2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Enterprise Patient Access 2013

Trying To Solve Patient Access Challenges

Healthcare reform and decreasing reimbursements are pushing provider organizations to realize greater efficiency at the financial front end. In essence, providers are looking for a next-generation approach. While the traditional methodology has consisted of multiple bolt-on solutions to support patient access–related tasks, a few innovative vendors are heeding the providers’ call for a more holistic, workflow-driven approach. This study takes an early look at enterprise patient access, as well as which vendors are gaining traction with broad functionality and what automation is most desired.

Comprehensive Enterprise Patient Access Suite: A Cutting-Edge Approach

“We are looking for an integrated workflow in which we can manage all the patient access–related tasks from a single, centralized hub.” - Director of Patient Access

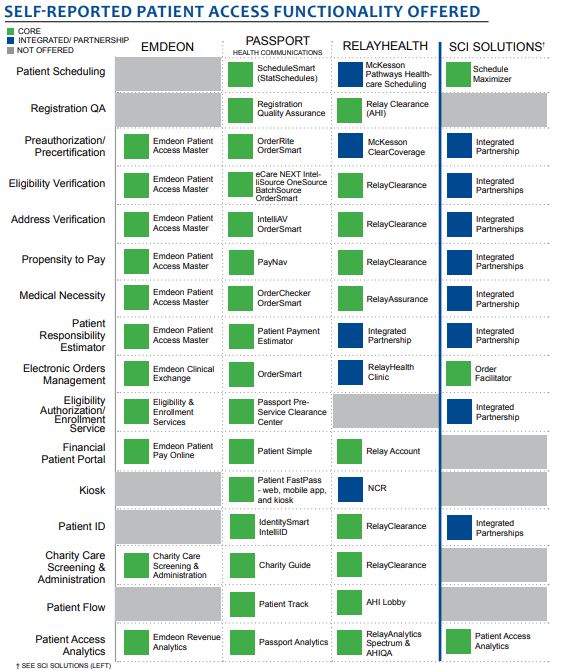

Enterprise patient access is a cutting-edge approach led by the claims clearinghouse vendors Emdeon, Passport Health Communications, and RelayHealth. SCI Solutions is there too, but from a different angle (see next page). Advisory Board, DCS Global, Recondo Technology, and TransUnion Healthcare are a few steps behind but also provide technology to support a seamless blend of front-, middle, and back-end business office processes.

Siemens envisions the next-generation revenue cycle with Soarian Financials. Epic sees it too. Still, no single vendor does it all, which is why next-generation revenue cycle is truly a story about the integration of admission, scheduling, patient accounting, and collections with the smallest number of bolt-on vendors who can round out an integrated enterprise solution.

Best-of-Breed Approach Prevails for Most

“I am sure it would be great if we could ever go with just one vendor that had everything, but we seem to find that the main vendors don’t have everything we need.” -Director of Patient Access

The need for individual point solutions continues to frame how patient access issues are solved. Some providers expressed skepticism that a truly enterprise patient access solution exists and are forging ahead with a best-of-breed, bolt-on strategy.

Many providers are looking to accomplish as many patient access functions as possible through their core patient accounting vendor, only then rounding out missing functionality with bolt-on solutions.

“We will bring our first hospital live on Epic in less than a year. We will evaluate what Epic can provide for patient access first, and only after that, we will make a determination as to what needs to be bolted on to round out our patient access needs.” - Director of Patient Access/Revenue Cycle Operations

Bottom Line on Enterprise Vendors

EMDEON (89.4)—Offers a broad complement of both front-end and back-end revenue cycle functionality. Core missing components include patient scheduling and charity care functionality. Many customers feel Emdeon promotes older technology and is not sufficiently innovating to advance the Emdeon product suite. Support issues seem to be of lesser concern lately as Emdeon has increased their focus to achieve a higher level of service.

PASSPORT HEAlth communications (89.4)—Largest number of customers using technology in broader enterprise fashion. Newer eCare NEXT solution introduces workflow-driven enterprise PA design, but adoption is slow with existing customers. Some branding confusion exists where customers are unclear as to what Passport modules/versions they actually use. Passport currently holds an edge over competitors with Epic integration for eligibility verification.

RELAYHEALTH (84.1)—Offers a broad suite of both front-end and back-end functionality, including preauthorization. McKesson has relied on a strategy of both organic development and acquisition to build their product suite. RelayHealth struggles with service and functionality issues. Although a small minority of the overall RelayHealth customer base, McKesson patient accounting customers believe McKesson/ RelayHealth interoperability should be far superior.

sci SOLUTIONS (93.6)—Not a traditional patient access vendor. SCI Solutions relies on partnerships for all electronic data interchange–related functionality. Greatest strength lies with robust rules-driven scheduling functionality and electronic orders management. Strong service organization. SCI Solutions’ strategy is at odds with organizations seeking a single-vendor patient accounting/ scheduling solution.

where should vendors focus future development?

- Integration:

The number-one provider concern is for improved integration between patient registration/scheduling and patient access functions to facilitate a more seamless, structured workflow. Items most frequently mentioned as requiring improved integration include address verification, charity care, eligibility, and medical necessity. - Automated PreAuthorization:

The desire to both minimize denials and reduce manual labor tasks is driving the interest for organizations to automate the tasks associated with preauthorization and precertification requirements. Recondo Technology was the vendor most mentioned as one to watch for the development of automated authorization. - Estimated Patient Responsibility/Point-of-Service CollectionS:

Estimated patient responsibility and point-of-service collections are taking on a role of greater prominence as organizations are working to shift as much of the collection effort to the front end as possible. Providers mentioned MedAssets and TransUnion most frequently as vendors considered for estimated patient liability functionality.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.