2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

The Future of Interoperability 2015

Current State and Next Steps; Market Immaturity Highlights Opportunity

ABOUT KLAS

Using the voice of healthcare software and services customers, KLAS has measured healthcare IT vendor performance since 1997. Today, KLAS collects and publishes customer feedback on over 800 products and services. Roughly 30,000 providers work with KLAS each year. Over 98% of KLAS research is collected in live conversations over the phone, to ensure accuracy and clarity, since healthcare IT is often a nuanced and complex discussion subject. All interviews are strictly anonymous, and participants are granted broad access to the feedback of other participants. Access to KLAS’s findings is available through subscription and individual report purchases.

ABSTRACT

Today there are very simple and technically successful ways to exchange patient data between systems from different EMR vendors. Unfortunately, they are not yet usable or effective for physicians. Interoperability is a complicated issue, due to the complex nature of healthcare, the variety of provider use cases, the multi-branded development of healthcare technology, the strict nature of privacy laws, the promulgation of too many incomplete standards, and sometimes ineffective incentives for both providers and vendors. Impacted industry players seem to agree that poor interoperability is overall a result of market immaturity, with no single culprit or character to blame.

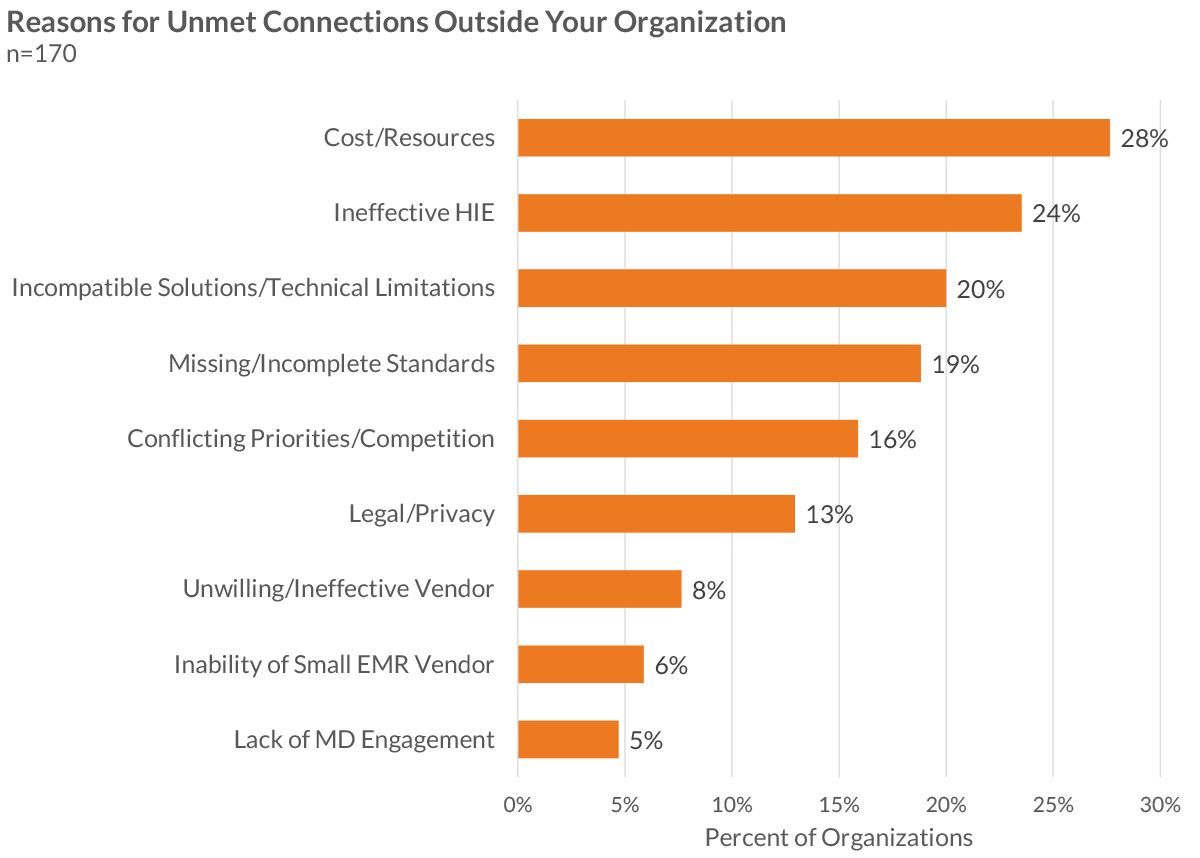

Most provider organizations interviewed have multiple connections to outside records through a variety of connection types, but they report frustration with high costs, complex connections, extreme variation in the value of health information exchanges, and unresolved legal/privacy concerns. Vendors and providers are aligned as to what the key issues are that are holding back interoperability, including standards, patient identification, participant willingness, privacy laws, and security. How interoperability will mature is unclear, and the process could take several paths.

REPORT BACKGROUND

This report is the subset of a larger report that was produced by a collaborative effort between healthcare provider executives, CHIME (College of Healthcare Information Management Executives), and KLAS. This version is targeted toward providing a clear view of interoperability for interested parties across the nation, including policy makers and national leaders.

