2026 BEST IN KLAS

2026 BEST IN KLAS

Preferences

Related Series

Related Segments

PACS Technology 2013

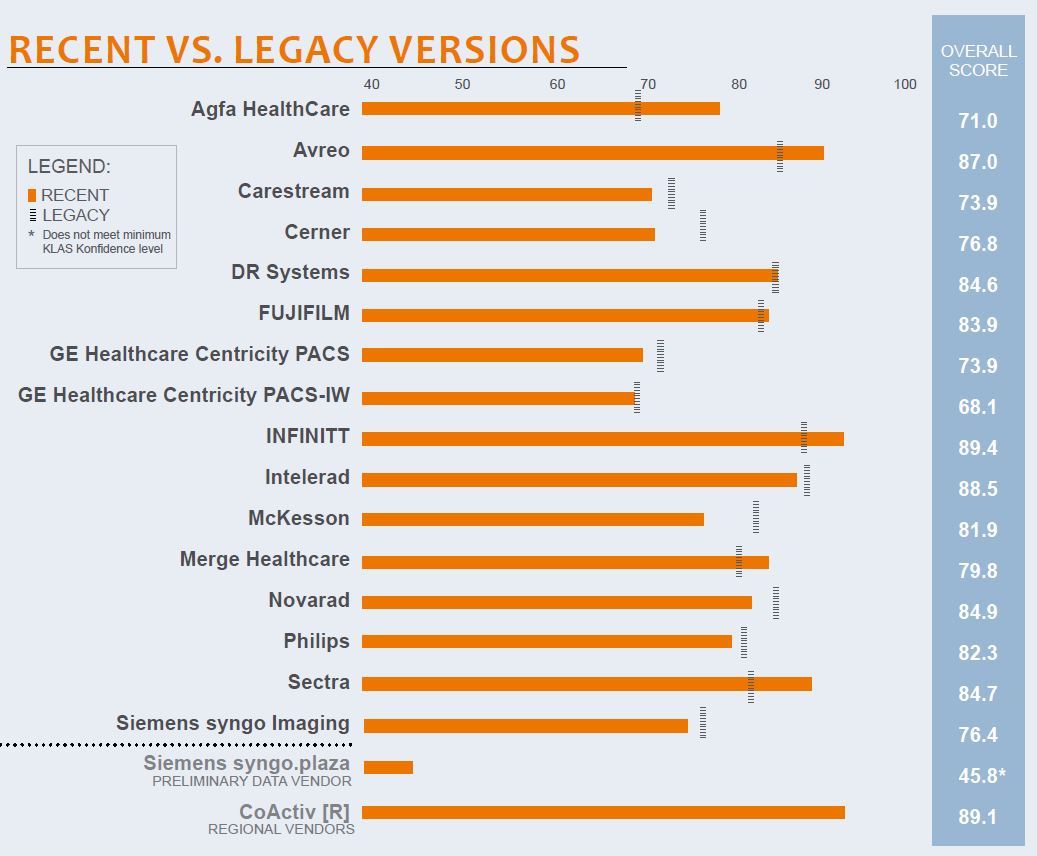

New Versions Stepping Up?

With a tight global economy, providers are vigilant before making PACS purchases. Consolidation is driving change in the U.S., while the UK is in a replacement cycle. In the Middle East, South America, and Asia, many providers are buying PACS for the first time. The provider feedback in this report is from U.S. data, and the remainder is from outside the U.S., with a focus on product quality, technology, and performance of recent versions. Whether from the U.S or other parts of the globe, providers need to know which vendors are best delivering and developing, which PACS are dependable and scalable, and whether recent versions are actually an improvement. Recent version data is generally from smaller sample sizes, and the total number of provider interviews in this report is over 1,100.

New Versions Stepping Up?

Report Author: Ben Brown

With a tight global economy, providers are vigilant before making PACS purchases. Consolidation is driving change in the U.S., while the UK is in a replacement cycle. In the Middle East, South America, and Asia, many providers are buying PACS for the first time. The provider feedback in this report is from U.S. data, and the remainder is from outside the U.S., with a focus on product quality, technology, and performance of recent versions. Whether from the U.S or other parts of the globe, providers need to know which vendors are best delivering and developing, which PACS are dependable and scalable, and whether recent versions are actually an improvement. Recent version data is generally from smaller sample sizes, and the total number of provider interviews in this report is over 1,100.

