2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Related Segments

Infection Control 2013

High Performers Abound

More than half of respondents in KLAS’ 2012 Infection Control study were still planning to choose a solution. Many still are. With a number of new and tenured solutions on the market, which ones perform the best? Are lesser known, less expensive solutions viable? What impact will the EMR vendors have? KLAS spoke with 224 individuals to find out.

INFECTION CONTROL 2013

High Performers Abound

Report Author: Adam Cherrington

More than half of respondents in KLAS’ 2012 Infection Control study were still planning to choose a solution. Many still are. With a number of new and tenured solutions on the market, which ones perform the best? Are lesser known, less expensive solutions viable? What impact will the EMR vendors have? KLAS spoke with 224 individuals to find out.

WORTH KNOWING

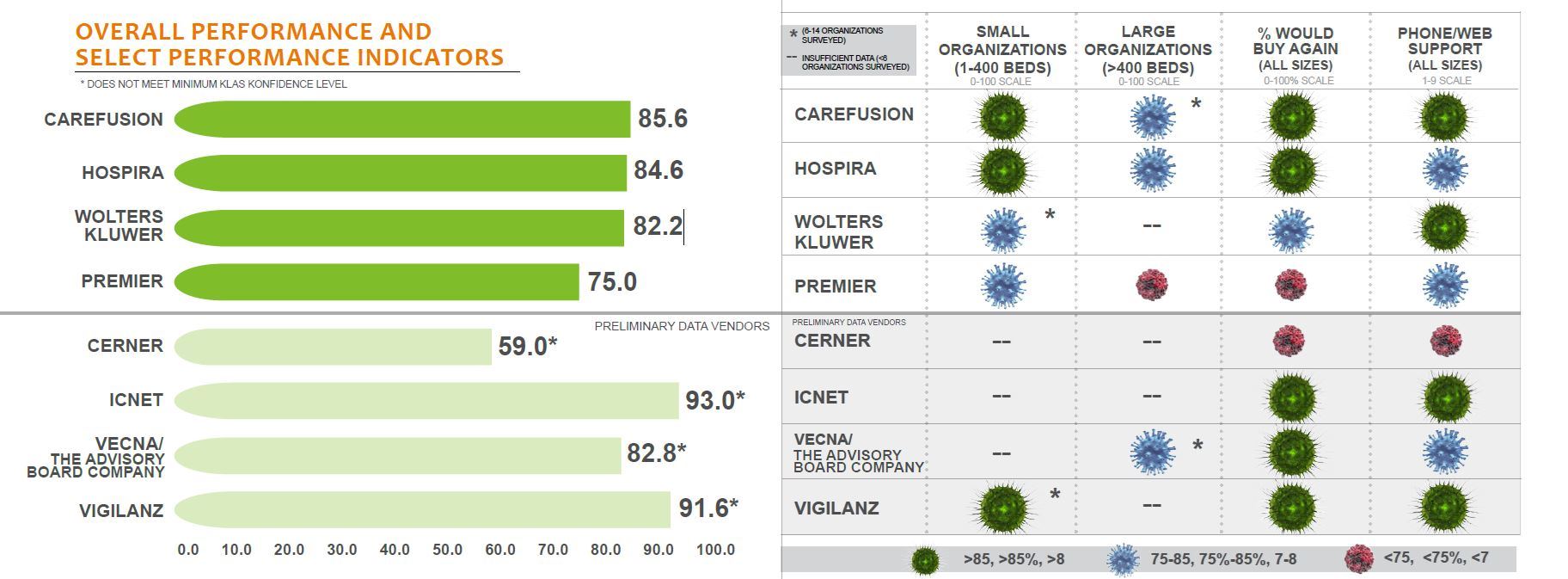

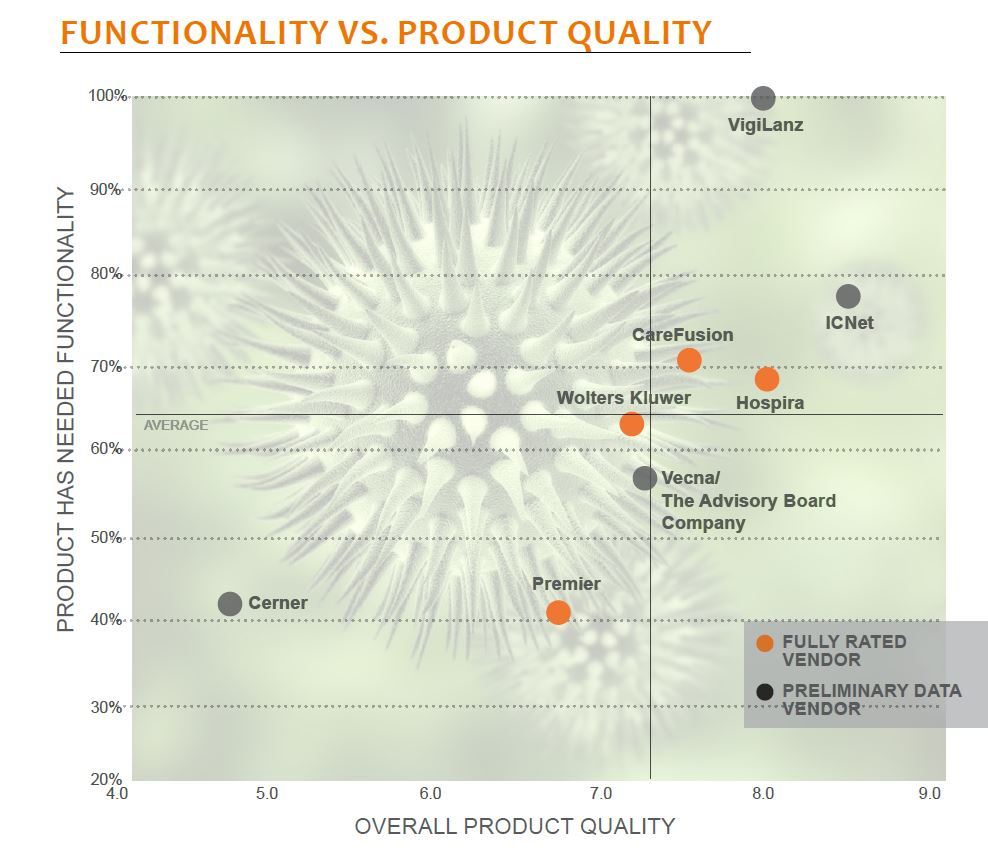

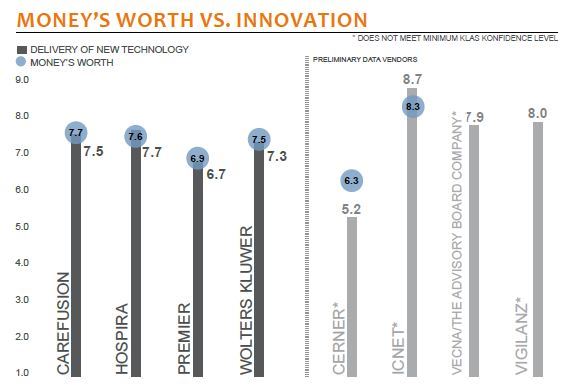

LEADERS PLAY LEAPFROG Market share leaders CareFusion and Hospira continue to perform highly in nearly all areas. CareFusion’s web-based model stands out for its ease of use, system speed, and exceptional service. Conversely, Hospira’s product quality and integration with other systems are highly regarded. Both vendors’ large customers continue to be slightly less satisfied than smaller ones, though the gap has narrowed for CareFusion. Large CareFusion customers noted some development and integration concerns and stretched support teams. Large Hospira customers indicated some challenges with stretched resources and implementations.

