2025 BEST IN KLAS

2025 BEST IN KLAS

Preferences

Related Series

Related Segments

Clearinghouse Services 2012

Yesterday 5010, Tomorrow ICD-10

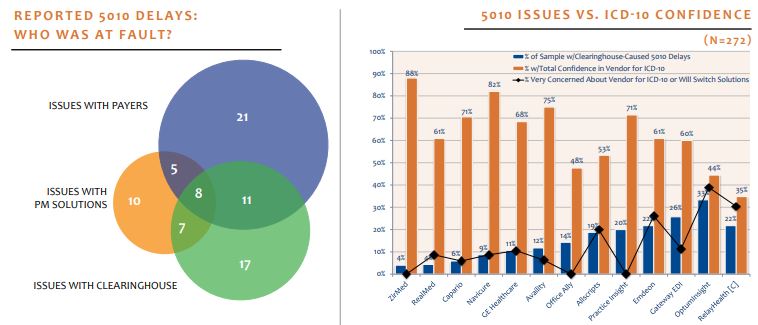

In 2011, 55% of providers said they were relying on clearinghouse vendors for a smooth 5010 transition. Fortunately, most clearinghouses and payers were prepared for the change. Of 2012 respondents, 70% had no 5010-related concerns. However, 30% reported issues that significantly delayed payments and cost practices money. Blame for these delays is shared among payers, practice management (PM) vendors, and clearinghouses. For this report, 753 providers participated in the research.

Key Findings

HIPAA 5010 Performance a Bellwether for ICD-10? For most, the answer is yes. Providers who experienced delays with the 5010 process identified ICD-10 as a primary concern for their clearinghouse. ZirMed, RealMed, and Capario clients reported few 5010 problems thanks to proactive attention from their EDI vendor working with PM vendors and payers. OptumInsight, Gateway EDI, Emdeon, and RelayHealth clients all reported unprepared vendors, long reimbursement delays, and insufficient pretesting. Based on 5010 experience, ZirMed, Navicure, and Availity had the highest percentage of confident clients, while OptumInsight, Emdeon, and RelayHealth clients were the most concerned.

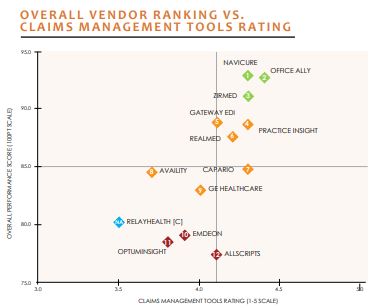

Where Differences Exist: While ambulatory clearinghouse services are becoming more commoditized, key areas of differentiation in the market still exist—primarily in service, offered tool set functionality, and ability to maintain high performance during regulatory changes, such as the HIPAA 5010 transition. Navicure, Office Ally, and ZirMed perform the best for providers with both top-tier service and highly rated claims-management tools. Allscripts, OptumInsight, and Emdeon lagged with the lowest overall performance scores as well as higher percentages of 5010 delays.

What More Can Clearinghouse Do? Clearinghouse Services is one of the highestperforming market segments monitored by KLAS. However, 59% of interviewed providers still identified specific areas for improvement. The most-requested items were general improvements in claims processing and a sharp focus on ICD-10 preparation. Improved vendor communication and cleaner reports were also frequently mentioned.

Bottom Line on Vendors

1st Tier

Navicure (92.9): Highest-rated vendor in this report with full suite of highly rated claims tools and top-rated support. Few 5010 issues. Of clients, 82% confident for ICD-10. Proactive support and development; 100% of clients said vendor keeps promises.

Office Ally (92.7): Very close second in report with highest-rated workflow tools and capabilities and top-tier support. Free (payer-supported) clearinghouse with some premium services. Highest rated for allowable attachments and secondary insurance processing; 100% said they would buy again and that vendor keeps promises. Good reported A/R days. Client confidence in vendor for ICD-10 was the third lowest.

ZirMed (91.2): Highest ICD-10 confidence (88%) and fewest 5010 problems. Good reported A/R days. Easy-to-use, highly rated claims tools. Highest rated for online edits. Top-tier service/support.

2nd Tier

Practice Insight (88.8): Shortest 5010 reimbursement delays, and 71% of clients confident for ICD-10. Best reported A/R, with all providers reporting A/R days under 30; 100% reported the vendor keeps promises and they would buy again.

Gateway EDI (88.7): High adoption of highly rated claims tools. Best score for normalized payer reports. Longest 5010 reimbursement delays. Clients indicate vendor was unprepared for 5010, and only 60% of clients totally confident for ICD-10.

RealMed (87.6): Tied for fewest 5010 problems; 61% of clients confident for ICD-10. Full suite of better-than-average claims tools. Best for claims status tracking. Lowest score for electronic attachments.

Capario (84.8): Handled 5010 well; 71% confident in vendor for ICD-10. Average adoption of highly rated claims tools. Best for eligibility checking, and 100% said vendor keeps promises. Average service/support.

Availity (84.5): Free (payer-supported) clearinghouse. Limited, but very specific payer mix. Client confidence at 75% for ICD-10. Average service/support with below-average tool set. Lowest scores for processing secondary claims and denials management.

GE Healthcare (83.0): Used exclusively with GE’s PM solution. Tied for best denials management and for worst eligibility checking functionality. Average service/support. Largest percent of clients with A/R days over 30.

3rd Tier

Emdeon (79.1): Good claims scrubbing. Bottom-tier service and support vendor with below-average ratings for limited offering of claims tools. Highest percent of customers (20%) would not buy again, but 61% of clients confident for ICD-10.

OptumInsight (78.5): Highest percent (33%) of clearinghouse-caused 5010 reimbursement delays. Client confidence for ICD-10 second lowest. Highest-scoring denials management piece a positive in a below-average claims management tool set. Of respondents, 33% plan to switch vendors.

Allscripts (77.5): Almost exclusively used by Allscripts PM clients. Lowest-performing vendor in report with lowest service/support. Of clients, 53% confident for ICD-10. High adoption of average-scoring tool set; lowest-rated claims tracking an exception. Of respondents, 20% plan to switch vendors.

Component

RelayHealth (80.2): Provides limited tool set solely through PM. Worst normalized payer reports. One-fifth of customers reported 5010 reimbursement delays. Lowest confidence for ICD-10 (35% confident). Of respondents, 21% plan to switch vendors.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2025 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.

.jpg?preset=report-cover-two-page-report)