WORTH KNOWING

GREAT IMPROVEMENT WITH RECENT VERSIONS Agfa, INFINITT, and Sectra are showing significant improvement over their legacy versions, specifically with integration, implementations, and money’s worth, respectively.

NEWER VERSIONS FALLING SHORT Cerner, McKesson, and Siemens are disappointing their client bases with their recent versions. Customers of these vendors reported having to wait too long for upgrades and upgrades not living up to the expectations set by their vendor.

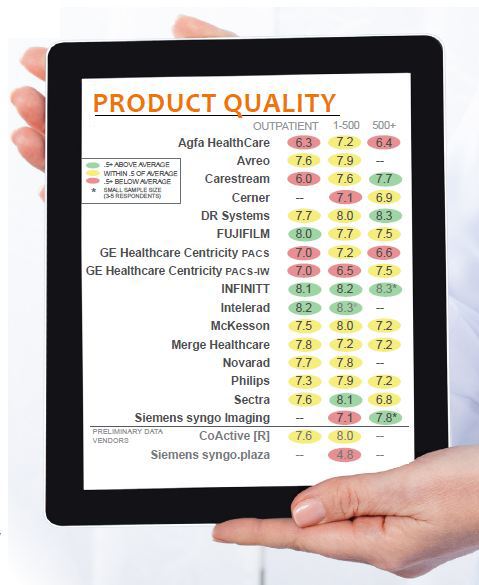

WHO IS CONSISTENT AND SCALABLE? DR Systems has customers in every size breakout and is a very consistent high performer in all sizes. INFINITT also performs well across the board but has fewer customers in hospitals over 200 beds. Fuji has a large number of customers over 500 beds and performs just above average. Avreo and Novarad are strong overall performers, but they have few validated customers over 200 beds.

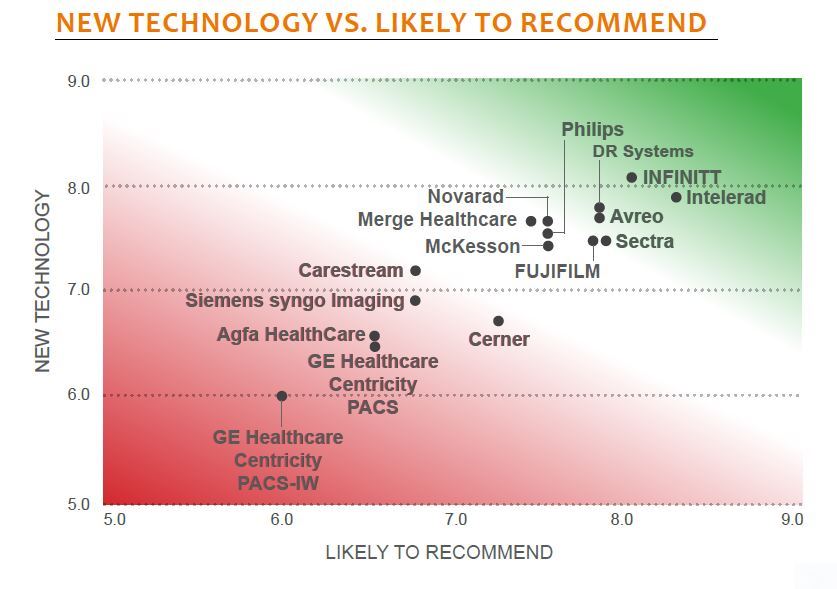

INNOVATION VS. REPUTATION Strong performers INFINITT and Intelerad strike a balance with delivering great technology and creating customers who are product evangelists. DR Systems and Avreo are also top innovators. Impactful new development has been slower from GE. GE customers want substantive upgrades that do not have bugs and add real end-user features.

BOTTOM LINE ON VENDORS

AGFA HEALTHCARE—Significant improvement with recent v.6.5, but overall poor performer. Agfa seems to be partnering with customers on their upgrade to the new version and contracting is better. Satisfaction with functionality is the same compared to satisfaction with legacy versions. Poor training an issue for those that upgraded to v.6.5. Scales up above 500 beds, but performance weaker with larger customers.

