2025 BEST IN KLAS

2025 BEST IN KLAS

Preferences

Related Series

EMR Technology Perception 2013

Separating Fact From Fiction

With millions of dollars in electronic medical records (EMRs) at stake as a result of meaningful use, vendors have made underlying technology a key value proposition in recent sales pitches. This value goes well beyond scalability and uptime to cover how data architectures, system flexibility, and open standards can positively impact clinical quality. Marketing campaigns appear to make compelling arguments around technology, but what is proving true with providers? To provide clarity around the facts and fiction that surround EMR product technologies, KLAS interviewed 117 progressive organizations to determine what really matters and the impact technology is having on what they are able to do.

EMR TECHNOLOGY PERCEPTION 2013

Separating Fact from Fiction

Report Author: Coray Tate

With millions of dollars in electronic medical records (EMRs) at stake as a result of meaningful use, vendors have made underlying technology a key value proposition in recent sales pitches. This value goes well beyond scalability and uptime to cover how data architectures, system flexibility, and open standards can positively impact clinical quality. Marketing campaigns appear to make compelling arguments around technology, but what is proving true with providers? To provide clarity around the facts and fiction that surround EMR product technologies, KLAS interviewed 117 progressive organizations to determine what really matters and the impact technology is having on what they are able to do.

WORTH KNOWING

CLAIM: It is easier to access data and modify EMRs that have mainstream technologies at their cores

