2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

UK and Ireland EPR/PAS Performance 2013

A Peer Review of Current Experience

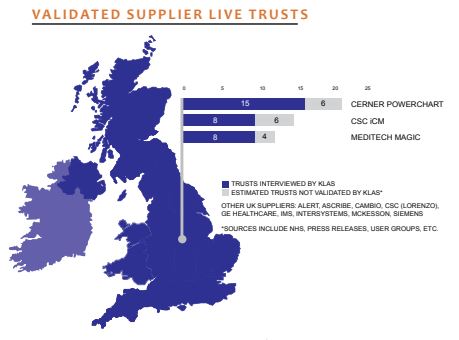

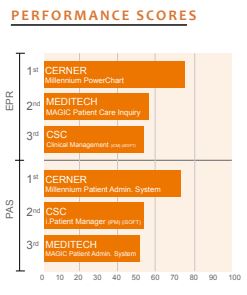

In 2012, 50% of interviewed trusts reported plans to acquire an EPR and PAS in the next 24 months. Key questions providers asked included: Can CSC finally deliver Lorenzo? How does Cerner perform outside of NPfIT? What other suppliers can deliver, outside of Cerner and CSC? KLAS interviewed 45 trusts in the UK and Ireland on their current performance and gathered enough information to report on the following suppliers: Cerner, CSC, and MEDITECH.

In an effort to ensure that their GP systems are equipped

for delivering quality patient care, many GPs across the UK are exploring their

options. KLAS interviewed providers from 102 GP practices to offer greater

transparency into supplier system performance. Which suppliers lead in system

functionality, service, training, and up-to-date technology? KEY FINDINGS

EMIS Web and TPP lead in both market share and performance—EMIS Web and TPP have comparatively newer platforms and the most satisfied clients. Clients using EMIS Web have a direct support relationship to their supplier, leading to a 5% higher overall score than clients struggling with indirect support from TPP. Respondents suggest that EMIS Web and TPP’s respective platforms offer better functionality as go-forward products than competing solutions.

EMIS, TPP, and INPS struggle with ongoing training after implementation—Over 60% of those interviewed say they wish they had better training from their supplier during and after implementation. Microtest* is the only supplier whose clients report excellent training and assistance, while EMIS and INPS clients struggle the most.

Nearly half of respondents report lacking functionality—EMIS PCS clients are the only ones who do not report documentation as their primary concern. INPS and TPP clients are happier with usability than other suppliers’ clients, but these suppliers still have room to improve. Overall, 43% of respondents report lacking needed functionality—with top concerns being documentation, usability, reporting, and search functionality.

Providers starving for strong support and communication.

Microtest* bucks the trend—Most providers feel their supplier did not offer sufficient on-the-ground support or a good way to take care of development requests. TPP’s overall support scores suffer the most as their clients feel a non-direct support relationship does not meet their needs. Microtest* is the one supplier that excels at support. EMIS and INPS also have room to improve, as EMIS clients feel their supplier is stretched thin from updating clients from LV or PCS to Web and INPS clients struggle to get through a phone queue to reach experienced support.

*Small sample size

PEER FEEDBACK: SUPPORT

PEER FEEDBACK: SUPPORT

EMIS: ‘When I try to get support, I often get passed on

to many people. I wish EMIS could provide a direct number and have a live

person on the other end of the phone.’ -GP

INPS: ‘We are still spending far too long in the phone queue.

We don’t seem to get to speak to the second line enough.’ -IT Supervisor

TPP: ‘My biggest challenges come with having to go through a local support company and not having a direct connection to the supplier. The support company that TPP uses is not qualified to answer the more technical questions.’ -Practice Manager

Microtest*: ‘If we have a problem, we can call the support up and talk to a live person and get an answer. If they can’t sort our issue out right away, they will log the issue away and come back to us when they have an answer or if they decide to incorporate that into their next update.’ -Practice Manager

BOTTOM LINE ON SUPPLIERS

Fully Rated Suppliers:

EMIS: Owns over half of GP market. Web is go-forward, hosted, Windows-based system and scores highest overall among rated supplier solutions. EMIS hopes to have the vast majority of their clients move to the Web platform but will continue to support older systems LV and PCS for the near future.

INPS: Most customers are longtime clients using a C/S model. Vision 3 rates average in all categories including functionality, implementation, and support. Of responding clients, 90% report INPS is part of long-term plans, but INPS is slow on support and behind in development.

TPP: Has experienced growth via product offerings in prisons as well as secondary care, mental health, and social service settings. Many providers say increased growth is distracting TPP from paying attention to current clients. Clients mention that a cluttered user interface complicates usability, and many are frustrated with an indirect support relationship.

Preliminary Supplier:

Microtest*: Smallest customer base among all suppliers. Excellent support and hands-on guidance lead to top scores in every category, with some requests for improved search and reporting functionality. Limited data sample prevents full comparison to other suppliers.

*Small sample size

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.