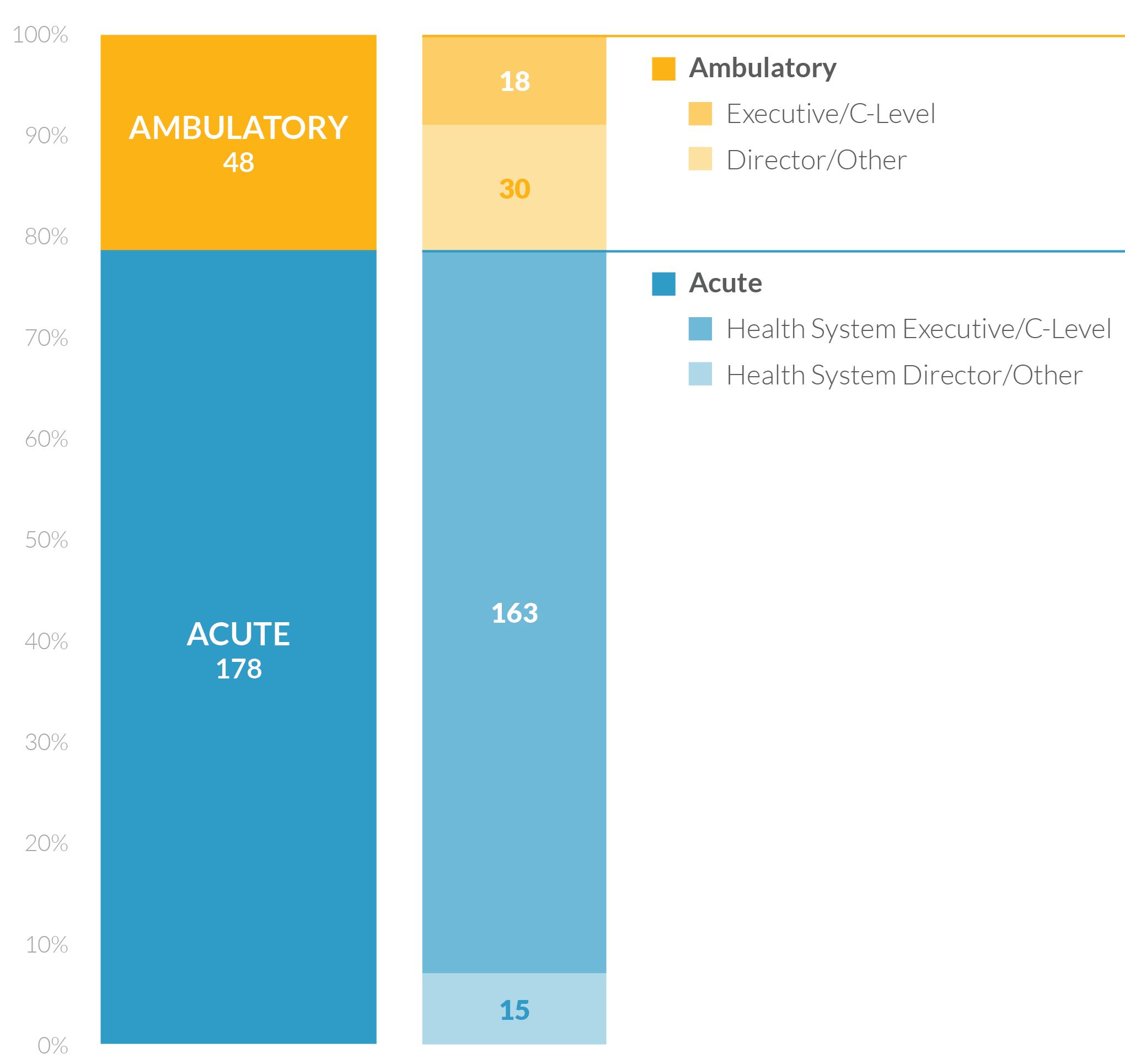

Interoperability is both difficult to measure and critical to the future success of healthcare IT. A panel of CHIME CIOs designed a detailed questionnaire to measure the current state of interoperability and vendor achievement. KLAS interviews routinely lasted 60 minutes or more and often included multiple members of the provider organization’s senior IT and clinical team members (e.g., the CIO, CMIO, CMO, etc.). Over the course of three months, KLAS conducted over 240 interviews. To cover the largest number of impacted providers and patients, the research targeted mainly healthcare enterprise organizations (both acute and ambulatory) but also included standalone clinics and physician practices. There was no effort to include many other types of care-delivery organizations, such as behavioral health, long-term care, home health, and other organizations, though the study organizers recognize that these organizations are an important part of the puzzle and will have to be part of the overall solution.

Sampling was targeted toward many of the most interoperable organizations within each customer base. Vendors were asked to share a list of their most interoperable customers so that KLAS did not miss important, bleeding-edge interoperability progress.

KEY PARTICIPANTS BY PROVIDER TYPE AND JOB LEVEL

WHAT IS INTEROPERABILITY?

With the help of a provider expert panel, interoperability was defined in this report for simplicity’s sake as

The ability of two or more healthcare entities to exchange and incorporate information with precoordination and context such that the information has utility in improving patient care.

Note that this definition includes connections between organizations using the same EMR vendor—what some call “intraoperability.” With the emphasis on patient care, the ultimate goal is for providers to be able to access outside patient information regardless of the technology used. Thus, in this context, intraoperability is simply a subset of interoperability.

CURRENT STATE OF INTEROPERABILITY

An EMR clinical record can contain as many as 100,000 (and growing) different data fields and elements that are a mix of numeric data, structured text, unstructured text, scanned images, diagnostic images, and so on. In the evolution of their products, each EMR vendor has defined slightly (or significantly) different data fields. Connecting different EMR brands at a database level requires an understanding of all data fields as well as a means for translating or labeling discrepancies between databases. To make matters more complicated, individual institutions often customize their installation of an EMR, evolving their databases away from those of peers using the same brand of EMR.

For data sharing, context is critical for the receiving clinician. Without context, information is often overlooked or cannot be reliably used. Industry standards for data sharing are varied, with many different standards that often lack needed specificity. And the application of such standards is allowed to be so varied that an integration point that is contextually strong is likely expensive.

The lack of uniformly adopted, specific, deep standards makes data sharing a clumsy process. Most data sharing today is based on sharing some data fields with contextual integration, or sharing view-only document summaries of many data fields without much context. Furthermore, the development of an interface between two EMR installations can almost never be used across multiple customers in a plug-and-play fashion.