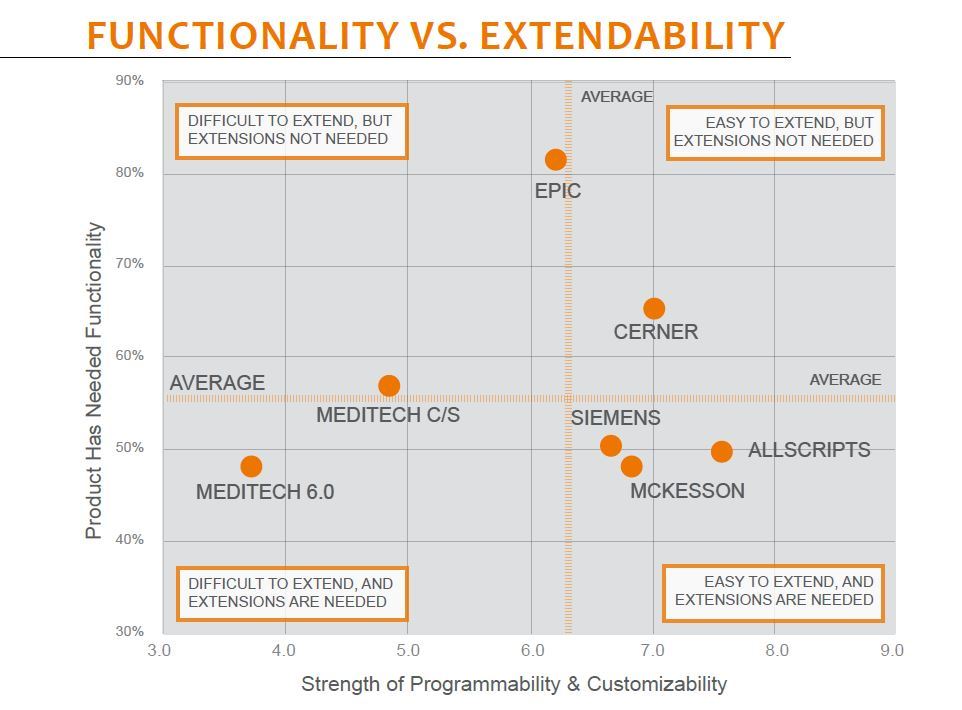

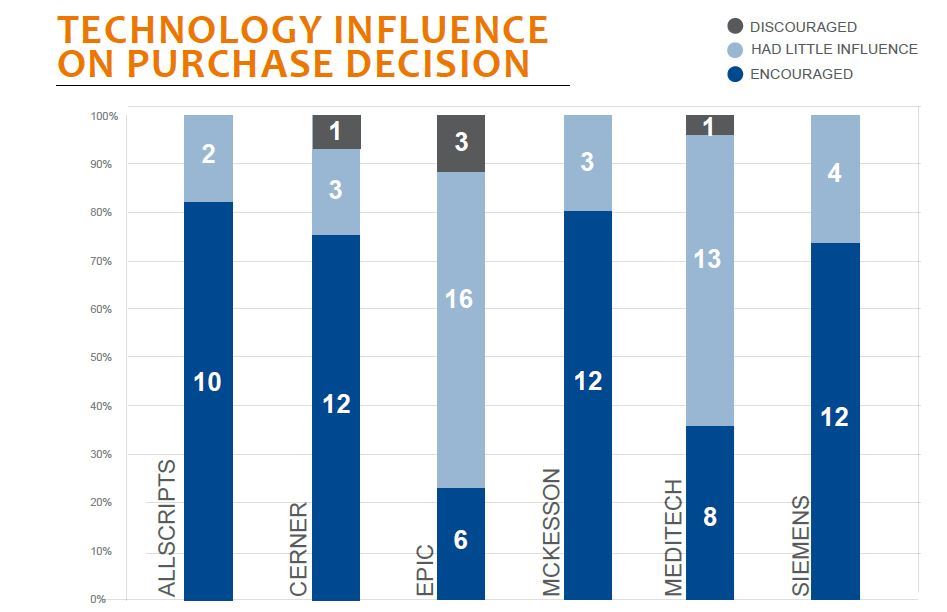

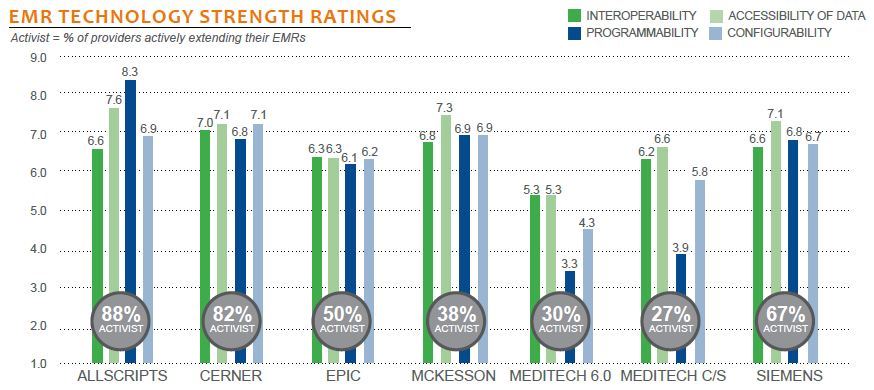

FACT: Mainstream technology was a strong driver in the selection of Allscripts, Cerner, McKesson, and Siemens (e.g., SQL, .NET, Oracle, etc.), but not Epic or MEDITECH (e.g., Cache and MAT). Providers who purchased their systems for technology rated their systems higher for accessibility of data, programmability, and configurability. The biggest gap was in the ability for programmers to extend systems, where Allscripts was the highest rated. Beyond platforms, lower ratings for Epic and MEDITECH were influenced by a perception of design complexity, vendor protectiveness, and scarcity of skilled staff.

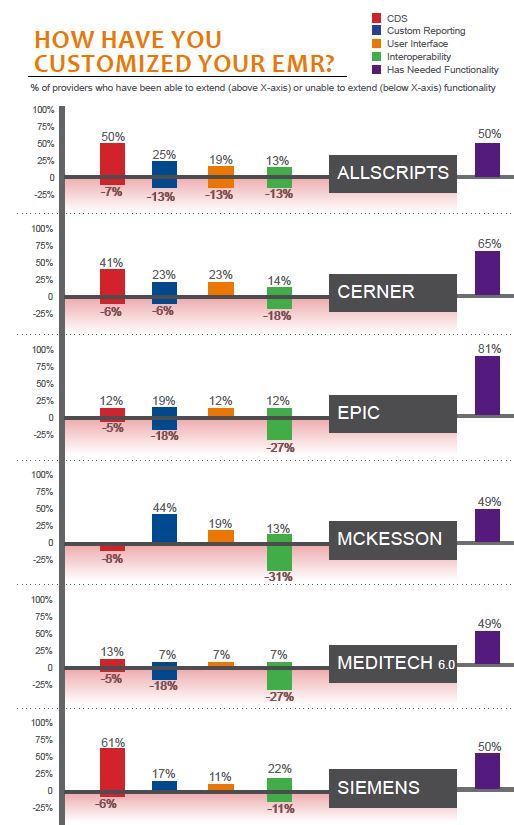

CLAIM: The underlying technology in some EMRs is a barrier to achieving clinical goals FICTION KLAS is often asked whether EMR technologies significantly impact providers’ ability to achieve clinical goals, but there is no evidence this is a true statement. It is true providers using Allscripts, Cerner, and Siemens were more likely to build extensions, such as CDS, but most providers using other systems said technology is not holding them back. Additionally, there was no indication of a specific functionality that could not be done on a specific EMR. Bottom line—in most cases, if providers really want to do it they probably can.