CERNER STILL HAS ROOM TO GROW AS FIRST ENTERPRISE EMR VENDOR IN INFECTION CONTROL As the first enterprise EMR vendor to try infection control, Cerner has yet to deliver a fully functional, easy-to-use infection control product. Cerner’s performance is low (preliminary data), with large organizations being the most dissatisfied. Customers noted immaturities like bugs, missing data fields, extra clicks, and challenges with NHSN reporting. However, customers are optimistic that Cerner will ultimately deliver. No other EMR vendor claims to have live functionality in this area.

UP-AND-COMING VENDORS FIGHTING FOR RELEVANCE Other infection control vendors exist, though most are still fighting for market share. Wolters Kluwer is one exception, having increased their footprint since last year, though customers noted some growing pains. ICNet has come on set from the UK and has a limited albeit highly satisfied customer base. VigiLanz customers appreciate good reporting capabilities and service, but KLAS has been unable to validate claims of a large customer base. Vecna/The Advisory Board Company also performs well but has yet to be widely deployed.

DESPITE HIGH PERFORMANCE, CAREFUSION CUSTOMERS WEIGHING OPTIONS Despite placing first in this report, CareFusion is most at risk to lose customers. Sixteen percent of customers said they are leaving. This actually represents the largest percentage of any vendor, since most of those leaving SafetySurveillor plan to migrate to Premier’s new platform. Cost and a perceived slowing in development were top concerns among those leaving CareFusion.

PREMIER CUSTOMERS STILL WAITING Premier announced plans to release their new platform, SafetyAdvisor, by January 2013, but they have been slow to deliver. KLAS has validated a couple of customers that are installing the new platform currently and plan to be fully live shortly. Others mentioned being slated to receive the new platform in the coming months.

