2025 BEST IN KLAS

2025 BEST IN KLAS

Preferences

Related Series

Related Segments

Healthcare Analytics 2013

Making Sense of the Puzzle Pieces

The analytics market is complex and fast moving, leading to confusion for most. With the ideal of a single vendor meeting all BI/analytics needs largely unfulfilled, this report assists providers to better understand the pieces of the puzzle and differentiate between vendor products, including leaders and laggards.

HEALTHCARE ANALYTICS

Making Sense of the Puzzle Pieces

Report Author: Joe Van De Graaff

The analytics market is complex and fast moving, leading to confusion for most. With the ideal of a single vendor meeting all BI/analytics needs largely unfulfilled, this report assists providers to better understand the pieces of the puzzle and differentiate between vendor products, including leaders and laggards.

WORTH KNOWING

A NEW TOP PERFORMER

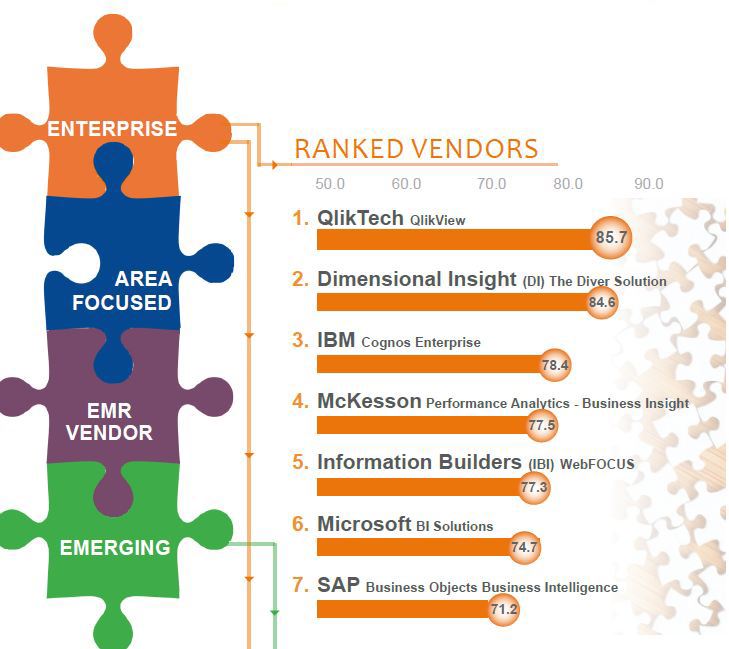

QlikTech deployments have grown notably over the last several years while client satisfaction has remained high, slightly edging ahead of multiyear leader Dimensional Insight.

HEAVYWEIGHTS TOO HEAVY FOR HEALTHCARE?

SAP, Microsoft, and Oracle lag in performance, dragged down by system complexity. Clients see Information Builders and IBM as doing slightly better but still only average overall. MicroStrategy bucks the trend—but only with a small number of clients.

ANALYTICS: USES FOR ACOs EMERGE

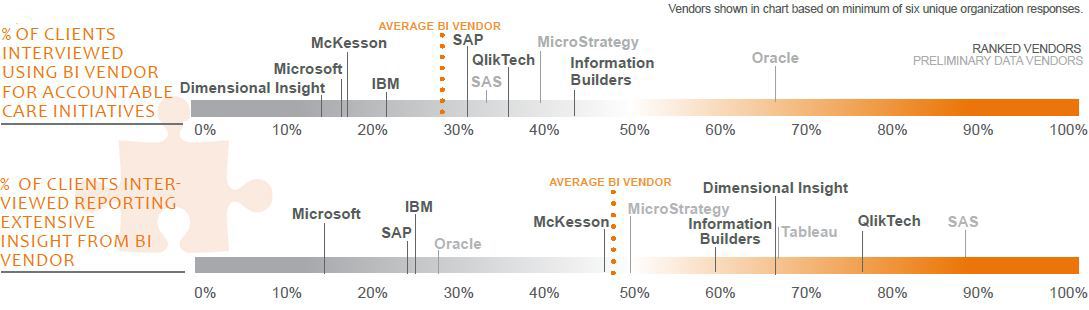

Deep BI/analytics capabilities in enterprise tools lead providers to expand use for ACO-related analyses: 23% of providers reported using their BI tools in this way. Oracle use stands out here, followed by Information Builders.

INSIGHTS GO DEEPER; EASE OF USE IS KEY

Forty-seven percent of respondents reported extensive insights from their BI tool. Tools famed by clients for ease of use such as QlikTech, Tableau, and Dimensional Insights get particularly high marks, but clients put SAS at the top for extensive insights. (Note: Most SAS users are very advanced/superusers.)