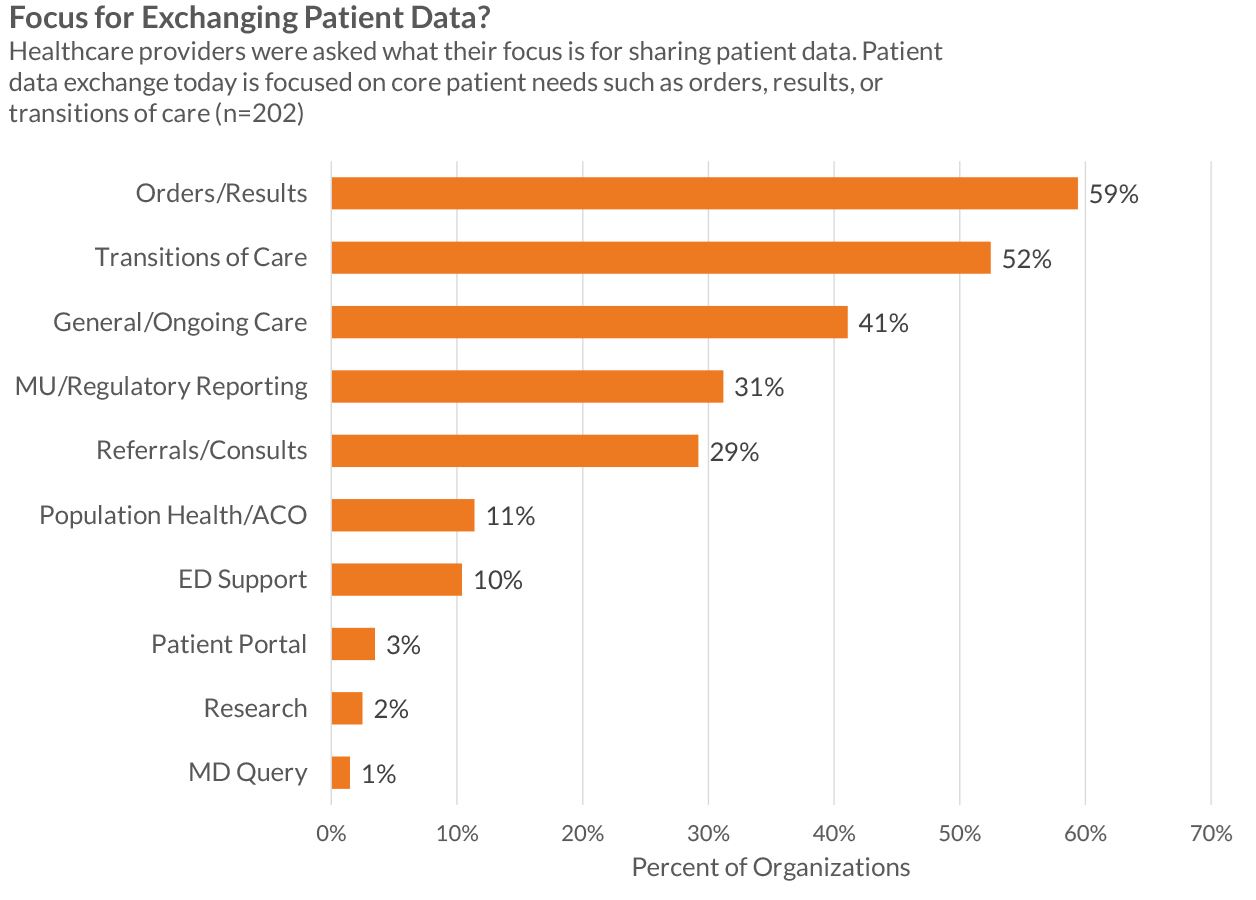

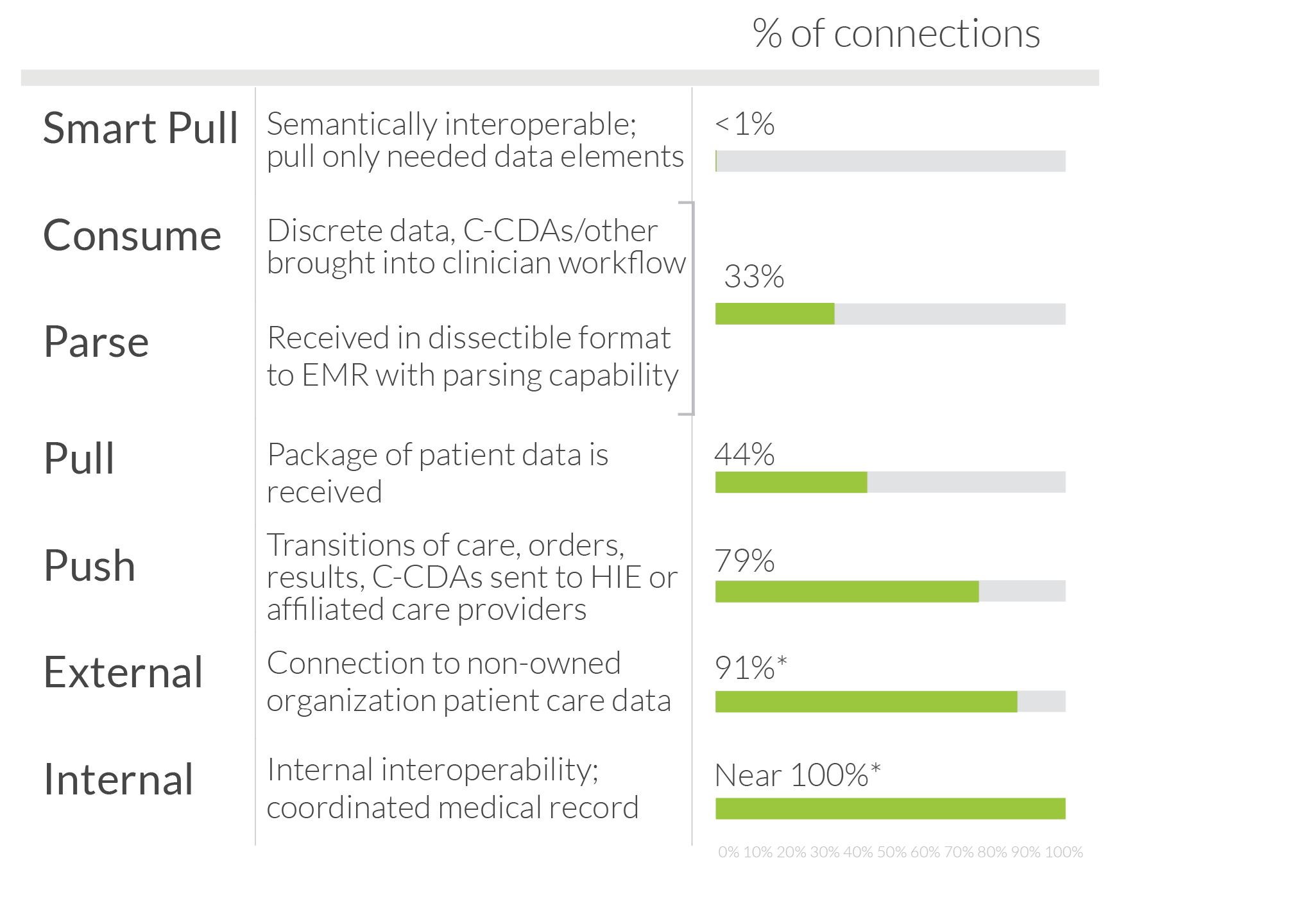

Organizations participating in this study shared the three currently live interoperability connections that they feel are most clinically valuable. Feedback highlighted the incredible heterogeneity of connection types, breadth, scope, and use. Providers classified their main connections into six broad connection types:

| Connection | Description | Feedback from Healthcare Providers |

| Public HIE | Connection to a publicly funded or shared governance health information exchange (the converse being an exchange primarily hosted by a single healthcare system) | Public HIEs account for high volumes of transferred patient records. Unfortunately, much of the data shared is limited to summary of care documents pushed by hospitals to the HIE. In many instances, public HIEs see little usage of this data in the end, and providers give public HIEs low value assessments. |

| Private Network/HIE | Connection to a privately funded health information exchange | Discouraged by the cost and inflexibility of public—or shared—HIEs, larger providers have shifted to creating their own HIEs, to first connect groups within their own organizations and to then move outside. These private networks can be expensive and rather difficult to set up and maintain, but they are designed to meet providers’ specific goals (including results delivery) and thus have higher value in improving patient care. The high cost typically moves this type of HIE out of reach for smaller health systems and practices. |

| Direct Messaging | A newer standard for sharing packets of information, including a CCD or CCR. | Although Direct messaging is expected to be nearly ubiquitous thanks to the meaningful use requirements (or standards), fewer than half of the study participants named it as one of their top connections. Even when Direct messaging has been implemented, many organizations complain that not enough outside providers are prepared to receive messages; they report that this is particularly an issue with those running ambulatory EMRs from small vendors. The value of Direct messaging is also inhibited by organizations’ inability to import discrete patient data from CCDs. Interpretation of the CCD standard varies, leading to incompatibility in how data is formatted. Additionally, CCDs typically include much more data than receiving clinicians need, making the most applicable information difficult to locate. Under these conditions, some providers say their CCDs are no better (and are maybe worse) than faxed documentation. |

