2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Related Segments

Cardiology 2013

Identifying Structures for Success

Structured reporting in cardiology is receiving intense scrutiny as organizations seek to improve patient outcomes and reimbursements, but not at the cost of decreased productivity. Providers demand that cardiology IT vendors improve functionality with their core reporting as well as areas like hemodynamics and ECG data management. Which vendors are best delivering structured reporting and hemodynamics? Who has improved and who is lagging in development? How well do vendors communicate about upgrades? KLAS spoke with 287 providers to find out.

Identifying Structures for Success

Report Author: Monique Rasband

Structured reporting in cardiology is receiving intense scrutiny as organizations seek to improve patient outcomes and reimbursements, but not at the cost of decreased productivity. Providers demand that cardiology IT vendors improve functionality with their core reporting as well as areas like hemodynamics and ECG data management. Which vendors are best delivering structured reporting and hemodynamics? Who has improved and who is lagging in development? How well do vendors communicate about upgrades? KLAS spoke with 287 providers to find out.

WORTH KNOWING

MERGE LEADS IN REPORTING FUNCTIONALITY AND OVERALL SATISFACTION: Merge’s structured reporting improved over last year and Merge receives the highest ratings for adult cath and invasive vascular. Fuji’s score shot up over the past year as well, especially with large hospitals, due to improved implementations and training and better functionality. Siemens has seen steady improvement due to better cath reporting and integration. Epic customers are optimistic Epic will deliver but are still waiting for Cupid to offer all the modules they need. KLAS interviewed six INFINITT customers, and INFINITT is hitting it out of the park on their new offering. Like with INFINITT’s radiology PACS, the service and support are excellent and INFINITT offers a feature-rich solution.

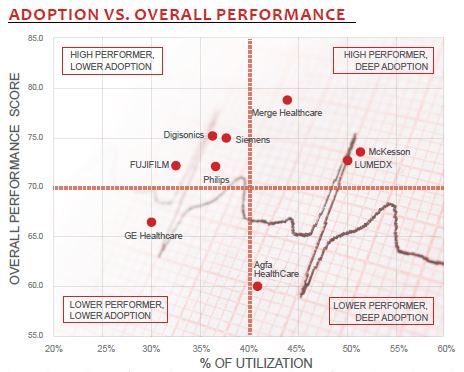

WHO IS NOT DELIVERING?: Digisonics is branching out beyond echo to cath reporting. But as they do, their overall performance has slipped and even satisfaction with their echo modules has declined. Adoption of cath reporting has been slow, and adoption of invasive vascular is minimal. GE customers have been waiting for GE’s new platform, and while some are hopeful, others have jumped ship or are looking for other options. Agfa’s performance continues to decline from already low levels.

TRENDS IN HEMODYNAMICS: Philips is sunsetting their older Witt front-end hemo monitoring modules and is beginning to implement their new hemo front-end module, Xper Flex Cardio. However, several customers that have started the implementation process reported that the system is not ready for prime time. Merge is delivering solid functionality and developing excellent upgrades. Also, Merge’s vendor-neutral integration is a plus. McKesson has less adoption of their hemo system, but early trending suggests it is performing well, though only McKesson-to- McKesson integration has been validated. GE’s hemo system is basically meeting needs, but customers say GE charges an arm and a leg for upgrades and service.

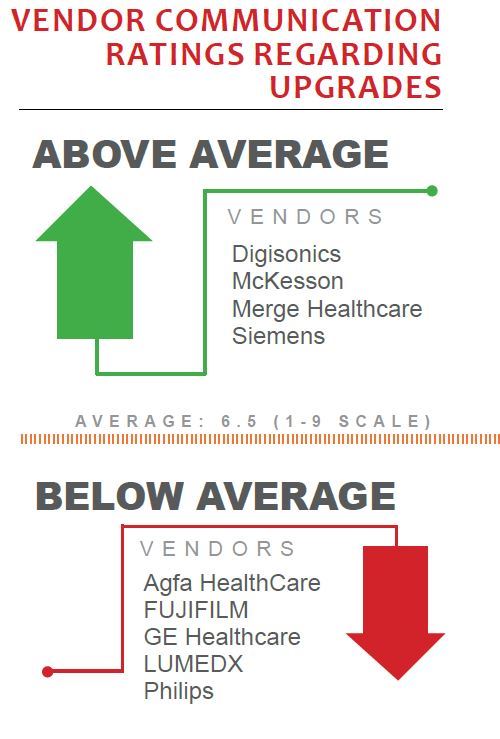

COMMUNICATION REGARDING UPGRADES LINKED TO OVERALL SATISFACTION: Top-performer Merge leads in communication and education regarding upgrades, by a wide margin. McKesson and Siemens are also meeting provider needs in communication around upgrades. These vendors use several outlets, such as email, webinars, and visits from the account or sales representative, to reach providers to let them know about upgrades.

