2024 BEST IN KLAS

2024 BEST IN KLAS

Preferences

Related Series

Related Articles

Accountable Care Timing 2013

Migration From Volume To Value Speeds Up

In every direction, vendors are spending millions to recast their products and reputations as population health specialists. They hope to cash in on what some see as a provider rush to accountable care. To date, providers have signed hundreds of value-based agreements with payers, but many of these are symbolic or experimental efforts of limited scope. When will providers truly switch from the current fee-for-service market to one of managing population health? KLAS spoke with 73 organizations, mostly medium to large-sized IDNs and hospitals, to find out where they are and how fast they are traveling in their migration from volume to value.

ACCOUNTABLE CARE TIMING 2013

Migration from Volume to Value Speeds Up

Report Author: Mark Allphin

In every direction, vendors are spending millions to recast their products and reputations as population health specialists. They hope to cash in on what some see as a provider rush to accountable care. To date, providers have signed hundreds of value-based agreements with payers, but many of these are symbolic or experimental efforts of limited scope. When will providers truly switch from the current fee-for-service market to one of managing population health? KLAS spoke with 73 organizations, mostly medium to large-sized IDNs and hospitals, to find out where they are and how fast they are traveling in their migration from volume to value.

WORTH KNOWING

MIGRATION FROM VOLUME TO VALUE SPEEDS UP.

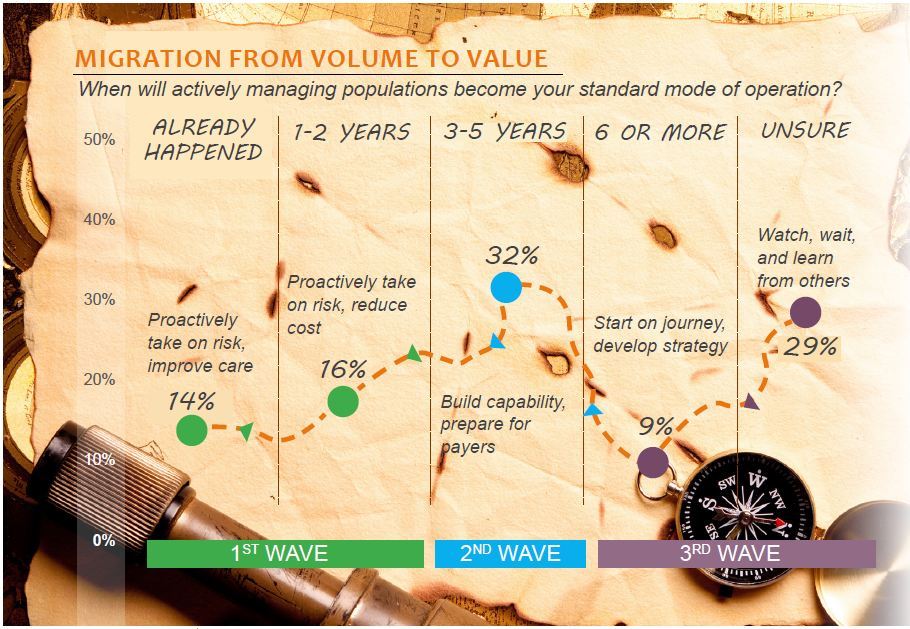

Accountable care is seen as inevitable for the vast majority of providers. Two-thirds expect managing populations to become their standard mode of operations within five years. Half of these have already made the shift or plan to do so in the next two years. The remaining one-third are holding back, expecting a gradual transformation and an opportunity to learn from other trailblazers.