| EMR Vendor's Private HIE | Health information exchange hosted by an EMR vendor for their customers. Sharing is typically (but not always) between customers with the same EMR. | Today, the connection type that comes closest to being plug-and-play is the private network offered by some EMR vendors to facilitate sharing, primarily, among their own customers. Epic has been an early leader with adoption of their Care Everywhere platform by 1) providing it to every customer for no additional charge, and 2) requiring that all customers be willing to open up to sharing with others on the network. Despite sharing mostly in a homogeneous EMR environment, such networks have the highest transaction volume and highest value and require the lowest effort to set up and maintain. Aside from Epic, other vendors with this type of network include athenahealth, eClinicalWorks, Cerner, and Greenway. |

| Point-to-Point Interfaces | Traditional connections implemented for specific business reasons, such as orders and results sharing between hospitals and community practices. Typically share specific, pre-specified data elements. | Considered the traditional means of sharing information—the second most common form of data sharing. Providers feel that point-to-point connections have high value but are costly to set up and maintain. The need to configure each interface separately, along with dependence on vendors to do it, often makes establishing these direct connections a drawn-out process. And point-to-point connections often lack broader utility for sending patient data beyond simple lab results. In the future, point-to-point connections could also include access sharing instead of data record shipping. |

| FTP/Other Connections | File Transfer protocols or other means of connecting. | FTP connections have minimal usage now and are mainly dedicated to specialized data sharing, such as feeds for state immunization registries. |

All vendors have success with all of the above connection types, with the exception of the private EMR vendor HIE—only a handful of vendors offer that connection. EMR vendors’ private HIEs have best met expectations by providing high value and simple-to-implement connections, recognizing the obvious limitations. Once a vendor has laid a solid framework for an exchange within their customer base, these connections can sometimes be turned on automatically with almost no thought or effort. While these connections have not solved the critical need for heterogeneous connections built through vendor collaboration, they improve patient care.

Many are hopeful that given time to mature, Direct messaging will provide a valuable plugand- play connection between vendors. To date, most are disappointed with poor coordination among vendors on the Direct messaging standard (meaning, the sending and receiving EMRs do not agree on how to format a document), difficulty in locating records, and limited parsing abilities. A majority of respondents report that local public HIEs provide limited value, and there is little optimism about the future of public HIEs.