AVREO—Strong overall performance, improved upon with v.7.x. Functionality is better for customers on most recent version, as is communication. Overall, Avreo is a star player in hospitals under 200 beds where communication and executive involvement are making a difference.

CARESTREAM—Poor implementations, especially those on recent versions. Overall, recent version not an improvement over older versions. Some slight improvement with functionality such as advanced 3D tools. Ease of use is consistent between versions. Weak performance in clinics, though sample is small.

CERNER—Upgrading to v.3.2.8 provides improved functionality, such as a better viewer and better system response time, but development is slow. Clients frustrated with length of time between upgrades, and not everything promised is delivered, such as better web access. Integration and stability meeting needs.

DR SYSTEMS—Performance is consistent when comparing recent versions to legacy versions, but experience varies with the upgrade to v.10.x. While providers like the added functionality such as web access and automation for comparison exams, the new version has some bugs. Majority of customers in hospitals under 500 beds.

FUJIFILM—Implementations of v.4.x executed well and on time. New versions seen as an improvement over older versions—new edge enhancement features are singled out as a great development. Fuji accommodates requests and suggestions from users. Consistent performance across facility size.

GE HEALTHCARE—Version 4.x of Centricity has not improved customer satisfaction over satisfaction with legacy versions. Hanging protocols still an issue. No major enhancements of functionality. Expensive and customers not as likely to recommend. Scalable and stable. Centricity PACS-IW weakest overall performer. Most recent version, v.3.7.3.9, not an improvement for providers. Training weaker for those who have upgraded and customers feel nickel-and-dimed. Mixed feelings about moving to the Enterprise Archive back end. No major functionality improvements.

INFINITT—Overall strongest performer. Recent version improves on already excellent offering. Well-executed implementations and great training. Good pace of development. INFINITT creates excellent value for customers. Primarily found in outpatient facilities and small hospitals; less experienced with larger hospitals. However, INFINITT’s few larger acute customers are incredibly pleased.

INTELERAD—Strong performance consistent across all facility sizes, but fewer large hospital customers. Satisfaction with newest version is two points below satisfaction with legacy versions. Most indicators are stable, but several clients noticed less communication with radiologists. Of those on recent versions, largest proportion of clients is in outpatient setting.

MCKESSON—Recent v.11.9 has smooth implementations, but training lacks compared to older versions. Slow pace of development frustrates clients. Upgrades are costly, and contracting satisfaction is lower for the recent version. Preliminary findings on v.12 show improved functionality with clinical reference viewer as well as improved EMR integration.

MERGE HEALTHCARE—Merge’s recent v.6.4 has improved user friendliness and technology. However, providers report that the upgrade is expensive with added fees for tasks associated with the upgrade. Merge’s happiest clients are in outpatient facilities, a few of which are radiology practices with over 50 physicians. Beginning to upgrade some clients to v.6.5.

NOVARAD—Consistent performer overall across client sizes. Considered to be a good value. Ease of use and integration remain consistent with recent versions. However, implementations to recent version rough. More than half of upgraded facilities are outpatient. Lower satisfaction with functionality on recent v.7.5. Some challenges with hanging protocols on new version.

PHILIPS—Philips’ slowdown of v.4.4 rollout had a large negative impact on provider satisfaction with the quality and timeliness of the upgrade. Of those that have upgraded to v.4.4, expectations of new features and functionality have not been met. Most of the improvements made are on the back end.

SECTRA—Clients on v.14.3 and above are happier than those on older versions. Improved functionality with reporting and web-based access. Providers seeing value with new version. Rollouts of new version performing well in both outpatient and acute care facilities. Room to improve communication.

SIEMENS—syngo Imaging overall performance has improved but ranks 12 out of 16. Easier to use and better worklist integration, but providers still want more usability. Eighty-three percent plan to stay. Initial reports on next-generation PACS, syngo.plaza, are terrible. Missing needed functionality, and training and implementations are below par. Service is not responsive.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

Project Manager

Robert Ellis

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2026 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.