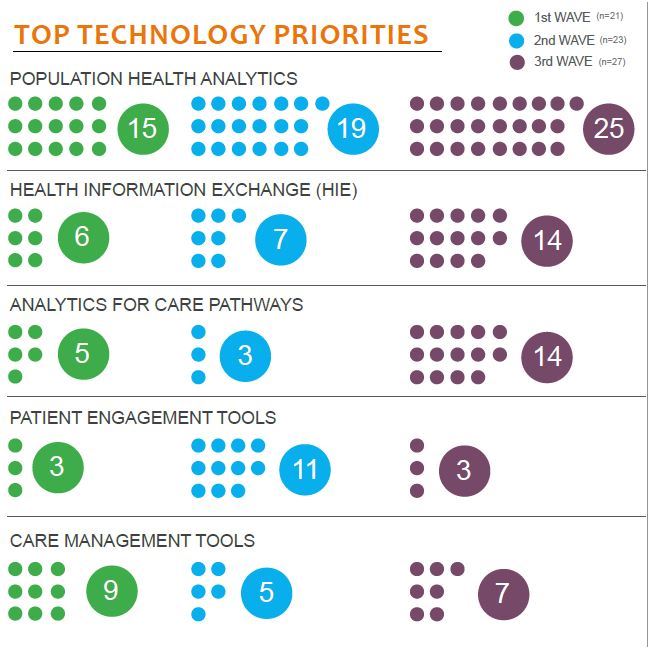

POPULATION HEALTH LANDGRAB.

A majority of providers are opening up their pocketbooks to invest in solutions for population health. Spending will be spread out in roughly equal waves as providers prepare for transformation in one of three categories: two years or less, three to five years, and six years or more. This includes pioneers who have already made the shift and wish to augment homegrown tools with commercial solutions.

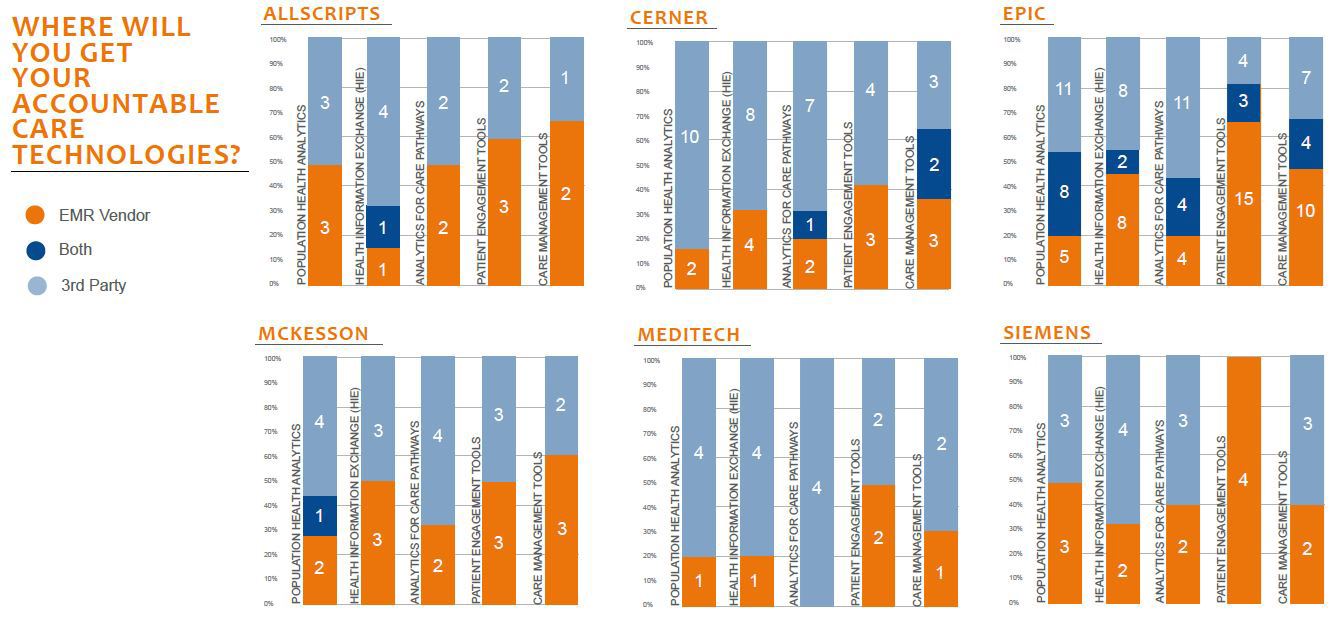

THIRD-PARTY VENDORS SECURE SEATS AT THE TABLE.