CONNECTION MATURITY

Providers have repeatedly reported to KLAS the critical importance of bringing outside data all the way into a clinician’s workflow. When data is not effectively brought into the clinical workflow, it is often disregarded or overlooked.

The value of a connection is often tied to the breadth of information being shared, the volume of records available to clinicians, and the maturity of the connection. As connections grow in maturity, data is not just sent in large packets to a common viewing portal but is instead brought into the clinicians’ workflow. Integration maturity is described below:

NATURAL INTEROPERABILITY PROGRESSION

IDENTIFYING INTEROPERABILITY HURDLES

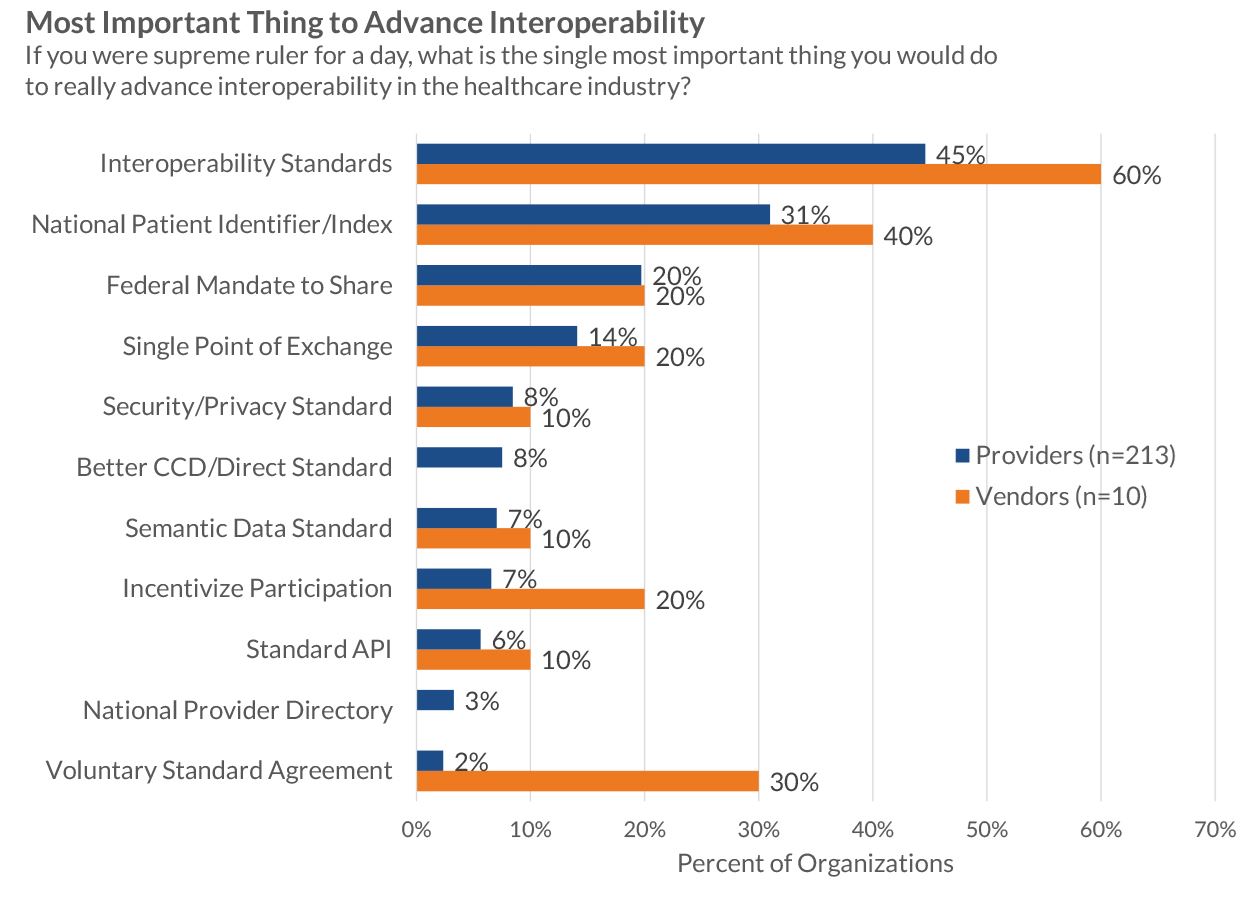

Vendors and providers were asked to identify what could advance national interoperability, and both groups reported a similar story:

- Unclear standards are the greatest hurdle to sharing. Almost no respondents report a lack of standards but instead report frustration with the depth of current standards, as well as poor clarity regarding the application of current standards.

- Lack of a standard patient identifier is also a significant frustration. Records that cannot be found cannot be shared.

- Provider willingness, security, and legal governance are other key hurdles to record sharing

In addition to these hurdles, forward-looking industry leaders identify the lack of a provider directory and the lack of a consent registry as two hurdles that the industry will have to face in time. Without a provider directory, finding trading partners is difficult. Without a consent registry (detailing what a patient has consented to exchange), privacy laws cannot be effectively maneuvered.

A DEEPER LOOK AT STANDARDS

Identified by both providers and vendors as a key hurdle to interoperability, standards are much more complicated than they appear to be on the surface. To an industry outsider, it might seem that a central body could easily dictate standards and force compliance (such as was done in the railroad industry with rail width). However, difficult-to-follow standards are an outgrowth of a lack of standardization within clinical practices. Over the years, clinicians have demanded customization and alignment with local workflow idiosyncrasies over all other features.

