2025 BEST IN KLAS

2025 BEST IN KLAS

Preferences

Related Series

Tomosynthesis 2016

Can GE and Siemens Compete with Hologic?

Since first releasing tomosynthesis in 2011, Hologic has dominated the 3D mammography market and until recently has had no competition in the U.S. Despite significant imaging-equipment footprints, Siemens and GE were slow to release tomosynthesis, receiving FDA approval in 2014 and 2015, respectively. While providers using all of these systems are highly satisfied and feel the technology is worth the investment, users point to key differences among vendors in regard to implementation, development, and relationships that they feel others should know about before selecting a tomosynthesis solution.

1. HOLOGIC STILL A LEADER; GE HEALTHCARE AND SIEMENS START SEEING TRACTION WITH UPGRADES

Most customers making a net-new tomosynthesis purchase that is not part of an upgrade say Hologic is still top of mind. Providers say that high image quality, a strong culture of support, and guidance in optimizing the technology make Hologic a safe bet. Providers using GE Healthcare report good image quality and good clinician usability. GE Healthcare customers say that the comparatively low cost of upgrading an existing 2D unit versus buying a new unit makes GE Healthcare a strong option with a product that is worth the investment. Early adopters of Siemens' tomosynthesis upgrade say they would purchase from the vendor a second time, pointing to strong technology and service as driving satisfaction.

2. DELAYED IMPLEMENTATIONS, SLOW ADOPTION OF GE HEALTHCARE’S TOMOSYNTHESIS

Some providers contracted with GE Healthcare for tomosynthesis report significant delays between signing their initial contracts and going live with the technology due to communication gaps with GE Healthcare's implementation teams, challenges interfacing GE Healthcare's technology with PACS products, software bugs, and a lack of clarity around expectations. As a result, adoption of GE Healthcare's solution has been slower than expected, despite GE Healthcare's receiving FDA approval a year and a half ago. KLAS interviewed the majority of early adopters at unique organizations who have upgraded to Siemens' tomosynthesis, and these users report timely implementations and strong field expertise.

3. HOLOGIC SETS THE BAR FOR FUTURE TOMOSYNTHESIS DEVELOPMENT

Providers feel Hologic will lead in development due to the vendor's niche focus on women's imaging and history of bringing to market additional tools, such as C-View dose-reduction technology and biopsy technology. Those using GE Healthcare feel that the vendor will be able to keep up with the industry, but many question GE Healthcare's ability to lead in market innovation due to their lack of a clear development road map and their poor experience with implementations. While many Siemens customers feel it is too early to comment on their vendor's development strategy, others are confident in the solution's future due to Siemens' reputation for strong development in other imaging modalities.

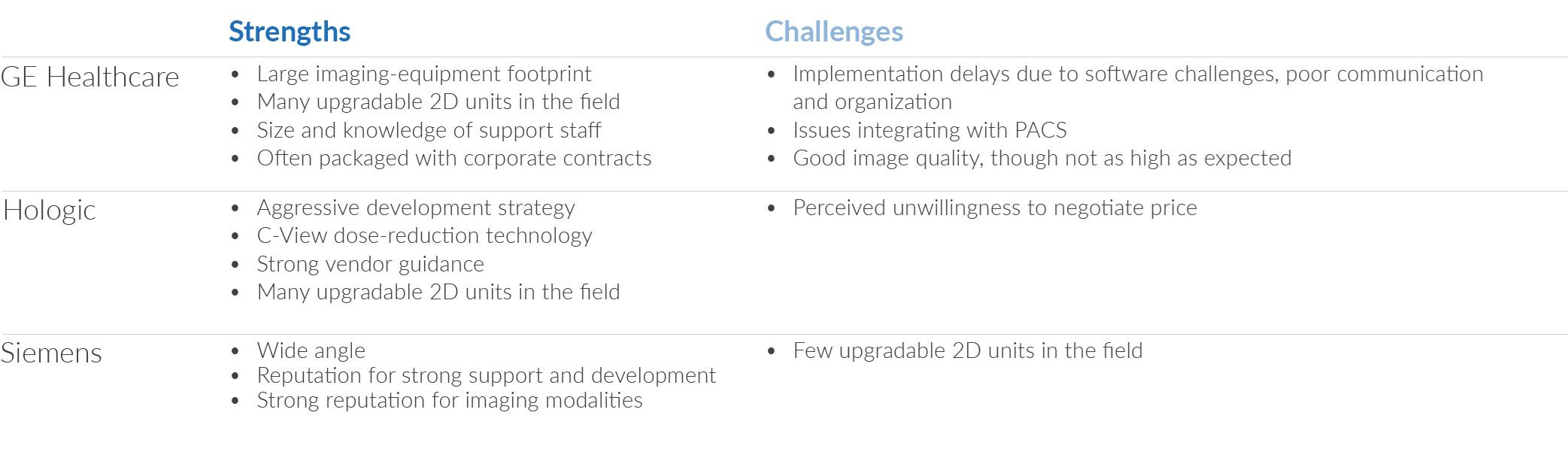

4. WHAT DO PROVIDERS WANT THEIR PEERS TO KNOW ABOUT EACH VENDOR?

Vendor strengths and challenges

5. IMAGE QUALITY AND DETECTION RATES WITH TOMOSYNTHESIS ARE HIGH, REIMBURSEMENTS ARE LOW

Providers say the image quality of tomosynthesis exceeds expectations and works well for patients with dense breasts. This leads to higher cancer-detection rates and can lead to additional business from patients. Reimbursements are still lower than many providers expect, though most agree that the benefits of tomosynthesis outweigh the reimbursement challenges. Providers also say that potential tomosynthesis customers should know that the increased image size has an adverse effect on clinician workflow, IT requirements, data-management protocols, and data-storage requirements, but providers still feel that tomosynthesis is worth the investment.

Writer

Emily Paxman

Designer

Natalie Jamison

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2025 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.