In the top-three investment areas of population health, health information exchange, and business intelligence, 65%–75% of respondents said niche vendors will play a major role.

EMR VENDORS INVITED BUT HAVE ROOM TO GROW.

EMR vendors will first lend support with registries, care management, and patient portals. For analytics, providers say EMR vendors offer only pieces and parts today, but they hope vendors will grow to fill population health shoes. Epic customers were most likely to describe a long-term vision for their EMR vendor’s role, often alongside third-party solutions.

PROVIDER BRIEFS

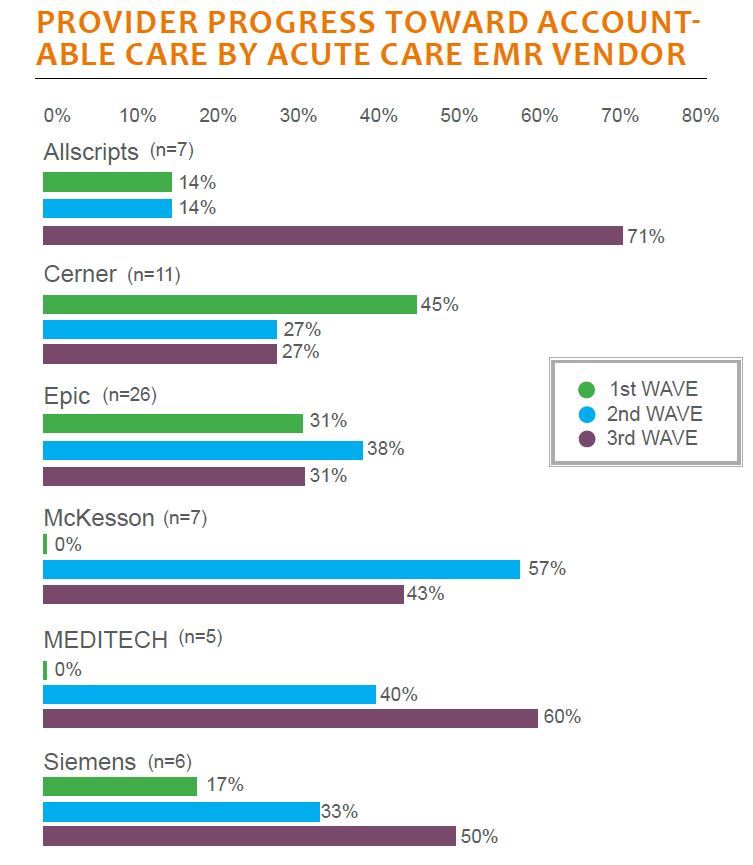

FIRST WAVE

Early leaders in the movement have already made the shift to a population health culture or expect to do so within the next two years. They proactively take on risk but may also place nonmonetary goals at the forefront. Already experienced at managing risk, first wave providers often use integrated EMR vendors (e.g., Cerner and Epic) but frequently develop their own analytics tools. Care management is the next priority.

SECOND WAVE

The value-based writing is on the wall for second wave providers. They have dabbled in at-risk agreements but feel unprepared for the real thing. They are actively building capabilities for when payers force change. Population analytics, patient portals, and HIE are in the works to support a hoped-for transition from volume to value in three to five years. Integrated or not, most enterprise EMR vendors are represented.

THIRD WAVE

Accountable care is an inevitable but distant reality for third wave providers. In current models, risk exceeds value for provider organizations, so they will take a wait-and see approach—learning from the mistakes of others before their own time comes. Analytics leads a range of technology priorities. Provider tool sets are not ready today, and a long timeline allows a broad view of needs. Allscripts, McKesson, and MEDITECH are prominent.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2014 KLAS Enterprises, LLC. All Rights Reserved.

This material is copyrighted. Any organization gaining unauthorized access to this report will be liable to compensate KLAS for the full retail price. Please see the KLAS DATA USE POLICY for information regarding use of this report. © 2024 KLAS Research, LLC. All Rights Reserved. NOTE: Performance scores may change significantly when including newly interviewed provider organizations, especially when added to a smaller sample size like in emerging markets with a small number of live clients. The findings presented are not meant to be conclusive data for an entire client base.