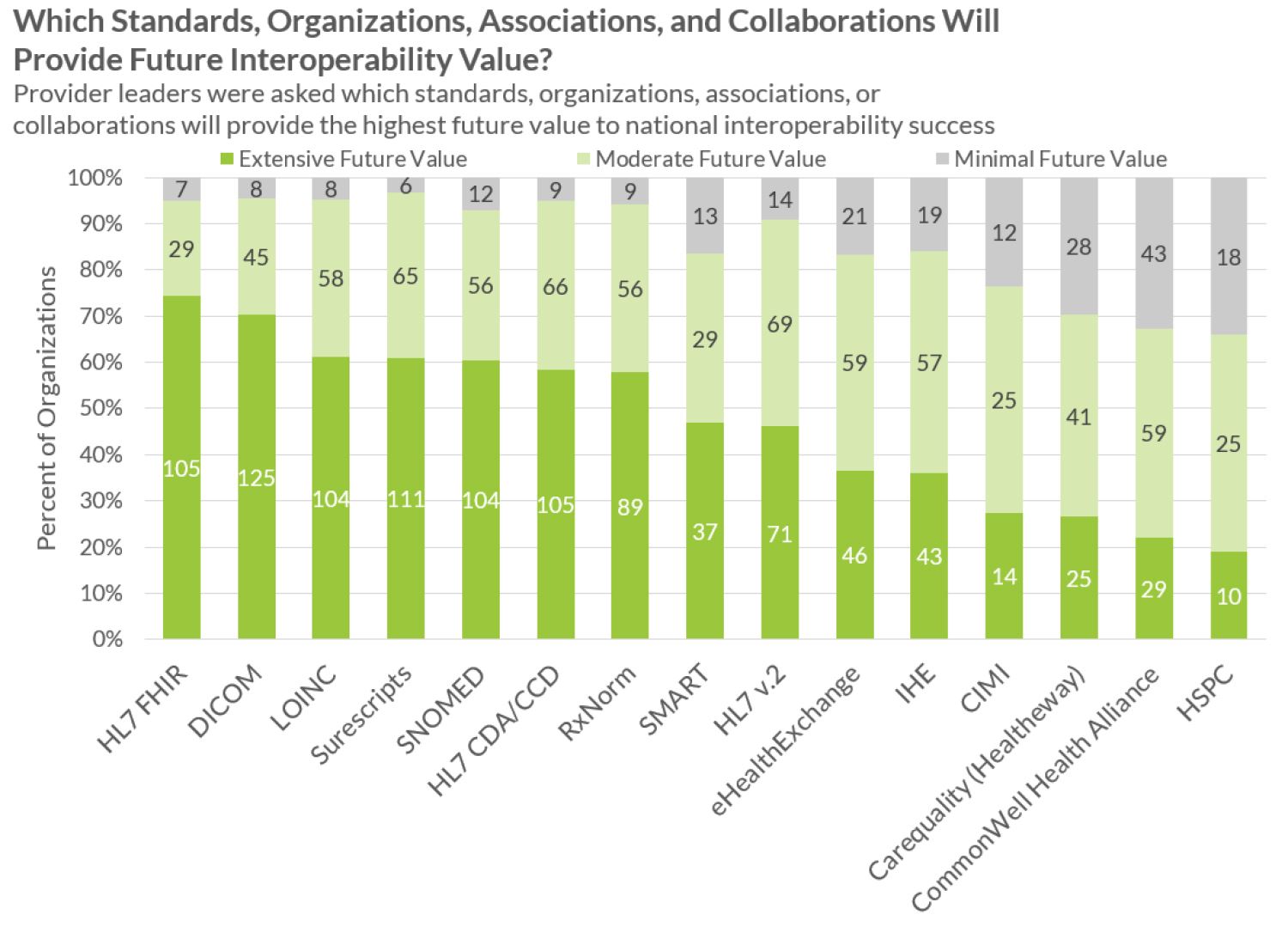

Providers often feel they have too many standards, including RxNorm, SNOMED, HL7, HL7 FHIR, DICOM, LOINC, and IHE. HL7 is a good example. In an effort to progress with industry complexity and needs, HL7 is constantly updating and releasing new iterations of its standards. However, in the short term, this has increased standards heterogeneity. Conversely, current standards cannot be left stagnant since medicine continues to rapidly evolve. The balance between updating standards and driving clear adherence is difficult at best.

WILLINGNESS TO SHARE

98% of providers mention that they are willing to share, but only 82% report their main competitor to be similarly willing. Either way, most providers are starting to see data sharing as inevitable, but resistance remains. Smaller ambulatory practices are the least likely care providers to want to share their own records.

Providers overwhelmingly report that their vendors are willing to help them share but that business revenue models and lack of technical resources often get in the way. Only 8% of providers mention that an unwilling or incompetent vendor is the key hurdle stopping record sharing (see Figure 2).

Overall, there is significant evidence that current willingness far exceeds market maturity in interoperability efforts.

LOOKING FORWARD

How will interoperability be achieved? Looking into the future, how exactly will interoperability connections be functioning? What barriers will have been overcome?

Providers overwhelmingly report that successful interoperability will be nearly invisible for those involved. Just as billions of people use email today successfully with most users not stopping to think how addresses are maintained and data packets are shared, so too do providers expect a successful future state of interoperability to “just work” without most end users understanding how or why.

In order for sharing to work invisibly, providers and vendors report that the following must be achieved:

- Aligned Incentives: Providers must see effective record sharing as a win for their caredelivery and business interests. Vendors must see data sharing create a benefit for them—a competitive advantage or required market core competency.

- Robust Legal Governance: All parties must feel confident that they are on strong legal footing for sharing medical records and that conflicting or unclear privacy laws are resolved, including variations by state.

- Record Location: Clinicians must be confident all available patient encounters are accurately found from other organizations. This will likely include a provider directory as well as an effective voluntary national health identifier.

- Clear Context/Standards for Sharing: Shared data must be well labeled in a way that the receiving system can identify and properly ingest such data. Strong standards and cooperation will be required.

- Adoption into Clinical Workflow: Busy clinicians must be able to see all patient data (from their organization and from outside organizations) in an appropriate view. Data sharing that is outside the clinical workflow allows for clinical mistakes due to overlooked data and lower adoption.