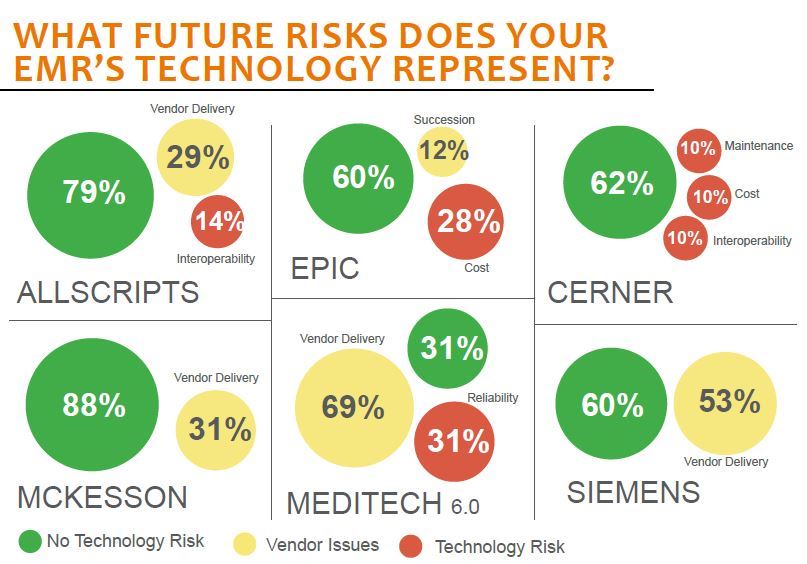

CLAIM: Underlying technology poses a significant risk for providers in the future FICTION Providers made it clear that vendors, not technology, were their primary concern. Nearly two-thirds indicated they did not see their EMR’s technology posing a risk going forward, but over half mentioned their vendor’s ability to deliver new functionality as a threat. The exceptions were Cerner and Epic, who had no clients mention delivery concerns. Both did have providers mention ongoing cost as a risk, but this was most notable among Epic customers.

CLAIM: Being able to customize the system is becoming more important as providers face healthcare reform.

INCONCLUSIVE: Most providers who modified their EMRs made fairly modest changes, and recent market share shifts indicate that most providers purchase based on vendor delivery, current functionality, and integration. Most providers expect a combination of increased functionality and best practices rather than a development platform. That said, no vendor’s technology has adequately addressed interoperability and data access—yet.

BOTTOM LINE ON VENDORS

ALLSCRIPTS Based on SQL and .NET. Technology a strong draw for buyers. A standout in programmability. Providers greatly appreciate the ability to develop their own medical logic modules (MLMs). Customers are by and large development activists and are most likely to develop new alerts, surveillance, usability, and workflow enhancements. Biggest risk is lack of promised integration.

CERNER Attractive to customers with Oracle experience. Customizability through Cerner’s MPages highly appreciated. Customers laude their ability to modify the system as well as the level of functionality and support delivered. Rates above average in all technology-strength areas. Upgrades can be disruptive, but interoperability is the biggest concern.

EPIC Cache database praised for speed and reliability, but key value is ability to deliver functionality, not technology. Programming more difficult, but few say they are unable to achieve goals as Epic offers, or is expected to offer, much of the functionality on providers’ wish lists. Some customers concerned about ongoing cost (e.g., licensing and staff) and succession of Epic leadership.

MCKESSON Ubiquity of SQL and .NET makes hiring IT staff easy. Customers rate Paragon above average, especially for data access. More likely to build custom reports than expand clinical functionality. Many waiting for formal upgrades to improve usability. Technology presents little risk, but some are concerned about McKesson’s ability to deliver integrated modules, particularly for ambulatory, which is reported to be live at beta sites.

MEDITECH Reputation for reliability supported by MEDITECH’s proprietary technology. Total cost of ownership drove original C/S selection rather than technology. Version 6.0 perceived as technology upgrade for clinical functionality, though many backend, departmental applications remain the same as in C/S. Version 6.0 rated lower in all areas, though less so for technology than for implementation and code quality. Providers most concerned about timely delivery of promised improvements but look forward to web-enabled v.6.1.

SIEMENS SQL, Service Oriented Architecture (SOA), web technology, and workflow engine appeal to new buyers looking to push clinical envelope. Customers are most likely to develop their own CDS/workflows. Taking advantage of flexibility requires internal development and thus is a cost/staffing burden for some. Complexity a source of disruption during upgrades. Customers awaiting the recently released integrated ambulatory offering.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2025 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.