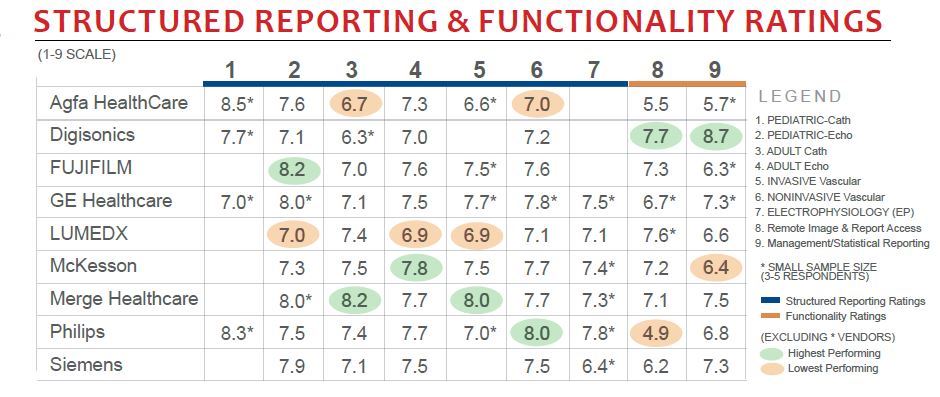

AGFA HEALTHCARE: Overall performance declined since last year. Pediatric and adult echo significantly improved. Adult cath functionality is weakest in the study. Very few using system, and poor performance with management and statistical reporting. Remote access is weak and reported to be slow. Poor relationship acumen adds to frustration with product.

DIGISONICS: While typically a front-runner, Digisonics is surpassed by Merge and Siemens in this report. Contracting and phone support still far above average, but scores for has needed functionality and overall performance have slightly declined. Top performer in management and statistical reporting and remote access. Echo reporting performance is one of the weakest areas. Only a handful of clients validated using cath reporting, and performance is poor so far.

FUJIFILM: Great improvement in overall performance, due to drastically better contracting and implementations, particularly for facilities over 400 beds. Earns top scores in pediatric echo and second highest in remote image / report access, nearly a 2 point improvement over last year. Cath reporting performance is improved. Echo reporting adoption above average while all but noninvasive vascular are below average.

GE HEALTHCARE: Adult cath has improved but still mediocre. Adult echo performance is middle of the pack. Relatively low adoption of many modules, such as noninvasive vascular, remote image and report access, management and statistical reporting, and pediatric echo. Fifty percent said that they are nickel-and-dimed. Seventy-five percent said it is part of their long-term plans. Several mentioned that they are looking forward to GE’s new cardiology platform.

LUMEDX: Strong cath module and highest adoption of cath reporting. Customizable solution is a double-edged sword, putting the onus on providers to make it functional. EP performance strongest in the study. Echo module is lagging behind provider needs for measurements. Not many using remote image and report access, but big improvement since last year. Calling into support can be painful. Cardiology niche vendor but not relationship driven.

MCKESSON: Needed Functionality rating 79%, which is the highest of the fully rated vendors. Cath, vascular, and remote access ratings above average. Best echo reporting score. Adoption of those modules far above average. Management and statistical reporting painful to use; performs poorly. Weak contracting, and implementations not always on time. Hemodynamics is growing and early customers are happy—though only McKesson-to-McKesson integration is validated.

MERGE HEALTHCARE: Top overall performer, top integration score, and great executive involvement. By far top performer for adult cath structured reporting; providers reported it has improved. Top performer in invasive vascular reporting—meeting basic functionality needs, but more measurements desired. Room to improve remote image and report access reliability and image quality. Strong, vendor-neutral, hemo system.

PHILIPS: Adult cath and echo performance above average, and adult cath greatly improved. Other than adult and pediatric echo, adoption of most modules is below average. Excellent performance in EP and pediatric cath, though based on small sample. Remote image and report access lowest rated—having limited remote access is big pain point for customers. Providers who were on the old Witt platform for hemo are weighing their options.

SIEMENS: Improvement in overall score due to better functionality, integration, and response time. Adult cath performance improved, though adoption still relatively low. One of the top performers in management and statistical reporting and pediatric echo. Room to improve remote image and report access. Executive involvement far below average; however, many feel communication around upgrades is adequate. Hemo system meeting needs.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.