- Data Security: Data security and full interoperability can seem to be antithetical objectives. In order for data sharing to work, only the designated correct parties can have access to a patient’s data.

Based on feedback from the provider, vendor, and expert communities, below are several scenarios for interoperability maturation that could occur. A possible future state could be a combination of multiple states.

STATE #1: INTEROPERABILITY THROUGH HEALTH INFORMATION EXCHANGES (5+ YEARS)

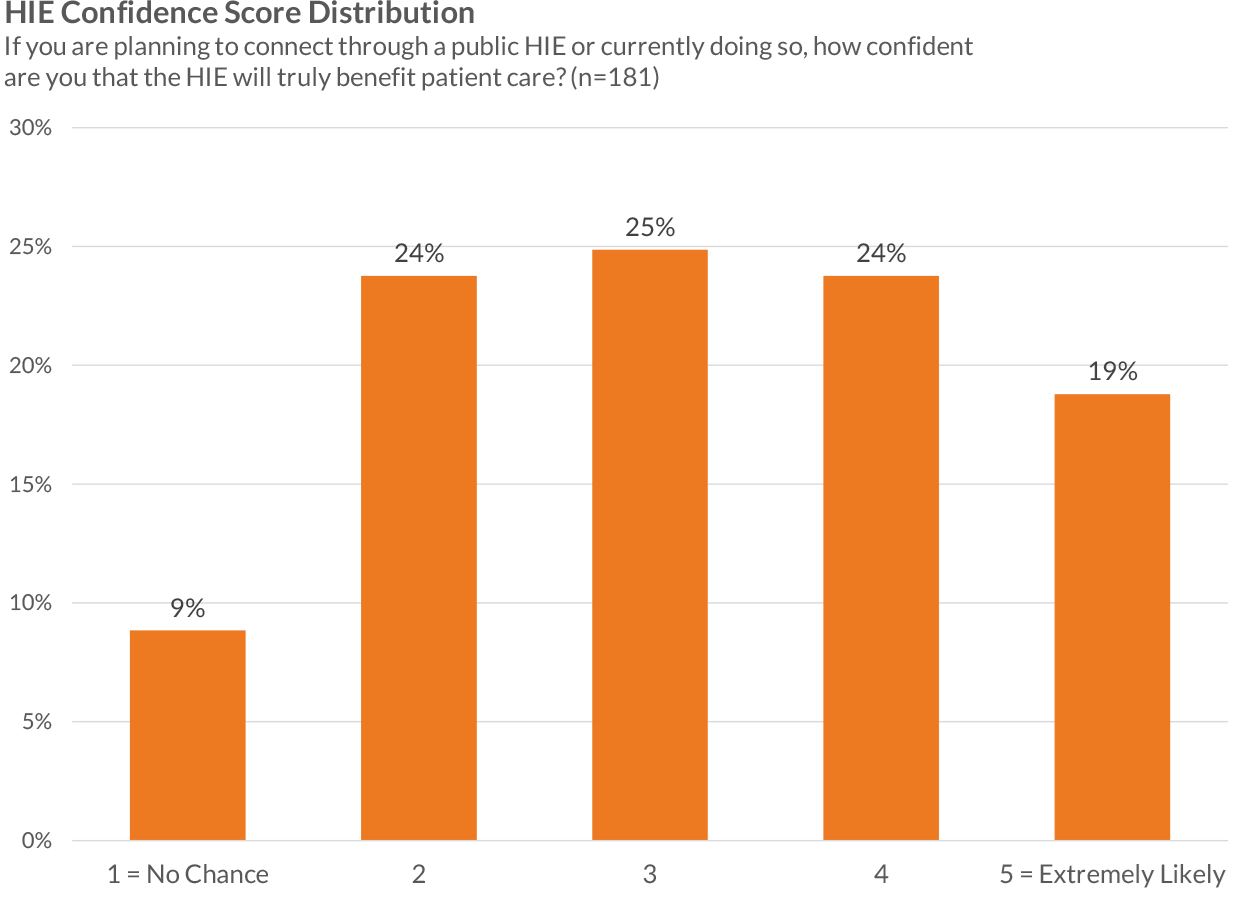

Widely thought of several years ago as the likely scenario for interoperability, the vision of a national health information exchange built on the backs of many smaller health information exchanges is starting to dim in the eyes of many providers and some vendors. As measured in this research, less than half of providers interviewed expect that their local HIE will be successful in meeting their needs. Customer satisfaction with HIE solutions overall is extremely low in spite of a handful of standout successes, and many providers share disillusionment regarding a hub-and-spoke sharing model with middleman HIE vendor technology facilitating connections. HIE sharing does not make connections simpler, data is often not put within the workflow of the clinician, and it is often a struggle to get rapid growth of the HIE and adoption of sharing because that is controlled by the HIE middleman. A fact even more critical to overcome is that an HIE framework model requires a middleman, and middlemen make for higher costs. Financial incentives to pay for these middleman HIEs are often unclear.

The HIE model does overcome some hurdles for sharing. Record location is the backbone of any HIE effort and is arguably the greatest strength of a public or private-network HIE. HIEs also are able to define their own governance and standards. While self-defined governance and standards enable a single successful HIE launch, they also inhibit cross-HIE connections. While hundreds of functioning public and private-network HIEs exist today, cross-HIE connections are extremely limited.

Despite these challenges, HIE solution providers will almost certainly continue to provide needed services of data sharing in specific, high-intensity situations, such as specialized ACO data aggregation and image exchange.

