2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Related Segments

Outsourced Coding 2014

Do You Have Enough Resources for the ICD-10 Transition?

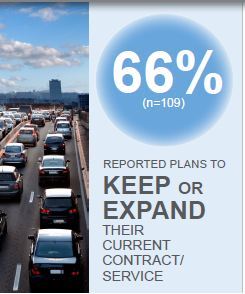

With the ICD-10 deadline in clear view, the outsourced coding market has never been as exciting—or as noisy—as it is today. Facing coder shortages and productivity loss, many providers are looking to outsourced coding firms to address current and anticipated coding gaps. This report explores which coding firms providers are contracting with, how they compare in various quality measures, and what providers’ future plans are with these services.

WORTH KNOWING

DEMANDS ARE INCREASING, BUT SCALING UP IS AN ISSUE FOR ALL.

Spurred by decreased productivity and a shortage of coders, provider demand for more coding resources is widespread; however, no firm demonstrated reliable scalability for all clients interviewed by KLAS. Precyse and Kforce came close, showing the best ability to scale up and maintain quality. Clients of other firms gave mixed reports on scalability.

CODING QUALITY, PRODUCTIVITY, AND QUALITY ASSURANCE DIFFERENTIATE HIGH PERFORMERS.

Excellence in these areas propelled LexiCode and Anthelio to the top-two ratings in this report. And KLAS noted a solid link between high provider satisfaction with quality and a high percentage of internal QA, as demonstrated with Precyse and TrustHCS. Though receptive to customer concerns, 3M had the lowest overall score.

DOMESTIC VS. OFFSHORE: THE JURY IS STILL OUT.

Most providers have avoided offshore resources due to security, accreditation, and quality concerns, but cost advantages and a shortage of domestic resources are driving more to consider them. Early data from the very limited number of providers with offshore resources shows those resources earn similar performance scores as onshore resources. Half the firms in this report provide offshore options, including Optum360, 3M, LexiCode, COMFORCE, Med-Partners, and Anthelio.

BOTTOM LINE ON FIRMS

1) LEXICODE:

Highest overall performer in this report. Quality, productivity, and communication are top strengths. Highest rated in productivity, though some clients experience issues with offshore time difference. LexiCode has strong, long-term relationships with many of their providers. Some clients want more frequent and proactive delivery of reports and transparent audits. LexiCode has struggled to scale for some clients.

2) ANTHELIO:

Rated highest in coder quality (4.5 out of 5.0). Providers rave about Anthelio’s productivity, and many see Anthelio as a partner. Turnover of resources and getting coders up to speed can be problems. Anthelio’s new pricing structure has been a pain point for many providers, but they note that Anthelio has communicated the changes very well. Some wish for better account-manager visibility from Anthelio. Mostly serves small facilities.

3) KFORCE:

Scalability and communication are standout strengths; several clients value their long-term relationship with Kforce. Some say Kforce is expensive but worth the money because of the number of resources they have. Productivity has been a mixed bag for clients. Rated the lowest in QA, and some question Kforce’s auditing abilities and want more proactive auditing.

4) PRECYSE:

Reputation for high-quality coders. Demonstrates strong communication and seen by some as an HIM solution through expanded services for coding, training, transcription, and full HIM outsourcing. Pricier than most firms, and some providers question Precyse’s audits on the vendor’s own coders. Typically serves larger organizations. Many like Precyse’s ability to scale, but a few mentioned that Precyse has a hard time getting additional resources.

5) TRUSTHCS:

Highest performer in reporting, and pricing is attractive. Some clients report poor quality, though others have experienced recently improved quality and productivity. TrustHCS is willing to listen and remove coders that don’t work. Outsourced coders need to be managed by providers, but most providers thought TrustHCS would be managing them. Most of the validated engagements are overflow work.

6) PEAK:

Communication is hit and miss. Though problem resolution is good, upper management is sometimes forced to get involved. Peak’s greatest challenge is inconsistent coder quality and finding new resources for clients. Serves mostly small facilities.

7) MEDPARTNERS:

Has ability to scale up resources, and most clients say that the quality is either good or improving. Communication is most frequent complaint, most often related to MedPartners’ account managers. Some providers are not happy with the quality and productivity and wish for more reporting and tracking tools.

8) 3M:

Of the firms rated, 3M is the newest to outsourced coding and yet is servicing, by far, the highest median bed size. Though utilizing LexiCode’s resources through a partnership, 3M has the lowest overall performance. Struggles to meet client expectations and received the lowest ratings in coding quality, productivity, and reporting. Praised by some for strong communication, receptiveness to support issues, account management, and ability to adjust resources.

PRELIMINARY & COMPONENT DATA VENDORS

COMFORCE:

Reporting is highly rated. Providers like the idea of cross-auditing in-house coders through COMFORCE. Good communicator, but clients say COMFORCE could improve productivity. KLAS validated mainly overflow work.

MAXIM:

No real performance trends emerged from client responses in this report. Quality is praised by multiple providers, but Maxim receives mixed reviews on productivity, reporting, and QA. None of the clients interviewed for this study gave Maxim the highest possible rating for quality, productivity, reporting, or security.

OPTUM 360:

Providers using Optum360’s coding services are mostly ED with some inpatient coding. Highest performing for QA in this report. Many providers tout Optum360’ s strength in communication; some providers praise account managers that act like middlemen between the coders and the provider. Some complaints about the quality of resources.

Writer

Lois Krotz

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.