2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Digital X-Ray Performance 2013

Wireless and Workflow In Focus

Providers are seeing big benefits from wireless detector technology. With all of the major vendors offering it and prices coming down, it is becoming a standard for digital x-ray room replacements. But who performs best? KLAS interviewed 201 providers to find out.

Worth Knowing

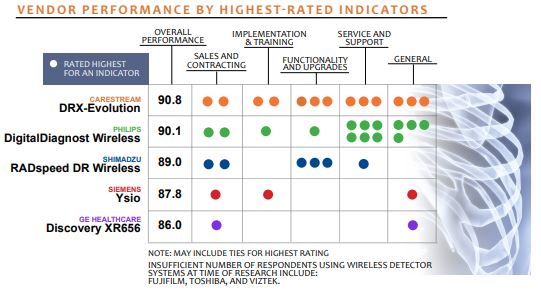

Carestream and Philips Take the Lead with Wireless Rooms: Moving ahead of perennial leader Shimadzu, Carestream has built on their wireless detector success with the DRX-Evolution. Providers are taking advantage of moving detectors between different rooms or of mobile x-ray systems. The DRXEvolution wireless rooms are also meeting provider needs with an intuitive user interface, great image quality, and reliability. Philips has improved their account management with their x-ray customers and is a high performer with image quality and reliability.

Reliability Holding GE Back: GE’s XR656 has challenges with downtime. Their reliability rating is weakest in the study, and providers who experienced downtime said that it breaks down repeatedly. Most problems were fixed within a few hours, but a few took several days to fix. Customers like the images from the XR656 but are waiting for GE to permanently address the downtime problems.

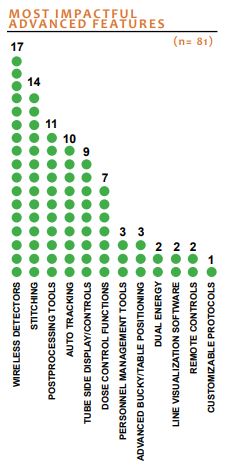

Workflow Is in Focus: Providers praise workflow enhancements, particularly Carestream clients. Carestream is top rated for usability. Also, Carestream, Fuji, and Shimadzu customers praise their vendors for excellent patient throughput. While image quality cannot be neglected, continued streamlining of the workflow is top of mind.

Dose Is on the Radar: Vendors have an opportunity to make an impact with dose because no one is a leader yet. Overall dose is less with DR than with CR, and most providers are happy with that progress. With awareness and low-dose pressure increasing, Toshiba, GE, and Fuji currently receive the lowest marks for their offering to track and monitor dose.

Wireless Detectors: Who Delievers Best?

All the major vendors now offer wireless detectors. Battery life, most providers agree, is meeting needs. However, providers mentioned they do have to be vigilant about returning the detector to the charger to avoid problems. When it comes to reliability, some vendors are doing better than others at delivering durable, reliable, easy-to-use plates. Many providers mentioned the fear of dropping their detectors because of how much they cost to replace.

One radiology director said, “We have a lot of students at our site in a training environment. Right now, the students aren’t using the Philips DigitalDiagnost room because of the possibility that they will drop the detector. As time goes on and the students begin using the room, we see ourselves being a little more vulnerable to damaging the detectors.”

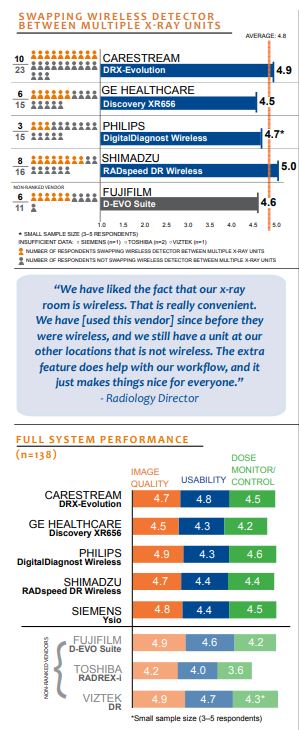

Despite the fear of dropping and breaking detectors, only a few actually had to deal with that issue in reality. While many said they were not utilizing the ability to swap detectors (either with a mobile unit or another wireless room), they like the option to do so and most said it is easy to do. Over 40% of Carestream customers are switching their detectors and noted that it is extremely easy. Fuji and Shimadzu have around half of their customers actually switching their detectors.

Shimadzu has the strongest performance with swapping detectors, and providers raved about how easy it is to do. One provider said, “One of the features that Shimadzu advertises is the ability to switch out the detector from one room to another or to a mobile unit. We have been trying that out with our mobile x-ray unit, and it seems to be working just fine. We just make sure the detector registers with the unit, and off we go.”

Bottom Line on Vendors:

Carestream: Reliable unit with great patient throughput. Easy-to-use and intuitive GUI consistent across CR and DR offerings. Detector battery life is meeting needs. Switching detectors works well, with nearly 40% using it. Carestream performs solidly across the ratings.

GE Healthcare: Lands fifth out of five ranked vendors. Implementations have been problematic and not timely, largely attributed to bugs with a new system. Below-average reliability negatively affects patient throughput. Image quality slightly below average, but with tweaking a few said they got it exactly right. Service and support vary based on region—better in Northeast and weaker out West.

Philips: Excellent reliability; downtime is quickly remedied. Solid product and tops in support and account management. Highest-regarded dose monitoring that is meeting needs for those using it. Found in larger facilities over 200 beds

Siemens: Leader with implementations; providers feel product does everything Siemens said it would do. Image quality and dose controls impress providers. However, several said workstation is cumbersome or inconsistent with Siemens’ other products. Field support is solid, but quicker response could improve it.

Shimadzu: Great reliability with very little downtime. Great value for quality x-ray equipment. Responsive service team. Image quality excellent across the board. Swapping detectors very easy to do with no hiccups. Detector battery life exceptional at an average of six to eight hours on one charge.

FUJIFILM: Wireless customers much happier than tethered. High percentage of customers swapping detectors successfully. Tethers reported to break easily. Excellent image quality overall, especially for skeletal studies.

Toshiba: Late to the game with wireless option. Large majority using tethered detectors. Several customers said they need better image quality, especially for small parts. Usability weaker than other vendors’ due to cumbersome workstation. Dose controls limited. Upholds reputation for excellent service personnel.

Viztek: Found mainly in ambulatory setting. Performs well with good images and patient throughput. Simple design and easy to use. Wireless option now being offered.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.