CHANGES IN COMPETITIVE LANDSCAPE:

Epic remained the leader in both overall wins and competitive wins with first-time customers (including 15 new multihospital IDNs). For the first time, Epic surpassed MEDITECH for the largest overall market share. Cerner won 3 multihospital IDNs and significantly closed the gap in new hospital wins based on the strength of their hosting for smaller standalones. As in previous years, Cerner and Epic were the only vendors to win competitive deals broadly across the size spectrum.

BIG CHANGES IN THE SMALL SPACE:

Since 2010, EMR sales to small hospitals have fallen by almost half, from 392 to 219. In a land of shrinking opportunity, large vendors Cerner, Epic, and MEDITECH took over two-thirds of wins with hospitals under 200 beds. Most small vendors—like CPSI, Healthland, and MEDHOST—saw a decrease in wins and an increase in losses amid customer frustrations with slow development and sluggish service.

LEGACY DECISIONS: SHOULD I STAY OR SHOULD I GO?

Nearly 1,300 hospitals (369 large, 888 small) are still running legacy systems and will face a purchasing decision in the future. MEDITECH MAGIC and C/S customers account for 60% of these hospitals, with McKesson Horizon and Healthland customers making up another 29%. In 2013, the majority of legacy-customer movement went to Cerner, then Epic, and then McKesson and MEDITECH.

VENDORS

ALLSCRIPTS

Six wins in 2013, five under 200 beds. Departures accelerated with a net loss of ten hospitals. Lowest overall market share of covered vendors. Existing customers say Allscripts is getting better, especially with implementations. Half said missing needed functionality.

CERNER

Almost doubled new wins from previous years to 87. Growth spread across three new IDNs, standalone community/rural hospitals signing for hosted EMR, and existing customers adding hospitals. Performance ratings continue to inch higher. Eight losses. No Cerner IDNs made wholesale moves to another vendor.

CPSI

Little net change; 11 wins and 13 losses. New hospitals mostly coming from paper. Losing customers mainly to larger enterprise vendors. Performance scores drifting downward, but experience is highly variable. Only half of customers say has needed functionality.

EPIC

Leader in overall hospital market share and 2013 hospital wins. Most of 107 wins are from 15 IDNs with no prior Epic relationship. Six losses all due to hospital ownership changes. Top-rated vendor in KLAS acute care EMR performance score for several years.

HEALTHLAND

Eight wins and 25 losses. Lowest ratings among small vendors. Leadership change encouraging for customers, and communication improving. High client optimism for future improvements.

MCKESSON

Thirty-six hospital wins for Paragon: 23 migrating from Horizon, 10 add-ons, and 3 brand-new customers. Most migrations from Horizon have over 200 beds. Forty-two Horizon hospitals chose other vendors. Paragon performance scores continued to fall over the past year as customers experienced delayed upgrades, service.

MEDHOST (HMS)

Gained seven hospitals and lost nine. Mostly critical access hospitals. Uptick in implementation quality makes MEDHOST the only small vendor to increase KLAS score in the past year. Patient Logic acquisition a boost for meaningful use, but development perceived as slow.

MEDITECH

Second largest overall market share, mainly in under-200-bed hospitals. New small-hospital contracts contributed to increased market share in 2013 with net addition of 12 hospitals. Fewer customers signed for 6.0 migrations, hesitating on cost and lack of software maturity.

SIEMENS

Added 12 and lost 17 in continued shift toward smaller hospitals. Performance scores dropped on development speed, code quality, and service. Users predict satisfaction will drop further. One-third would not buy again.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.