BOTTOM LINE ON VENDORS

FULLY RATED VENDORS, SORTED BY PERFORMANCE SCORE

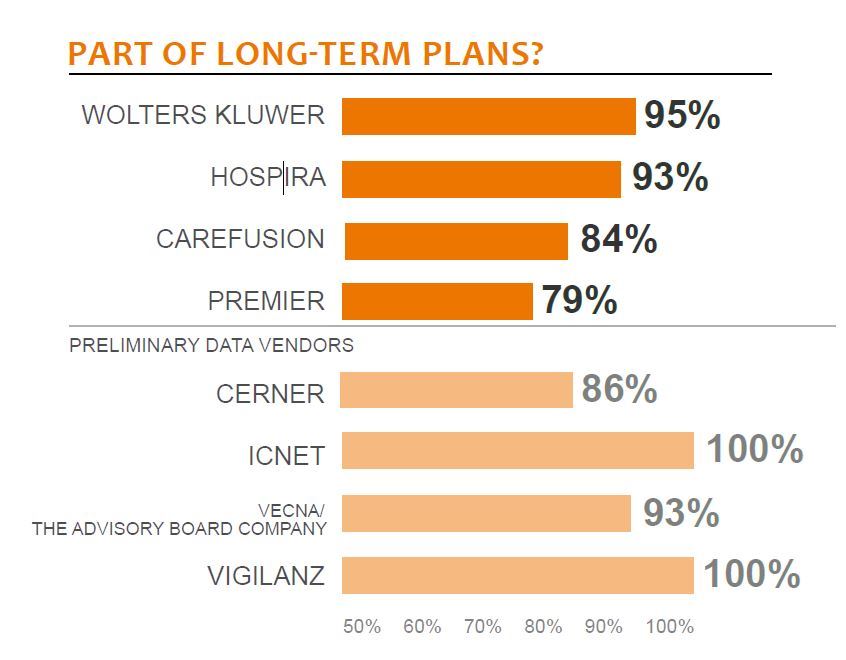

CAREFUSION (85.6)—Highest performer with strong service and support and executive involvement. Fast, easy-to-use, web-based product. MedMined University delivers quick, good online training. Proprietary nosocomial infection markers (NIMs) provide good quality metrics for providers. Most at risk to lose customers. Those leaving note perceived lack of development and integration with other systems. Expiring BCBS contracts in some states also a factor.

HOSPIRA (84.6)—Consistently high-performing vendor. Easy-to-use product. Customers enjoy good integration with a number of departmental systems. Service and support scores are average; 93% say product is part of long-term plans. Largest organizations mention some stretched resources and challenges around implementations.

WOLTERS KLUWER (82.2)—A less-costly, web-based option often considered in deals with strong pharmacy surveillance product. Gaining traction, but with growth some customers are struggling with implementation and training. Reporting capability leaves some frustrated, but support scores are among the best. Ninety-five percent say product is part of long-term plans.

PREMIER (75.0)—Performs below average due to delayed rollout of SafetyAdvisor—Premier’s new platform. Customers using SafetySurveillor rate Premier toward the bottom for development, communication, and service/support. Largest customers are more dissatisfied. Existing customers are split over migrating to the new platform: some are looking forward to it; others are confused about what it brings.

PRELIMINARY DATA VENDORS

CERNER (59.0*)—First enterprise EMR vendor entrant. Limited customer base. Low performer. Smallest facilities relatively satisfied. Several large customers have struggled to deploy the product and say that it is not ready for large facilities. Customers note product immaturity like bugs, missing data fields, extra clicks, and NHSN reporting challenges in first released version. Providers optimistic Cerner will resolve problems and deliver a more complete solution moving forward.

ICNET (93.0*)—High performer. Customers praise service and support on every level. Highly flexible for custom reporting. Only vendor with validated syndromic-surveillance capability. Customers enjoy rich functionality, and all say they would buy again.

VECNA/THE ADVISORY BOARD COMPANY (82.8*)—On par with fully rated vendors in most areas. System response time draws some complaints from largest customers. Vendor communication is excellent—a result of partnership with The Advisory Board Company. Customers like the continual technology innovation.

VIGILANZ (91.6*)—High-performing vendor. Great service and support. Customers report good innovation and integration. One hundred percent say product has needed functionality. Several say the system could be easier to use, especially for running certain reports or adding information to charts and graphs.

*Does not meet minimum KLAS Konfidence level

OTHER VERIFIED VENDOR

TRUVEN HEALTH (MICROMEDEX)—Only three customers validated live but mostly positive response, especially for ability to extract information from EMR and other sources. Service, support, and training are positives.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.