STATE #2: DIRECT MESSAGE EXCHANGE (3+ YEARS)

A requirement for Stage 2 of meaningful use, the Direct messaging standard is a payload agnostic means for sharing data and to date has mostly been used for passing CCDs. Many hope that Direct messaging can evolve to a point where a commonly understood packet of information can be sent from one EMR to another, in a format that the receiving EMR can understand and incorporate (parse) in the patient record. To date, sharing has been difficult, as this vehicle does not provide for governance, record location, or a clear context of data sharing. Despite these challenges, many are optimistic that Direct messaging could be an important piece of the puzzle. At the least, Direct messaging can be a replacement for record faxing. If coupled with clear governance, record location, and/or stronger context or standards, Direct could go much further.

To date, packets of information sent via Direct are often not very usable for clinicians. Data is often received in long, poorly structured documents, so important data elements are often hidden within many unneeded data elements. Almost all vendors are taking steps to better send, receive, and parse Direct messages.

STATE #3: SINGLE LARGE NETWORK OR HISP (3-5 YEARS)

While less clear, a possible maturation path for interoperability could mirror that of the Surescripts ePrescribing network, where a single dominant entity emerges as the governor and facilitator for nationwide sharing based on an extensive record of patient encounters across the nation. While focused on ePrescribing and medication information, the Surescripts network is widely recognized as the greatest health information exchange success to date. While the success of Surescripts has erupted in just the past four years, efforts to build a sharing network required over a decade of prework efforts before widespread sharing was able to take place.

If a single large network were to emerge as the data-sharing hub of the nation, providers today are uncertain as to which organization could successfully lead this effort. Providers were asked which collaboration will likely provide a strong contribution to interoperability, and their responses reveal that they are skeptical about the Sequoia Project, the eHealth Exchange (managed by the Sequoia Project), and the CommonWell Health Alliance and that they feel none of these organizations has shown clear startup traction. However, both the Sequoia Project and the CommonWell Health Alliance are relatively new efforts and have significant vendor backing.

It should also be understood that the challenges of a single large exchange would be larger than those of the ePrescribing network. Security alone might be a dramatically larger question as the sensitivity of the data, the number of connections, and the high-profile nature of a significant hub could make repelling outside attacks a dizzying endeavor.

STATE #4: NETWORK OF EMR NETWORKS (EXTEND POSSIBLY TO SUCCESSFUL HIES) (3+ YEARS)

To date, providers report that the highest-value/lowest-cost connection type has been the private EMR interoperability network. To date, Epic and eClinicalWorks have built significant internal sharing networks, and Cerner is just beginning to build a private network. Other vendors have announced plans to build shared networks. To date, no private EMR vendor networks have been connected.

With customers using similar installations of the same product, intraoperability (defined here as sharing between two organizations on the same EMR) could be the first step toward full interoperability. Data is naturally better aligned into the clinician workflow, data that is shared follows a similar format (making standards easier to navigate), and record location can be handled by the EMR vendor.

The hurdles for different EMR networks to connect effectively are significant. Agreements covering governance would need to be built, security concerns would need to be addressed, and record location capabilities would need to be built with each connection. As a first step, more simple connections could be made, and customers could push EMR vendors to improve the connections over time.

STATE #5: POINT-TO-POINT SHARING OF ACCESS (3-5 YEARS)

Some have argued that if trading partners are able to share access into their systems without actually shipping data, a viable replacement for data sharing (in many instances) could be achieved. It is common for larger health systems to provide logins to the health system EMR for affiliated physicians, and while data is not passed, physicians have the ability to see patients in the system. With access sharing, outside clinicians would be given access into an EMR without the need for setting up new logins.

Since data would not actually be shipped, security concerns could be significantly lessened. Conversely, such data sharing would require clinicians to view data in a different portal from their current EMR, subverting some possible gains that in-workflow contextual sharing could bring.

STATE #6: REGIONAL COLLABORATIVES (3+ YEARS)

Different from public HIE efforts, regional collaboratives focus more on governance than technology. Similar to work being done by the Mass HIway, provider organizations are able to share data through a variety of means (e.g., access sharing and Direct Messaging) but operate under a common governance with clear record location.

Providers and vendors are clear in their feedback that the technical aspects of exchange are not the critical hurdles to interoperability. Regional collaboratives work to fix some of the most pressing concerns (e.g., governance, aligned incentives, and record location) while leaving many technical barriers for the regional members to decide on. In Massachusetts, this approach has brought clinicians and patients clear value.

CALL TO ACTION

Will Vendors’ Willingness to Be Measured Make a Difference?

On October 2, 2015, a broad group of EHR stakeholders, including vendor CEOs and provider CIOs, agreed by consensus to objective measures of interoperability and to ongoing reporting. Leaders of 12 different EHR vendor organizations proactively stepped forward and agreed to have an independent entity publish transparent measures of health information exchange that can serve as the basis for understanding our current position and trajectory. Assisted by leading provider organizations and informatics experts, these executive officers knocked down barriers to arrive at measures to improve interoperability for the public good. Vendors and providers willingly committed to go arm in arm to work closely with Washington to help alleviate the interoperability measurement burden faced by the government.

CEOs and a few designated executives of the following 12 companies helped build/shape the measurement and support its use to independently and transparently measure/assess the status and trajectory of interoperability:

- Allscripts

- athenahealth

- Cerner

- eClinicalWorks

- Epic

- GE Healthcare

- Greenway

- Healthland

- McKesson

- MEDHOST

- MEDITECH

- NextGen Healthcare

Note: Current research by KLAS, especially the findings from the October 2015 Interoperability Study, does not reflect in any way the upcoming research that will be done using the new measurement model that is to be launched at the end of 2015. KLAS’ past interoperability studies, including those being published in 2015, are separate and independent of the future measurement to be done as part of the KLAS Keystone Summit. In fact, all past interoperability studies done by KLAS are focused on accurately representing the provider participant perspective and may not represent a particular vendor’s perspective, understanding of the market, or approval of the findings.

For access to more details about this report, contact

Annmarie Clark (801)226-5120 annemarie.clark@klasresearch.com

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.

.jpg?preset=report-cover-two-page-report)