Data & Analytics Platforms: Shifting from Siloed Capabilities

Historically, analytics capabilities for healthcare organizations have been offered in siloed solutions. These solutions provide quick insights but not the longitudinal patient, financial, and operational views organizations need to truly move the needle in their efforts to improve care and reduce costs. The good news is that as organizations’ analytics needs have expanded, so have vendor offerings. A number of vendors now offer consolidated, end-to-end platforms that provide a wide variety of data and analytics capabilities.

For KLAS Research’s recent Data and Analytics Platforms report, we interviewed the deepest adopters of these platforms to validate the capabilities actually being used. To provide additional context on the platforms’ specific strengths and weaknesses, we also gathered customer experience data from each vendor’s broader base of platform users.

Deep Adopters Have Made Significant Progress

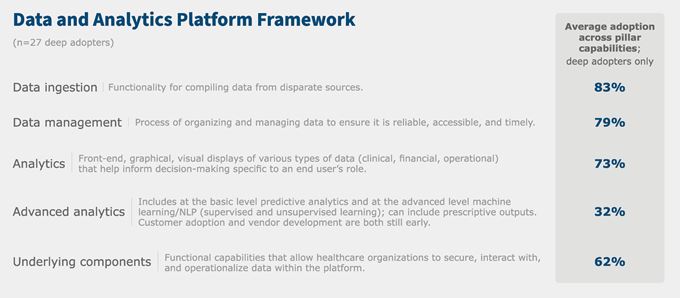

We hope this research will help the market define which capabilities are critical in an end-to-end platform and provide clarity to healthcare organizations as they evolve their analytics strategies. The framework below outlines the five pillars of a data and analytics platform as well as the average adoption within each pillar, as reported by vendors’ deepest adopters (three deep-adopter organizations per vendor).

The full report contains a more detailed view of the capabilities included within each pillar as well as a vendor-specific look at validated adoption.

As the framework shows, deep adopters have already made significant progress in adopting many of the capabilities available from their data and analytics platforms. This was a pleasant surprise given the relative newness of these broad platforms. Though the jury is still out on how comprehensively such platforms might be used by the market at large, the progress achieved by deep adopters bodes well for other organizations that are just starting their journey toward a soup-to-nuts approach to analytics.

While the advanced analytics pillar stands out for having the lowest adoption thus far, this is unsurprising given that such capabilities (e.g., machine learning and natural language processing) are not yet a strong focus for most users and have not yet been fully developed by vendors.

Cerner, Epic & Health Catalyst See Deepest Adoption among Established Analytics Solutions

The vendor solutions examined in this report fall into two categories—established players that have been in the analytics market for some time and those that have more recently emerged as viable healthcare analytics options.

Among the established players, adoption across pillars is deepest with Cerner, Epic, and Health Catalyst. Customers of the other two long-time players—Dimensional Insight and Information Builders—report more gaps, particularly with advanced analytics.

Compared to the more longstanding vendors above, four data platforms are relative newcomers. Innovaccer and Arcadia. io have both expanded their data sources and capabilities beyond population health management (PHM) and value-based care (VBC) to create broader analytics offerings. Alteryx, a cross-industry analytics automation platform vendor, has increased their healthcare focus in recent years. Starting from a data archiving background, Clearsense is beefing up their capabilities to include analytics. Among these newcomers, Innovaccer sees the deepest adoption.

In addition to sharing more details about capability adoption, the report also includes high-level performance insights from each vendor’s broader base of platform users.

What’s Next for Data & Analytics Platforms?

Looking forward, we hope to focus future research efforts on drilling down a bit deeper into the data management pillar, which will be critical as organizations ingest increasingly complex data sources and types (e.g., unstructured data, wellness data, SDOH data). To avoid a garbage-in/garbage-out scenario, organizations must figure out how to appropriately curate and govern all of the incoming data. KLAS would love to explore the customer experience with various vendors—including cross-industry vendors—that offer solutions to help in this area.

Future research will also delve deeper into customer satisfaction within the other pillars of the framework. While this report included some high-level customer experience feedback from vendors’ broader bases of platform users, future reports will look to highlight specific strengths and weaknesses within each pillar.

For a closer look at the full findings, we recommend reading the report.

This article was originally published in HIT Consultant.

Photo credit: aleutie, Adobe Stock