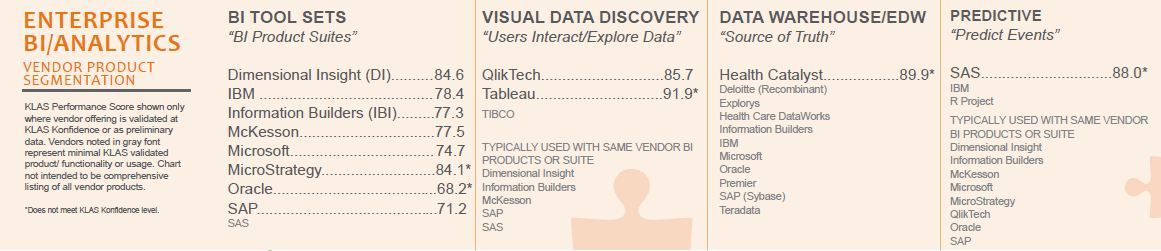

HEALTHCARE ANALYTICS SOLUTION PLATFORM

Some vendors noted in the EDW category are emerging with unique healthcare analytics solution platforms. What makes these options different is they have a healthcare-specific analytics foundation (i.e., EDW) with packaged healthcare-specific analytics applications built on top. From KLAS validated early interviews, examples include Deloitte (Recombinant), Explorys, Health Care DataWorks, Health Catalyst, IBM, Information Builders, Oracle, and Premier. Only Health Catalyst has enough live clients validated by KLAS for an early performance score—reviews are highly positive.

POPULATION HEALTH MANAGEMENT (PHM)

The aggregation and analysis of multiple sources of data, common functions of BI, are often functional requirements for population health analytics. Some vendors in this report, enterprise vendors in particular, can be used for analysis and reporting on population health–related metrics, but they generally lack in packaged patient outreach and care management functionality. A few area-focused vendor products with a performance score in this report, such as those from Advisory Board or Optum (Humedica), have more packaged applications. As population health is a new and high-interest area, KLAS has just published a report that gives an early look into population health management, which KLAS looks at as the process of proactively monitoring and caring for defined patient groups.

BOTTOM LINES ON RANKED VENDORS

1) QlikTech—Has changed the expectation of how BI can be used and enjoyed by end users. Deployments have grown notably and client satisfaction remains high, but lacks robustness of BI suite and some complaints about licensing model. Competition intensifying quickly.

2) Dimensional Insight—Consistent high performer; often wows majority of clients with product and service, except for a few recent implementation missteps. Receives less than expected consideration in heavyweight BI deals.

3) IBM—Viewed as having great vision and very advanced BI tools, an image other vendors seek. Performance score slightly up this year, but high cost and complexity are limiting factors to most of the market. Clients note gaps in visualization capabilities.

4) McKesson—Stands out due to strong market adoption of EMR-agnostic BI offering. Noted for scorecards and dashboards. Trying to move up the market but has only average overall performance and client base is mostly midmarket.

5) Information Builders—Fairly unique midmarket appeal as a comprehensive BI tool set at reasonable price, but proprietary nature of technology and some polarized client satisfaction give cause for concern.

6) Microsoft—Powerful BI tools when used and pieced together well, but most often underused and seen in the background; lacks healthcare specificity and focus. Most clients see other BI vendors as more strategic.

7) SAP—Receives strong market visibility with heavyweight tools, but lags far behind in performance and clients complain of terrible support. Seen as distanced; customers often left to their own success. Notable OEM relationships.

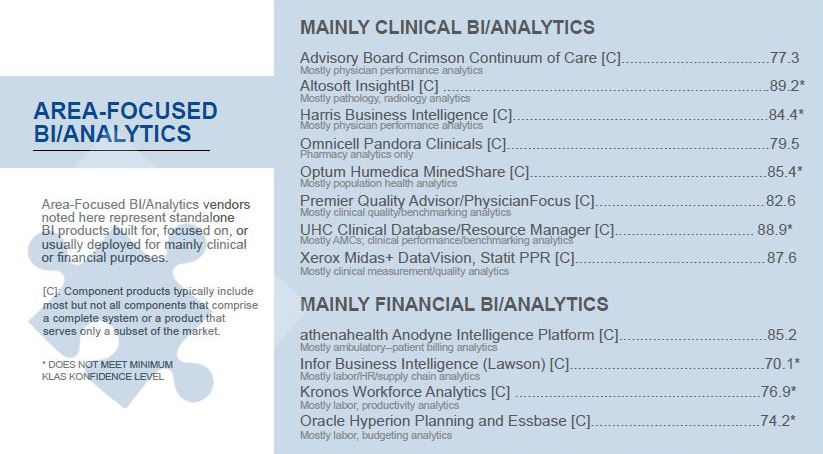

EMR VENDOR BI/ANALYTICS

(BI Products EMR Vendors Provide to Their Clients)

Clients often consider their EMR vendor for some level of BI/analytics, but most typically look to enterprise BI vendors for robust, organization-wide BI/analytics.

Allscripts (CPM)–Different from other EMR BI offerings; used for both regulatory reporting and for BI functions. Good fit for Sunrise clients. Very clinically focused BI, but relatively small client adoption.

Epic (Cogito)–Has made some much needed development progress, but EDW live sites still very sparse. Clients encouraged about future potential but mostly hesitant given its newness.

Cerner (PowerInsight) 68.3*–Struggling, fairly stagnant BI used mostly on Cerner clinical data. Some clients successful, but most frustrated and want more ease of use.

McKesson Performance Analytics (77.5)–Strongest BI showing among EMR vendors, but only average performance overall. Differentiated by adoption on other EMR platforms and by newer visual data discovery (Explorer product).

MEDITECH–Has worked with other vendors to fulfill client reporting/BI needs. Most notable is Medisolv, whose customers are mostly smaller hospitals and are generally pretty happy.

Siemens (Healthcare Intelligence)–New Siemens main BI offering with TIBCO workflow engine. Only a few live clients. Flexibility a strength but overshadowed by complexity and rough implementations.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2025 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.